Guide

Guide to D&O Insurance for IPO and Direct Listing Companies, 2025 Edition

Even though there was an uptick in IPO activity in 2024, many companies have taken a wait-and-see approach and deferred their public debuts to next year.

Still, going public in 2025 will come with challenges, such as regulatory scrutiny, litigation risks, and changing economic conditions.

Woodruff Sawyer’s 2025 Guide to D&O Insurance for IPOs and Direct Listings provides D&O risk mitigation guidance through every phase of the IPO process, ensuring that directors and officers are adequately protected as their private companies make this important transition.

Access your copy instantly here or read on for highlights from the Guide.

Why D&O Insurance Matters

For newly public companies, the risks are elevated for directors and officers.

Litigation is a persistent threat as some derivative suits garner massive settlements in the tens—and occasionally hundreds—of millions, and securities class actions are once again on the rise.

In addition, SEC scrutiny, especially around disclosures and governance, can lead to costly investigations.

Other regulatory agencies are also increasingly targeting directors and officers for accountability issues.

Given all these factors, a tailored approach to D&O insurance is essential.

IPOs and direct listings each present unique exposures, requiring customized coverage to protect directors, officers, and the company against threats.

A Note on the D&O Insurance Market

Though the D&O insurance market has experienced volatility in recent years, the good news for public companies is that we’re still in a favorable market.

Recall that D&O insurance premiums peaked at 4.7 times 2018 levels in Q1 2021. The good news is that these rates have since declined to 1.9 times the 2018 baseline by mid-2024.

To put that into perspective, in the first half of 2024, 83% of Woodruff Sawyer's public company clients saw premium reductions.

Despite this more favorable market dynamic, IPO companies still face higher D&O costs than their mature counterparts.

We expect 2025 to be another relatively favorable year for D&O insurance rates.

You can learn more in Woodruff Sawyer’s 2025 D&O Looking Ahead Guide.

Overview of the Key Phases in the D&O Insurance Process for IPOs and Direct Listings

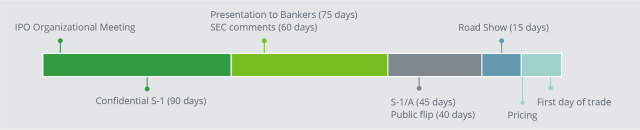

The process of going public requires more than just filings and investor roadshows—you also need a thorough risk management strategy, particularly when it comes to protecting directors and officers from personal liability.

Our 2025 Guide to D&O Insurance for IPOs and Direct Listings outlines a step-by-step approach to building a robust D&O insurance program that aligns with key milestones as a company goes public and beyond.

The process can be divided into several key phases: preparation, launch, broker, implementation, and post-IPO support.

Each phase requires careful planning and expert insight to ensure your company is fully protected against the unique risks of going public.

Preparation phase: Early strategy development is key for companies preparing for an IPO or direct listing. Before the IPO, it’s a good idea to secure at least $5 to $10 million in D&O insurance as a private entity to protect against hold-up shareholder lawsuits and ensure a smooth transition to public company insurance.

Launch phase: The scope of D&O insurance must align with the company’s risk profile. Using customized analytics in addition to peer data helps set appropriate insurance limits. Additionally, this is the right time to provide board members and executives with any needed training on public company risks in this phase.

Broker phase: An experienced, specialized broker is essential for negotiating favorable D&O insurance terms. This is also the time to focus on things like ensuring that higher limit warranties are structured to protect the company from exclusions as much as possible. These negotiations ensure the company has the coverage it needs without unintended gaps.

Implementation: Before a company’s first public trade, any outstanding subjectivities imposed by insurers must be addressed to avoid delays in binding coverage. Normal subjectivities, such as providing carriers with the final offering price and informing them of SEC approval, are typically not a big deal to handle. Be on the lookout for any others.

Support post-IPO: Companies, of course, face ongoing risks post-IPO. Continuing education is a great way to support directors and officers as new threat vectors develop. In addition, ensuring timely reporting of any claims and adhering to D&O policy terms concerning those claims is critical.

Woodruff Sawyer’s 2025 Guide to D&O Insurance for IPOs and Direct Listings offers valuable insights on what to expect with a D&O insurance program as your company prepares for a public debut.

For a deeper dive, get your copy of the 2025 Guide here.

Author

Table of Contents