Blog

What Are Key Exposures of Pre-Human Clinical Trial-Stage Companies?

In part one of our three-part series on Risk Management for Your Life Sciences Company, we break down the unique exposures companies face during the Research & Development: Pre-Human Clinical Trials stage.

Life sciences companies face unique exposures. Even within the various stages of research and development, the risks companies face change depending on their stage of development. With more than 500 clients in the life sciences industry—ranging from rapid-growth startups to companies with global product sales and operations—we have extensive experience with these exposures and know how to manage them.

In this article, we focus on critical exposures faced by preclinical development-stage companies as they ramp up for clinical trials. We will describe essential insurance coverages and provide recommendations to help you mitigate risk, avoid gaps, and reduce costs.

Check out our three-part webinar series on Risk Management for Your Life Sciences Company, available on-demand:

|

Coverage Needs for the Preclinical Development Stage

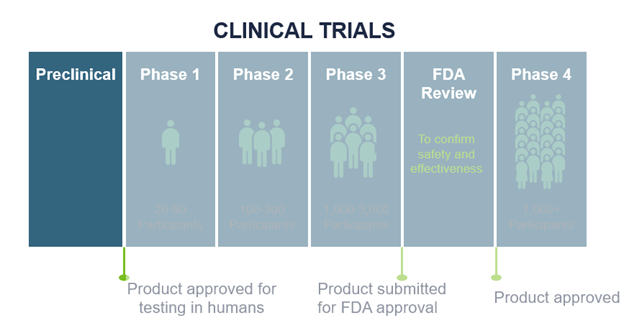

The preclinical development stage is when life science companies focus on lab work and animal studies as they ramp up for human clinical trials. The four primary areas of exposure that need protecting include people, assets, liabilities, and data.

People: A Most Important Asset

Workers' compensation (WC) insurance is a statutory requirement placed as soon as you hire your first employee. WC considerations for early-stage companies:

- Ensure you are using correct classifications for employees, capping any executive officer payroll.

- Ensure the right coverage for your state. For example, North Dakota, Ohio, Washington, and Wyoming are monopolistic states, meaning they have state-controlled WC plans.

Employees are otherwise insured by employee benefit programs that will generally include robust life and health insurance and retirement benefits. Companies at this state will also arrange business travel/accident policies to insure death, serious injuries, and, in some cases, foreign medical coverage as employees travel.

Key person life insurance provides payments to a company if a founder or other significant employee passes away.

Many preclinical development stage companies use a staffing organization or a professional employer organization (PEO) to manage employees and many of these coverages. When your company is ready to transition to a direct employment model, talk to your broker for resources to assist with this process.

Physical Assets: Protecting Against Physical Damage

The biggest catastrophic loss is a fire resulting in the loss of your data—but this isn’t the only asset you need to protect. Here are areas to focus on when protecting the company's tangible assets.

- Property insurance. This covers direct physical damage to tangible property in which you have an insurable interest, such as machinery breakdowns. Report property values at replacement costs.

- Business interruption. This coverage is for loss of income from physical damage to the premises by a covered cause of loss that could cause your company to slow down or even suspend operations. You'll want to ensure coverage responds to any loss of research and development income.

- Cargo. A cargo policy covers direct physical loss or damage to your property while it's in transit. It can be valued at replacement cost or at a fixed amount. Cargo cyber coverage applies to physical loss or damage to goods caused by malicious use of a computer, otherwise excluded under a cargo policy.

- Perishable property. Many life sciences companies depend on temperature-sensitive perishable property. Confirm that temperature-sensitive or perishable property are covered for “all risk” perils and have adequate limits for coverage at full replacement cost.

- Scientific animals. Valuations are critical here and involve the type, cost, and number of animals at the site; whether they are genetically modified; the length of time needed to prepare them; and the expense and time needed to conduct the animal study.

- Supply chain management. Ensure you have a contingency plan if a supplier within the supply chain goes down in order to move forward with the development of your product.

- Natural catastrophes. While natural events like lightning and wind will usually be covered by commercial property insurance, most property policies exclude natural catastrophes like earthquakes, sinkholes, mudflows, and floods. These perils can lead to significant losses, which is why specialty insurance market policies are expensive and have high deductibles. Most companies we work with in this stage do not purchase earthquake or flood insurance unless the lease agreement requires it. That said, it's essential to take steps to mitigate damage and have an evacuation plan and a business continuity plan in place in case a catastrophe occurs.

Liabilities: Casualty Coverages for Life Science Companies

Let's review the different forms of liability coverage that will protect life sciences companies.

- General liability. This coverage extends to bodily injury, property damage including fire damage, legal liability, personal injury, and advertising injury to a third party for which you are legally liable. In most cases, coverage does not extend to products liability, which is secured on a standalone basis.

- Employer's liability. As a part of WC, this covers liability for employee lawsuits. In monopolistic states (Ohio, Washington, North Dakota, and Wyoming), companies are covered under a stopgap endorsement within a WC or GL policy.

- Employee benefits liability. This covers an employer's liability for any errors and omissions (E&O) in the administration of an employee benefits program.

- Auto liability. This covers bodily injury or property damage to a third party for vehicles owned, leased, or rented by you for business purposes and for which you become legally liable.

- Umbrella excess liability. This coverage includes increased limits that may be needed over your primary general liability, auto liability, and employers’ liability coverage.

- Pollution/environmental liability. This covers personal injury and property damage as well as the cleanup cost to remove harmful substances and restore the property to its former condition. Some property leases will require this coverage. If you have low to no exposure, your broker should assist with having this requirement stricken from the lease and/or contract.

- Products liability. This form of coverage includes bodily injury and property damage arising from the use of products or operations and includes clinical trials taking place within the US and sitting DIC/DIL (difference in conditions/difference in limits) over foreign clinical trials. (We'll discuss foreign clinical trials in the next webinar and blog in this series.)

- Professional liability-E&O for financial injury. This insures against losses where the insured is legally obligated to pay claims due to errors and omissions that have caused a financial injury to a third party.

Crime coverage doesn’t fall under liability but instead aligns with Management Liability and responds to employee dishonesty and theft claims. Preclinical development stage companies are susceptible to email compromise, phishing attacks, and other cybercrimes we classify as social engineering. This could include vendor or supplier impersonation, executive impersonation, or client impersonation, and the loss occurs when an individual voluntarily sends private information or funds to the attacker. This is one of the most difficult crimes to prevent, and organizations need to implement comprehensive security practices and employee training procedures to prevent them.

Data: Both an Asset and a Liability

As soon as computer systems are in place, there is the possibility of a security breach of confidential corporate or employee data, or a system failure due to an unplanned or unintentional network outage.

While most R&D companies typically hold limited confidential data, this changes when they have a repository or have unblinded information stored on their systems.

Cyber insurance covers companies that suffer a breach of your computer systems. A cyber policy can cover network security failures, service interruptions, network extortion, data recovery, privacy or cyber law violations, media liability, network business interruption, and breaches.

It also can provide coverage if a third party alleges that they were financially harmed by a breach—and cover the costs of notifying individuals affected by a data breach.

It's critical for companies to have ransomware controls, email filtering, and web security systems in place. Carriers require detailed underwriting information before placing a cyber policy.

Plan For Future Growth

We encourage preclinical development stage companies to work closely with their broker to ensure their insurance coverage is keeping pace with anticipated growth. For example, for any anticipated new property locations, buildouts, or remodels, talk with a broker about how to prevent gaps in coverage.

Watch the on-demand recordings of parts 2 and 3 of our Research and Development Webinar Series. We'll be discussing key exposures for companies holding clinical trials and commercialization.

Author

Table of Contents