Guide

Looking Ahead: A Guide to Property & Casualty Risk Management and Insurance in 2023

After stabilizing to some extent from the challenging conditions heightened by COVID-19, the insurance industry has been impacted by the current inflationary period, the war in Ukraine, and ongoing supply chain disruptions. As we look ahead to 2023, we see a mixed bag for Property & Casualty, with certain industries faring better than others.

In our annual P&C Looking Ahead Guide, our property and casualty experts discuss the factors they expect will shape 2023 trends. And, given the variance we anticipate in 2023, our industry practice experts provide insights into expectations for their industry segments.

Download the Guide for our 2023 market forecast >>

In such complex times, it is advantageous to have a knowledgeable and dependable insurance broker to help you navigate the evolving risks in all types of insurance markets. Read more for our insights and projections for the market in 2023.

Our P&C experts discuss the findings from the Guide in a Looking Ahead webinar on November 15th at 10am PT. If you missed it, stay tuned—we'll share a link to the recording here.

Commercial Lines Forecast for 2023

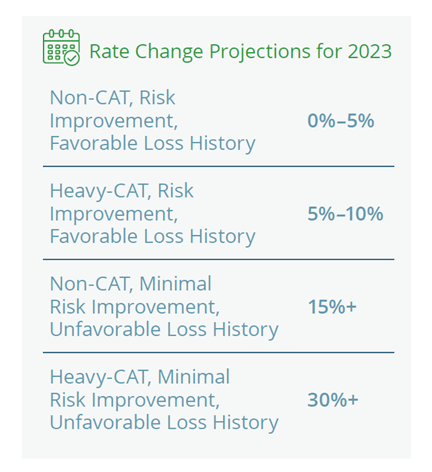

In most segments of the commercial lines market, premium increases have slowed, but we have not yet seen a general pivot to decreasing premiums. We believe this is due to a unique combination of macroeconomic and industry-specific factors.

Our View of 2023: Expect Varying Premium Increases Dependent on Product and Industry

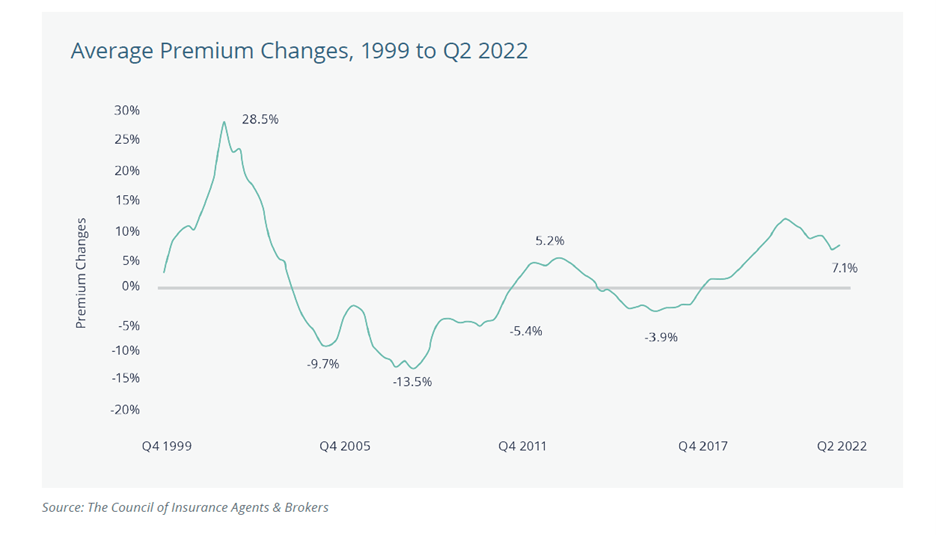

For most commercial lines segments, we believe 2023 will look very similar to 2022: Buyers should expect premiums to continue to increase, albeit at a slower rate. The Q2 2022 Council of Insurance Agents and Brokers survey reported that the average premium increase across the major P&C segments was 6.1% for the quarter, up from 5.7% in the previous quarter.

The unique situation impacting our view of 2023 is the combination of inflation and healthy balance sheets at most commercial lines insurers. The increased premiums over the last several years have lowered combined ratios at almost every commercial insurer.

Insurance premium cycles are inconsistent; our goal with our annual Looking Ahead Guides is to give our clients some guidance about what to expect in the coming year.

Regardless of whether rates are rising or falling, there are certain best practices insurance buyers can follow to improve renewal results:

- Start early and establish relationships with your underwriters.

- Work with your broker to gather detailed information about your risk. This will help differentiate you in the market.

- Address loss control recommendations and discuss these efforts with your underwriters. Proactive loss control demonstrates to underwriters a commitment to risk mitigation.

Property Update: Challenges Lie Ahead

We anticipate a continued hardening of the commercial property insurance market in 2023, largely due to inflation, supply chain constraints, secondary-peril losses, and a challenging reinsurance environment.

Secondary perils used to be considered high-frequency, low-severity events, such as wildfires, floods, tornados, or hail. In 2022, secondary perils, including floods, accounted for 70% of all insured losses. Carriers continue to develop their understanding and rating methodology of these events, which will continue to be a focus in 2023.

Over the past three years, many property carriers adjusted their portfolios, reduced line sizes, altered terms and conditions, and sought to achieve technical rate adequacy. All these actions translated to more stability in accounts. The stability and familiarity of a client’s property portfolio should result in more consistent renewals.

In 2023, there will be a significant focus on retaining and ceding risk, with alternative options such as parametric insurance needing to be explored. Carriers will continue to monitor adequate values, and a heightened focus will be on business income and continuity. Risk management is pivotal, and insureds and brokers will need to strategically determine how to best internally allocate or externally rent capital.

Next year looks to be a year of options. Read the Guide to understand the full landscape so that you as an insured can make informed choices. The detailed Property update starts on page 12.

Casualty Market Opportunities and Threats

The casualty insurance market remains challenging for corporate insurance managers. Heightened litigation, third-party investment in lawsuits, and increased liability verdicts and settlements continue to strain insurer competition and increase rates at a steady clip.

Workers' Compensation: Competition Drives Down Rates

Workers' compensation remains the best-performing casualty line of insurance. It is increasingly vital to organizations’ overall insurance program structures, as many risk managers continue to leverage their WC programs to generate insurer competition on tougher lines of insurance. While some uncertainty remains regarding the potential latent emergence of COVID-19 claims, the pandemic barely impacted insurers’ underwriting results.

Insurers cut rates by 1.2% on average in the second quarter of 2022 in response to the profitable underwriting results, according to the Council of Insurance Agents and Brokers Q2 2022 Rate Survey. We expect continued underwriting profit and insurer competition in the coming year.

The combined factors of stable loss costs, growing wages, and high interest rates will create continued competition among WC insurers while driving down rates. Risk managers will continue to be able to negotiate favorable WC rates and leverage the WC program to drive insurer competition for tougher lines of coverage—namely general/products liability, commercial auto, and umbrella liability.

|

Commercial Auto: Expect Modest Rate Increases

Commercial auto coverage continues to vex insurers. Despite passing along auto rate increases for 44 consecutive quarters, insurers had failed to meaningfully improve underwriting performance until 2020, when the pandemic reduced miles driven by businesses.

In the face of increasing costs for vehicle repairs, more aggressive litigation, and a greater frequency of distracted-driving accidents, insurers will seek rate increases to keep up with the loss cost trend.

|

Commercial General Liability: More Frequent Large Claims

Rate pressure is diminishing but is still present for general and products liability, thanks to an increased frequency of large claims. Per the CIAB, rates rose 4.3% on average in the first half of 2021, though increases were steeper for businesses in high-hazard industries: manufacturers of tough products (e.g., kids' goods, auto or medical parts, and chemicals), habitational real estate owners and operators, sharing economy firms (on-demand delivery services and home sharing), and companies with material wildfire exposure (utilities and forestry concerns).

|

Umbrella and Excess Liability: A Difficult Environment

The excess casualty market remains a difficult environment. Challenging large loss trends are stressing umbrella liability pricing, while insurer competition for higher layers of liability coverage provides some rate relief.

For three straight years, we have warned corporate risk managers of the dangers of social inflation, the phenomenon of increasing claims costs due to changing societal factors, such as legal advertising, litigation financing, the appeal of class action lawsuits, and growing public distrust of corporations.

While umbrellas remain challenging, higher excess layers have seen huge rate and capacity relief over the past year as even more new insurers emerged to offer excess coverage. Insurers generally view high excess pricing for large risks as adequate and are competing vigorously for both large and middle-market risks.

|

Managing the Impact of Employee Turnover on Workers’ Compensation

The twin forces of fast-increasing wages and mass quitting have created a hugely challenging environment for employers. The result of that change is that many employers currently have a larger number of new hires in their workforce than in past years.

This turnover can affect employee safety in three critical ways. First, newly hired employees are more likely to be injured. In two recent studies by large insurers, new hires accounted for 35%–38% of WC injuries across industries.

Industry Insights

The risk and insurance environment is nuanced, and as we have said, we expect some industries to fare better than others. Our experts provide insights on rate trends and market expectations for healthcare, life sciences, technology, and real estate. Since many companies are considering or in the process of building or updating their facilities, we’ve also provided guidance around the builder’s risk segment of the market.

In These Complex Times, We Untangle, Advise, and Solve for You

Property & Casualty insurance does not need to be a mystery. With expertise in loss control, risk mitigation, alternative risk funding, and cost-of-risk analysis, Woodruff Sawyer can help you navigate the complexities of insurance, ensuring that your programs are well-priced and carefully tailored.

For more analysis and predictions for the market in 2023, get the full P&C Looking Ahead Guide.

Author

Table of Contents

We anticipate a rate movement of -4% to +1%.

We anticipate a rate movement of -4% to +1%.