Blog

Property Insurance Market Leaving a Bad Taste in the Mouths of Food & Beverage Companies

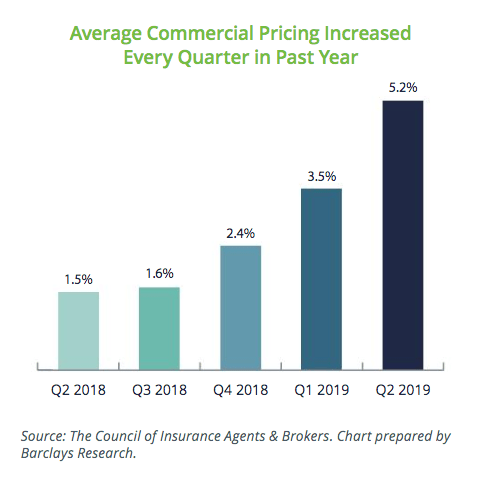

We are officially in a hard property insurance market. That means insurance underwriters are getting more selective and rates keep going up for food and beverage companies. Let's look closely at some of the trends in 2019 and 2020, and what to expect with your property coverage for the remainder of the year.

Rates Expected to Increase Through 2020

Gone (for now) are the days of rate decreases, expanded terms and conditions, broadening endorsements for no additional premium, and neglecting risk control recommendations.

Add to that loss trends such as cyber attacks, product recalls, catastrophic events such as earthquakes, wildfires, and now the novel coronavirus, and you have the recipe for the hard market.

What does this mean for food and beverage manufacturers? Insurance companies have tightened their underwriting guidelines in an effort to correct the underperformance of their portfolios.

Now, underwriters are seeking more desirable accounts. This includes those with good risk management, credible underwriting data such as property values and exposure information, and better claims management and loss control to prevent frequency and severity of loss.

Even before the pandemic, as outlined in Woodruff Sawyer's Looking Ahead Guide 2020 for property and casualty insurance, the rate increases we've seen develop over the past couple of years were expected to continue in 2020.

AmWINS Group reported in February that "early 2020 rate increases have been in the 10%–20% range for non-CAT exposed accounts. Accounts with CAT exposure and poor loss experience are realizing 20%-plus increases, and tougher classes are experiencing even greater increases."

Specific to the food sector, we've seen rate increases well over 20%. Insurance companies known for providing coverage for food and beverage manufacturers have limited appetite and have cut back on their capacity, which is driving some risks to the surplus lines market.

These restrictions are causing loyal accounts to look for new partners and to add more carriers to the program through shared and layered structures to get to desirable limits. Unfortunately, forecasts indicate additional constrictions in capacity, which will mean continued upward pressure on rates.

What's Trending (or Not): Stock Throughput Insurance

Over the past decade, as supply chains have become more global and complex, there was a trend to carve out inventory from the property policy and cover it on a stock throughput policy.

A stock throughput policy (STP) covers inventory from raw materials to finished goods, regardless of where it's at in the supply chain. So whether it's sitting at a dock waiting to be shipped overseas, in a delivery truck or in a storage warehouse, your inventory is generally covered.

In the past, STPs offered broad coverage, flat deductibles, and lower rates versus property policies, especially as it related to catastrophic risk. Another benefit is the coverage from origination to destination, eliminating the reporting of values at each and every location.

However, over the past couple of years, the STP market has suffered multiple large losses, leading to significant rate increases. This has pushed the risk back to property policies at two to three times the premium, which is still more economical than some of the STP renewals currently being offered.

Here's what we saw in 2019 with regards to STPs:

- Rate increases of 15% to up to 200% depending on loss experience and class of business

- A more stringent underwriting process requiring much more data

- The application of restrictive terms and conditions

- Reduced limit capacity, leaving brokers searching for markets to participate in quota share or layered programs

What does 2020 look like for the STP market? The good news is we're likely to see a return of capacity for STP in 2020 versus 2019. However, underwriter sentiment is that they will still be looking to underwrite a good risk for less premium, versus bad risks for more.

COVID-19 and Losses: What to Expect

With the novel coronavirus pandemic in motion, businesses and insurers won't know the full impact for a while, yet many are speculating.

Companies around the world are feeling the impact of business interruption and supply chain disruption. The insurance industry is bracing for how it will affect the property / stock throughput market.

Unfortunately, analysts predict that it is the businesses that will bear the burden of the financial loss. Though there is movement in Congress for a reinsurance backstop to cover losses--a Pandemic Risk Insurance Act (PRIA) similar to what was done after 9/11 with the Terrrorsim Risk Insurance Act (TRIA).

But keep in mind that in many property policies, communicable and infectious disease exclusions and limitations exist. My colleague Carolyn Polikoff writes about this as it relates to property policies, business interruption and COVID-19 here, including info about disruption in the supply chain, in which she points out:

Communicable/infectious diseases are almost never a covered peril. Furthermore, insurers usually will not offer the communicable/infectious diseases endorsements discussed above for CBI coverage.

With delayed or even cancelled shipments leading to spoilage of perishable items or reduced market value, know that STP policies ordinarily do not cover delay, fear of loss or spoilage. Stock throughput policies are similar to property policies in that the trigger is physical loss or damage of insured goods.

And while STPs are not designed to provide coverage for business interruption loss, there may be added provisions to address extra expenses. It is important to check your policy and consult with your broker about how your policy would respond.

While no two policies are the same and brokers are not arbiters of coverage, we encourage insureds to document the impact of COVID-19 on their operations in order to submit claims for consideration. It may be a long wait as this works through the system but if you don't ask, you don't get.

(For more on business risks and COVID-19, see our dedicated resource page.)

Food & Beverage: Prepping for Your Next Renewal

In 2020, food and beverage companies can expect carriers to have more interest in writing new business with the caveat that they will be very selective in the accounts they underwrite. We'll still see rate increases into the double digits for the remainder of the year.

As you prepare for your next renewal, here are some things to consider:

Know your risk. To know your risk is to control your insurance renewal. The better you know your risk and the better you can articulate your story to insurers, the better the outcome.

Bite the bullet. Now is the time to comply with those risk control recommendations you've been putting off. Your risk will be more appealing to an underwriter if you do so, and compliance will likely have more of an impact on premiums than it would have in the past.

Data, data, data. With the submission overload (many underwriters are seeing a 30% increase in volume because everyone is looking for an option), complete information from a reputable broker moves a "request for quote" to the top.

Start early. Develop a pre-renewal strategy with your broker. Schedule underwriting meetings and loss control visits with prospective carriers. Submit renewal updates (applications, exposure information, etc.) at least 90 days in advance.

Leave no pebble left unturned. While the softer, less restrictive market conditions might have resulted in binding the path of least resistance with minimal impact, now the recommendation is to exhaust all options. You may have to step outside of your comfort zone to obtain the coverage you need. This includes things like exploring the domestic and London market; looking at other insurance companies; evaluating current broker relationships; exploring different program structures with limits; and considering different deductibles to obtain the results you hope to achieve.

Innovation is exciting. Promote what you've done differently to improve your risk profile. What protection measures have you added? What risk mitigation tactics have you implemented? What employee training have you provided? What business continuity exercises have you launched? This is extremely relevant to an underwriter who is looking at your business.

Case Study: The Food Wrapper

In a hard market, brokers develop innovative ways to make sure clients get the coverage they need. We're leading the way at Woodruff Sawyer with a new solution called "The Food Wrapper."

The Food Wrapper takes four different insuring agreements specific to food and beverage manufacturers: stock throughput, product recall, terrorism and cyber, and wraps them into one policy to spread risk, enhance coverage and reduce cost.

"When we were informed by our Lloyd's market that they would no longer be able to offer stock throughput renewal terms for our berry processor client due to industry losses in that sector, we were worried we would not be able to find a solution for them, even at double the price. Fortunately, The Food Wrapper program was not only able to offer competitive renewal terms and conditions but do so at a very competitive price."

- Phil Howes, Vice President, Woodruff Sawyer

Closing Thoughts

The hard property insurance market will continue in 2020, but insurance companies will still charge their underwriters with writing new business including food and beverage companies.

As they become more selective, knowing how to distinguish your risk from the others on their desk is key. Seek out the right partners, explore alternatives, be creative, tell your story, and start early!

Author

Table of Contents