Blog

Scenario Analysis: A Powerful Insurance Purchasing Tool

When buying insurance, how do you determine what limits to purchase? Scenario analysis is one technique your broker can use.

When our clients consider buying insurance, a common question they ask is: “What limits should we purchase?” Several factors impact the decision to buy insurance, from subjective factors such as risk tolerance to objective assessments aimed at quantifying risk, such as measuring exposures and modeling the company’s losses. Modern technological advancements have further allowed risk scientists to evolve diverse risk quantification and limit assessment techniques. This blog, from the Woodruff Sawyer Analytics Desk, will cover one such technique: scenario analysis.

How Is Scenario Analysis Used for Risk Assessment?

Scenario analysis is a well-known term today within the finance, engineering, and science communities, aimed at examining the effect of factors that may change over time. In the context of commercial insurance, Woodruff Sawyer experts use scenario analysis to measure the adequacy of our client’s insurance program to respond to a potential loss occurrence. With dynamic underwriting cycles, macroeconomic activities, and ever-changing market pricing, scenario analysis offers a tangible way to explore the extent of loss a company may face within a defined set of parameters.

It's worth noting that most scenario analysis techniques draw their assumptions from past known similar events or occurrences data in the same or parallel industries and sectors. In turn, such assumptions provide componentized levers that can be moved to generate a sufficiently large number of scenarios and assess potential loss in each scenario.

Simulations, a more sophisticated form of this setup, offer a wide range of possible loss events. This approach allows risk managers and financial decision-makers to compare and understand the extent to which current insurance programs cover losses and thus, develop plans for potential uninsured portions of risk.

Our Scenario Analysis Tools at Work

Woodruff Sawyer analytics experts have developed several customized types of scenario analysis tools depending on the type of risk exposure coverage. The coverage specific tools use attributes of exposures (such as change in total risk counts over time) and varying assumptions about potential losses (such as frequency, severity, or time horizon) to examine the widest risk spectrum. Below, we provide a few detailed examples of the scenario analysis by line of insurance coverage:

D&O Insurance

Consider D&O (directors & officers) insurance for a public company. As a director, do you know how much exposure you may have to your current market capitalization and the ongoing volatility in the equity markets? Can you reasonably anticipate and quantify a range of potential securities class action events and related settlements and measure the adequacy of your program to respond to such scenarios?

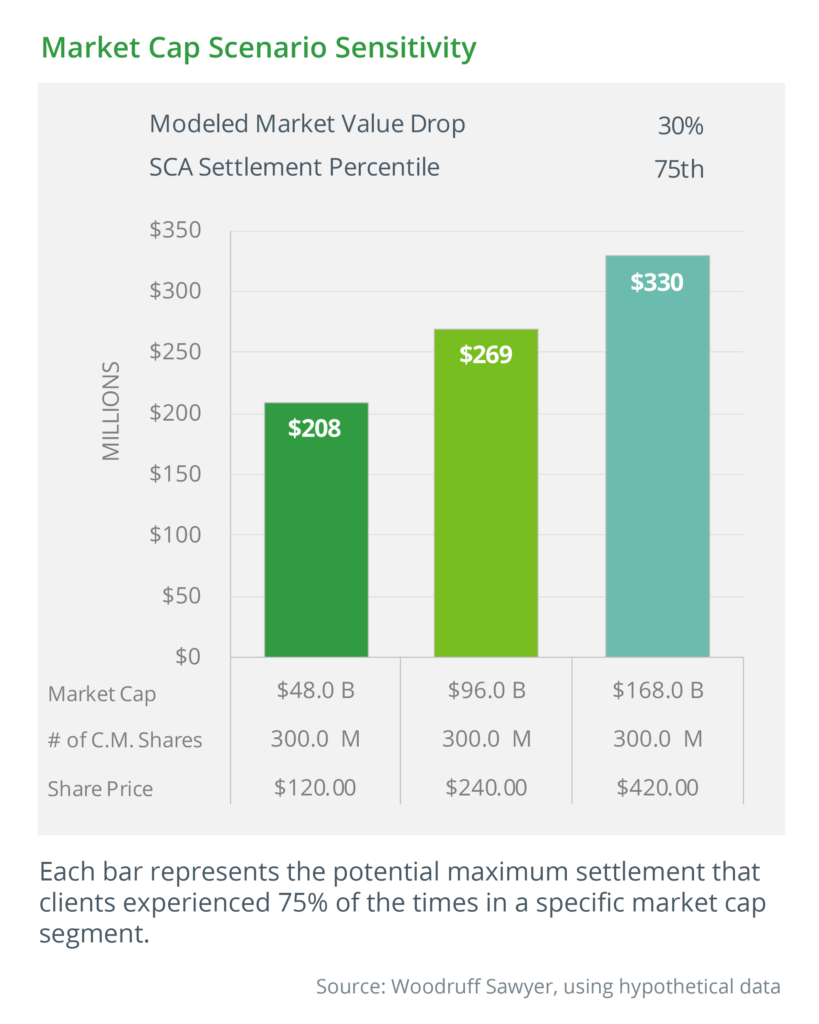

Woodruff Sawyer brokers use a proprietary toolkit of securities class action settlement data to draw assumptions and model potential loss scenarios related to D&O risk for public companies. The toolkit provides the ability to measure the impact of changes in stock price and market float and allows us to assess the adequacy of a company’s current insurance program to respond to such changes.

| The chart here shows an example of a comparative scenario analysis. Based on a modeled market value drop of 30%, the chart shows modeled 75th percentile loss comparisons a company may face in an SCA lawsuit settlement for 100% and 250% growth scenarios. This type of loss comparison allows you to assess the adequacy of your current risk management program and its ability to respond in case of explosive growth. |

Casualty Insurance

As another example, consider casualty insurance for a large fleet or product manufacturer and distributor. Under a loss-sensitive program (a form of self-insurance), the company may feel confident retaining its primary losses and ability to pay claims. But what about the cases where loss exceeds expectations? If a product malfunctions or its fleet operators are involved in a personal injury accident, claims could potentially surpass tens or hundreds of millions of dollars. In such cases, the losses pose a financial risk to the balance sheet of a company.

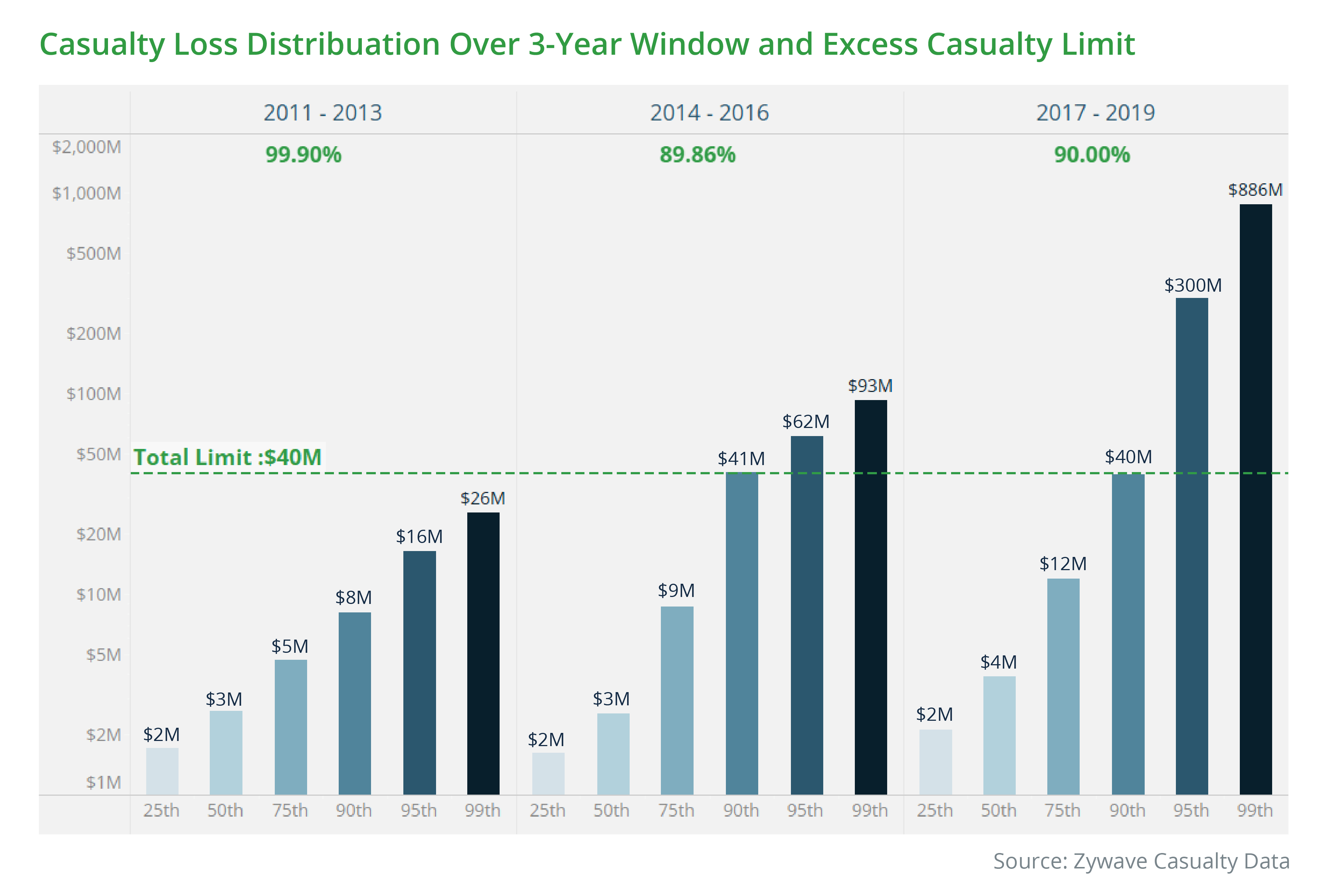

Woodruff Sawyer casualty experts use scenario analysis to build a customized loss scale and measure the adequacy of excess casualty programs in responding to large loss scenarios. The casualty scenario analysis produces a visual loss scale showing an estimated percentage of large loss scenarios that a client’s excess casualty limits can adequately cover.

| Depending on the data availability, the loss scale could be subdivided into short term periods to assess the volatility of loss distributions and adequacy of an excess limit to respond to shock periods. The bar chart represents an example for a custom standard industry classification (SIC) industry group. The premise is based on drawing events or occurrences from similar businesses and parallel industries, using them as a measuring stick to gauge potential shock loss distributions. |

Property Insurance

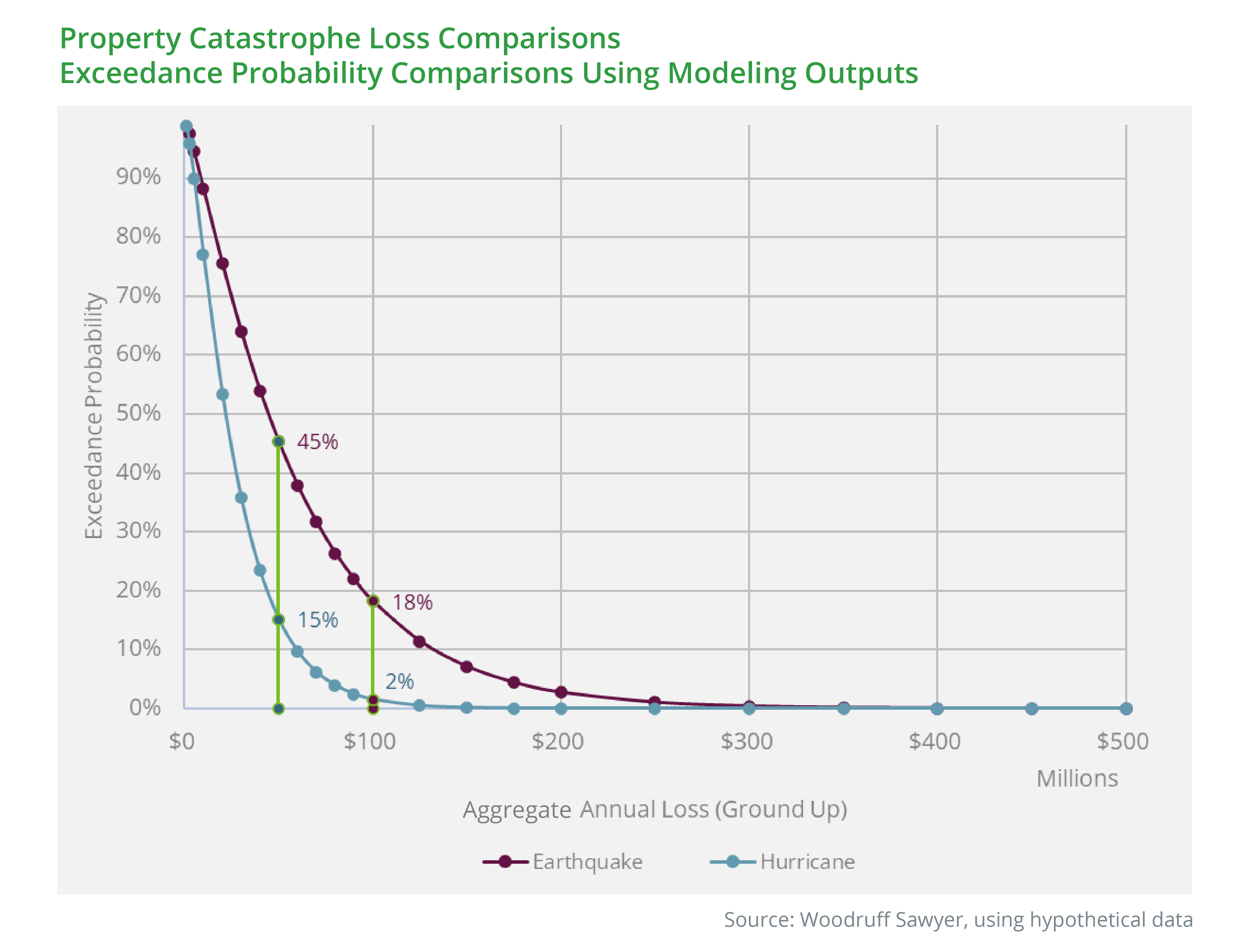

Risk scenario analysis for large property exposures is more sophisticated today than it was two decades ago. For example, catastrophic models can now provide the ability to model a known hurricane or earthquake footprint and measure a scenario loss using today’s exposure. Since exposures are for real property—using construction class, occupancy, height, age of the property, and installed utilities—scenario loss modeling can be customized for locations nationwide. Such analysis provides a probable measure of property loss that a business may sustain in a single event such as an earthquake, hurricane, flood, tornado, hail, or a combined potential loss in a given year.

Computer simulations have made scenario modeling much more accessible today for our clients. We collaborate and tap into the wide intelligence of catastrophe modeling companies and seek scenario analysis on demand for our property programs.

| The negative exponential curve chart on this graph is an illustration of a hypothetical client comparing the earthquake risk curve with hurricane risk. Note that these curves are developed by simulating tens of thousands of loss scenarios. |

Cyber Insurance

The cyber toolkit at Woodruff Sawyer has also evolved. The increase of cyberattacks and their related losses are no longer a myth in the industry. Albeit young and with limited loss history, modeling firms have used the power of scenario analysis to build a potential loss spectrum for a range of industries and company sizes. Data breaches, software/system impairment, or network outages are all well-known types of cyber risk scenarios. The type of industry; type and size of data handled (PII, PHI, or PCI); and the extent, type, and size of the cyber event invariably impact the potential loss a company may experience.

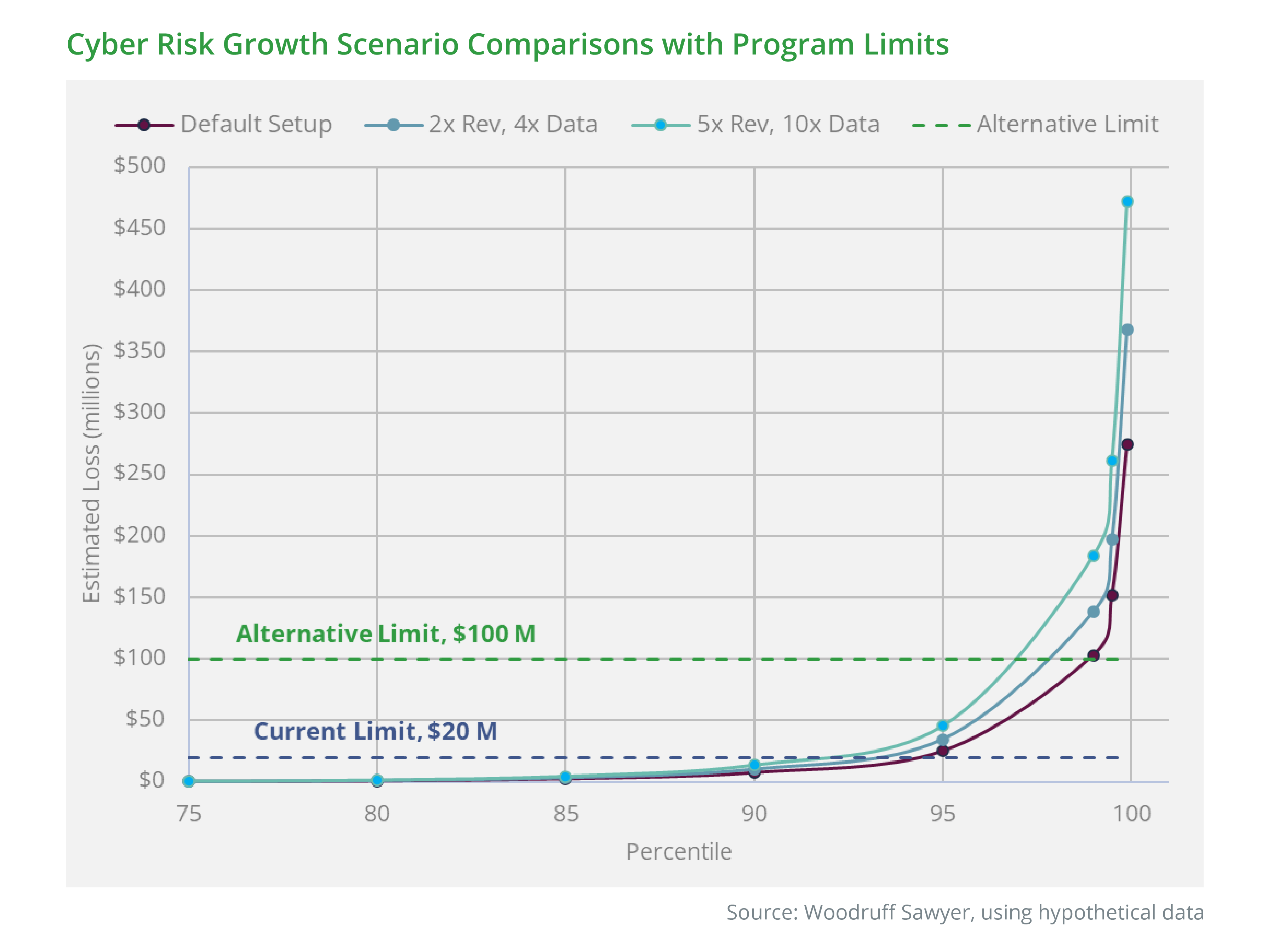

Using the CYBERCUBE model, Woodruff Sawyer cyber risk experts simulate revenue and data growth scenarios for clients to assess the percentage of scenarios covered by the purchased cyber insurance program limits. Such analysis allows companies to adequately measure the cost of premium versus expected losses and accordingly plan or explore alternative risk transfer instruments.

| The chart here illustrates two revenue and data growth scenarios and compares to the current state (default) of a hypothetical client. In addition, the chart also provides the comparison between current limits of insurance and potential alternative limits of insurance. |

From all the above examples of various risk coverages, I want to emphasize that scenario loss analysis provides only one yardstick to measure the effectiveness of a decision to retain or transfer the risk. While it is a powerful tool, at the same time it should not be solely used to make insurance purchase decisions. One must work with insurance experts to examine the qualitative factors, business goals, comparative benchmarking, risk tolerance, and business knowledge to become fully informed of the risks. Such an approach helps weighting traditional insurance with alternate risk transfer mechanisms such as captives, pools, multi-year coverage, etc .

Helpful Questions to Ask About Scenario Analysis When Quantifying Your Business Risks

Although quantifying risk is a complex statistical topic, you don't need to be a risk science expert to understand the potential loss scenario your business may face and assess the adequacy of insurance limits to cover such a claim. The questions below can inform your insurance decisions:

- What scenarios were modeled to assess the adequacy of your insurance program?

- What process was used in developing the scenarios for risk analysis?

- What data and information were gathered/used for developing scenario analysis?

- What assumptions were made in developing those scenarios?

- How would you determine the prioritization and use of scenarios for risk estimation?

- What type of tools, techniques, and technology was used in carrying out scenario analysis?

- How effective are the scenarios in informing the strategic planning and decision-making process?

- Out of 100, how many scenarios may have an uninsured loss in excess of the current program?

- What is the chance that an extreme scenario may occur? How does the scenario affect your exposure, and what is the potential loss?

- How was the specific past claims experience used in informing the scenario analysis?

After you have considered the questions above, here are some questions I’d like to ask you:

- How did you determine the right level of coverage for protecting your balance sheet?

- How do you measure your company’s risk tolerance and use that in risk management decisions?

- What options did you evaluate to select an effective insurance program?

- How do you ensure that your insurance coverage meets the needs of your company’s growth and evolution in the next three to five years?

- How complete is your risk management program coverage considering recent technological advances of your company?

- How deeply familiar are you with the risk measurement assumptions and techniques used to build your insurance program?

- Do you think your situation is ideal for forming a captive or should you purchase a multi-year guaranteed cost insurance contract?

- Are you facing a situation where you must balance your capital deployment between financing risk management and business operations?

- What is the biggest challenge facing your company in the current economic environment that impacts your ability to sustain your current insurance program?

- Are you curious about what Woodruff Sawyer experts may have to say about your current insurance program?

Ultimately, all types of businesses are faced with a wide spectrum of risks in today’s environment, be it physical, legal, economic, social, or political. The nature of the risk is that it is unknown, and no matter how much one quantifies or observes diligence, we will miss the “unknown unknowns.” However, we can use available risk science to develop estimates based on probable scenarios and make an informed choice of retaining or transferring financial risk. The effectiveness of your decisions would depend on the assumptions used in developing the scenarios.

If you’d like more information or need our expertise in running scenario analysis for your business situations, contact your Woodruff Sawyer representative. A conversation with our experts can either strengthen your confidence in your current program or allow you to explore options you weren't aware were available.

Table of Contents