Blog

Managing the Impact of Rising Auto Liability Claims Volatility

The cost of catastrophic auto collisions is on the rise and we see concerning trends in large claims, or those costing more than $15 million.

Few aspects of casualty insurance pose greater challenges to corporate risk managers and liability insurance underwriters than catastrophic auto accidents. Increasing medical costs and vehicle repair costs, combined with social inflation, have driven consistent growth in the number and average size of large auto cases over the past 15 years. Social inflation is the phenomenon of increasing claims costs due to changing societal factors such as legal advertising, litigation financing, the appeal of class action lawsuits, and growing public distrust of corporations. So, our casualty experts asked two questions:

- What does the latest large case data tell us about the trends in commercial auto liability claims over $15 million in total costs?

- What should risk managers consider in building their insurance programs?

To find the answers to those questions, the Woodruff Sawyer Commercial Business Intelligence Team analyzed approximately 48,000 auto liability claims and observed a handful of concerning developments.

Annual Large Auto Claims on the Rise

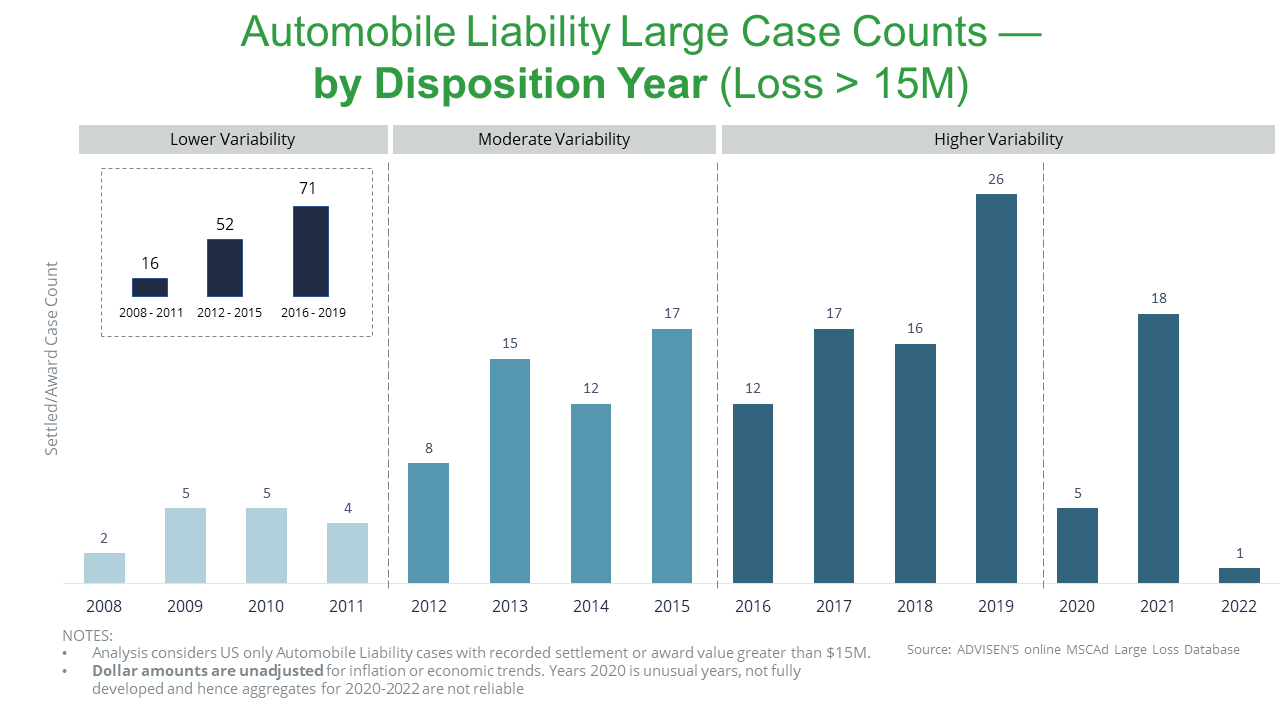

One helpful way of analyzing liability case data is to organize claims by disposition year, the year in which cases are resolved either via a settlement with plaintiffs or a court’s verdict. Disposition year accounts for both the time it takes for claimants to file lawsuits and the time for cases to be litigated and settled.

Since 2008, there has been a clear upward trend in the number of large auto claim resolutions. Companies allegedly responsible for the auto accidents resolved 18 large auto cases in 2021, compared with just two in 2008. Breaking that span into four-year periods, we see an even more definitive increase in the frequency of large auto liability cases. Within each four-year window, the number of large auto cases increased significantly from 16 in 2008–2011 to 52 in 2012–2015 and then to 71 in 2016–2019.

Since 2008, there has been a clear upward trend in the number of large auto claim resolutions. Companies allegedly responsible for the auto accidents resolved 18 large auto cases in 2021, compared with just two in 2008. Breaking that span into four-year periods, we see an even more definitive increase in the frequency of large auto liability cases. Within each four-year window, the number of large auto cases increased significantly from 16 in 2008–2011 to 52 in 2012–2015 and then to 71 in 2016–2019.

The number of resolved cases spiked in 2019, before plummeting in 2020 to 5 when courts were generally closed due to the COVID-19 pandemic. A key question is whether 2019 was an aberration or represents the “new normal” litigation environment for Auto Liability.

What Does the Trend Look Like When Sorting by Accident Year?

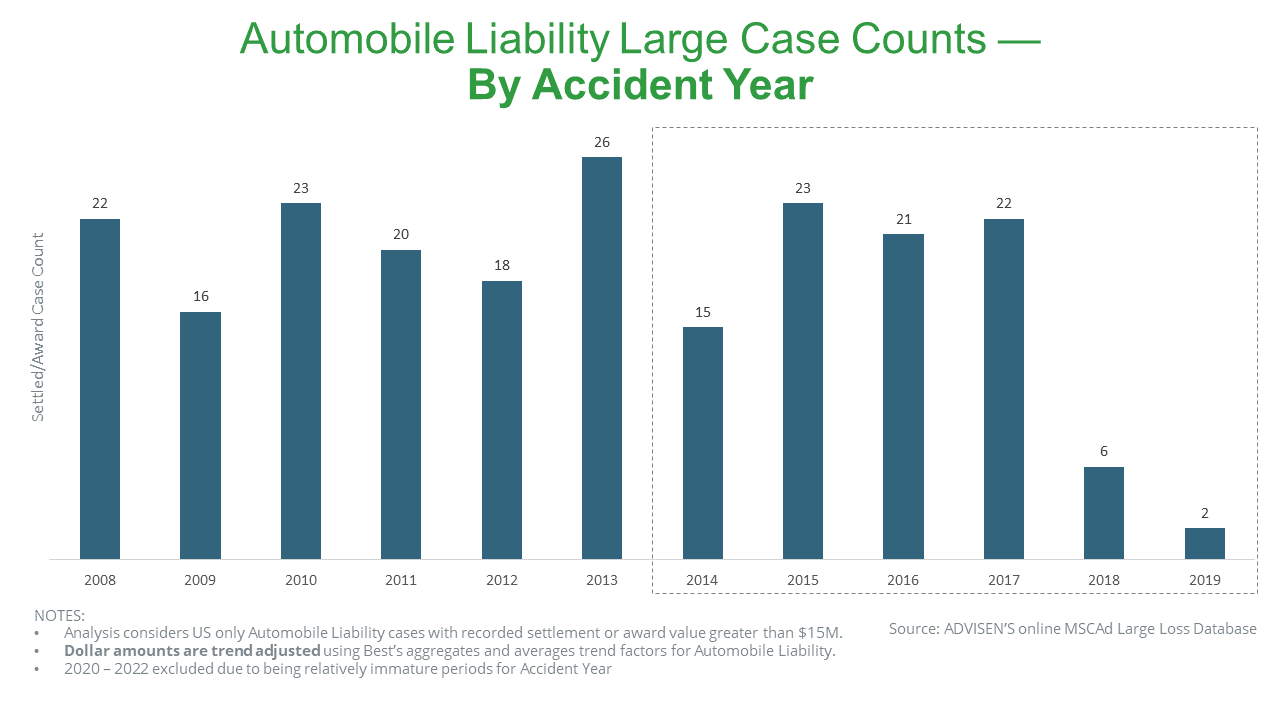

Examining large loss trends by accident year—the year in which the accident that led to the litigation occurred—is also useful in understanding the trend in the number of accidents themselves. However, recent periods in the Accident Year analysis are immature and will appear understated due to the lag in claimants filing lawsuits and courts processing cases.

At first glance, the long-term trend appears benign. The same number of large auto accidents occurred in 2008 as in 2017, and the number of cases in 2018 and 2019 dropped off significantly. However, it is critical to remember that almost certainly a material number of large auto cases occurred in the last years of the period (2017–2019) that have yet to result in lawsuits resolved in or out of court.

As claimants and corporations resolve these cases, which currently are absent from the Advisen data, the number of large claims for the immature years will rise in line with the disposition year trends.

Average Case Size Is Volatile

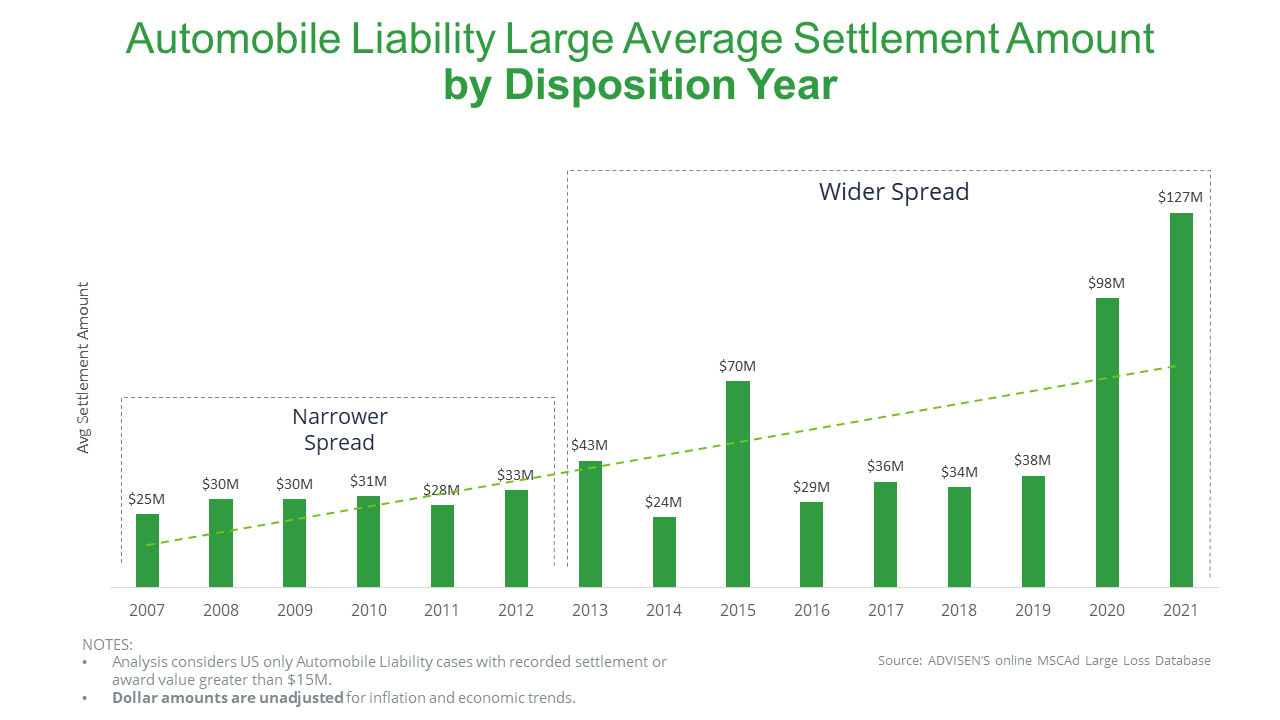

In terms of the average size of large auto accident settlements, it is hard to point to a clear trend. While the annual averages jumped in 2020 and 2021, those years were skewed by massive outlier claims.

What is obvious from the analysis is a huge increase in the variability of large claim severity, indicating that auto liability risk continues to become more unpredictable.

The Top 10 Large Cases in the Past Decade Resolved in Excess of $100M

Out of top 10 large cases since 2011, seven cases were filed and settled in 2015 or later years. Only four such cases involved for-hire trucking operations. Three of the remaining six cases involved owned or leased fleets of vehicles. Common allegations in cases involving fleets of trucks were:

- Negligence in vehicle maintenance

- Distracted or negligent driving

- Lack of driver training

Predictably, all 10 cases involved bodily injuries: six resulting in deaths and four resulting in severe injuries. All cases considered more complex financial implications of injuries on the lives of the injured or relatives of the deceased and resolved in the north of $100 million.

Managing a Tough Auto Liability Outlook with Strategic Insurance Program Design

The challenging litigation trend for large auto cases requires careful planning for Umbrella and Excess Liability renewals. The first step in approaching the Excess Casualty market is to conduct a thorough gap analysis of risk controls intended to minimize the potential of big auto losses.

To improve their risk profiles and ensure compliance with Department of Transportation (DOT) regulations, companies should consider conducting a mock DOT audit and gap analysis by location by working with a third-party vendor, their auto liability carrier, or even a state trucking association. But even those companies without DOT-level fleets can provide evidence to their auto liability carrier that they are limiting their auto liability exposure.

| Here are some of our recommendations for engaging the current Excess Casualty market: |

|---|

|

|

|

In addition to these tips, we recommend that companies renew their focus on driver safety and accident-prevention strategies.

Safety must be a top management priority. Companies should build, maintain, and document a safety and training process that includes ongoing coaching in operating the new technology in vehicles.

Reducing distracted driving is an essential prevention measure. A survey from UFG Insurance found that 72% of commercial drivers admit to distracted driving and 47% report they have texted while behind the wheel. The Federal Motor Carrier Safety Administration reports that the chance of a vehicle accident or a near accident (such as an unintentional lane shift) is 23 times greater for commercial drivers who text while driving.

Exhaustion that can lead to falling asleep at the wheel is also an increasing threat to driver safety. Companies need to put strict rules in place regarding cellphone use, enforce rest breaks, and limit night driving. Improved communication about these rules will demonstrate management’s commitment to their drivers’ safety.

If you would like more information on this analysis or on ways you can better handle the current Excess Casualty market, contact your Woodruff Sawyer representative.

Author

Table of Contents