Blog

Predictions for M&A Deal Flow in 2021

To say 2020 was an interesting year for mergers and acquisitions is an understatement. And now, people want to know: What does 2021 hold?

Working in reps and warranties insurance (RWI) gives us access to a wide variety of opinions throughout the M&A industry. We have spoken with underwriters, clients, and lawyers in both the financial and strategic investment worlds, and certain topics and trends seem to be dominating the conversation right now.

- What will deal flow look like in 2021?

- What impact will the new administration have on deals?

- Will we all start traveling again, and how will that impact the M&A world?

What Will M&A Deal Flow Look Like in 2021?

We had expected a busy fourth quarter of 2020 as the backlog of deals put on hold due to the pandemic in the second quarter of 2020 got back on track.

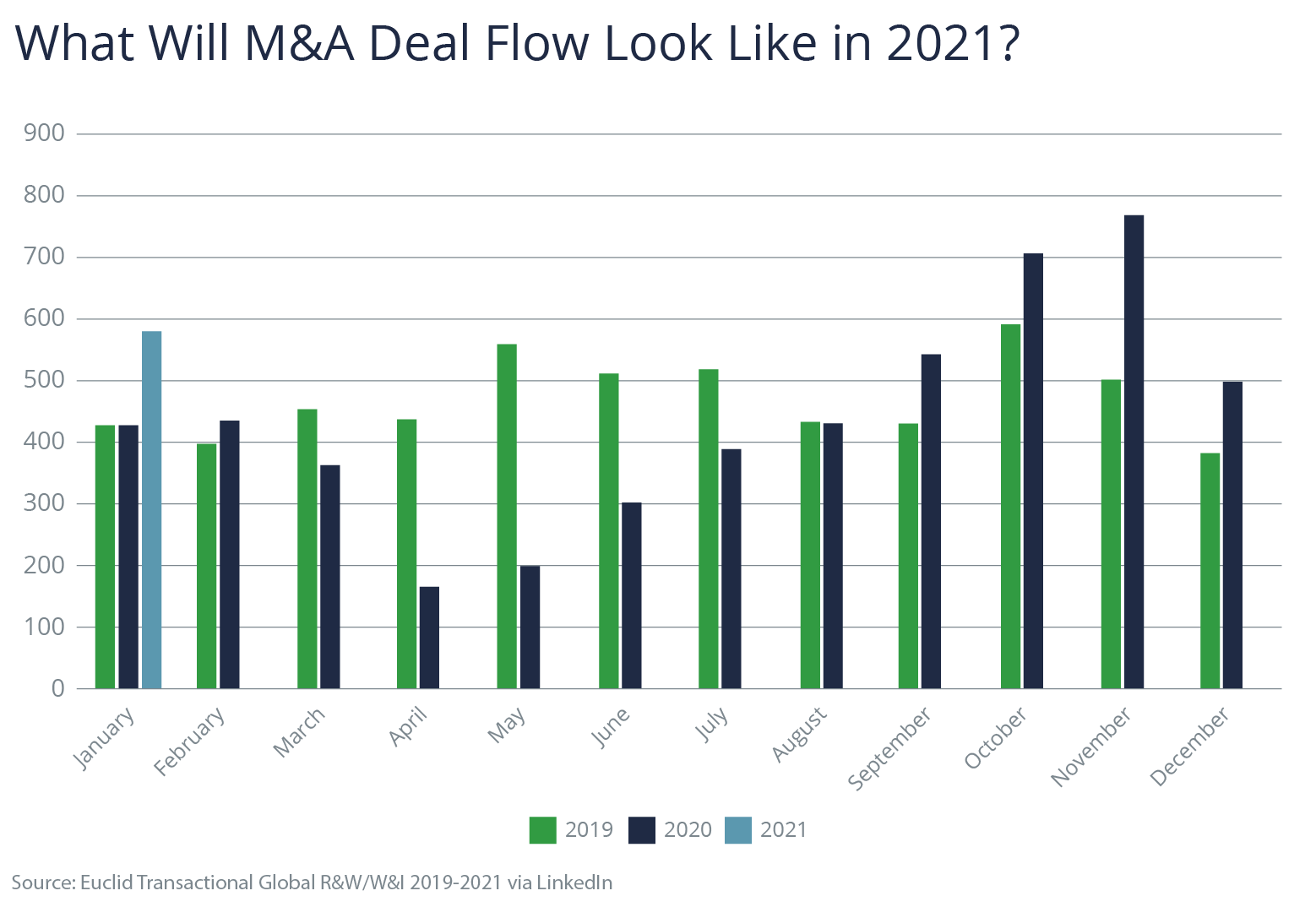

What has surprised and delighted us, however, is the unprecedented level of activity in January 2021. We did not anticipate this. And as the above chart from Euclid illustrates, we are not alone.

Do we think this trend is likely to continue, or are these deals that didn't make their deadlines in December 2020 and carried over? We think this is a train that's not about to pull into the station. The chart above shows the number of RWI submissions by month. If it was deals not making the 2020 end-of-year deadline you wouldn’t see new submissions. So we can surmise that brand new deals coming into the market are driving deal flow.

There are a number of sectors that jumped from steady performers to rock stars during COVID-19, including garden and pet supply, video games, online retail, and telemedicine, to name a few. These new rock stars are driving a lot of deal flow in two ways. Firstly they are looking to build out their offering. Secondly, there are buyers now looking to acquire assets in these new rock star spaces.

Listen in as experts Emily Maier and Luke Parsons discuss M&A deal flow in the private equity market in the coming year:

One counterargument is that we are not seeing an uptick in deals but an uptick in the number of deals using RWI as a result of a more risk-averse environment. It's not a bad argument, as people are more cautious in a post-COVID world. We doubt this, though, as RWI is not a particularly effective mechanism at hedging COVID risk.

A recent Deloitte study showed 61% of M&A professionals thought M&A would continue at pre-pandemic levels, and 53% of US executives said their companies plan to increase M&A investment in 2021.

The Impact of SPACs

Of course, no look at 2021 would be complete without reference to the SPAC boom.

Special purpose acquisition companies (SPACs) have a requirement to find a target within two years of forming, impacting the deal flow. If they cannot successfully do so, they must return the money to their investors, which no one wants to do.

Our SPAC clients have advised that many of them want to beat that two-year mark and have a deal in hand within 18 months, which will increase competition and potential deal flow.

What does that mean for the RWI market? Demand is currently outstripping supply, and that will inevitably lead to premium adjustment. We were already beginning to see this change toward the end of last year.

What Impact Will the New Administration Have

Another obvious question is the likely impact of the Biden administration on deal activity and focus. There are certainly signs that the Democrat-led administration is likely to get more interactive on deals.

First, there is a reduction in HSR thresholds for the first time in many years.

The Federal Trade Commission (FTC) argues that lowering the HSR thresholds is merely the result of a reduction in GDP. However, when we also see they have put a hold on early termination, it does raise some uncertainty as to the impact on length of deal time.

What about international scrutiny? A recent WSJ business insider article suggests Biden is beefing up the national security panel CFIUS to look at Chinese investment in US tech startups. It remains to be seen how the impact of the new administration will play out. Deals tend to find a way, but the cycle may take longer. If other parts of the M&A process are taking longer, we believe this may result in greater pressure on the RWI market and require other providers to work at even faster speeds to mitigate time lost.

Will We All Start Travelling Again, and How Will That Impact the M&A World?

The RWI market in the US has always conducted business at a distance. Unlike the London market with the physical Lloyds' marketplace, we have long done insurance business over email and phone.

Unlike us, the rest of the M&A world used to be a lot more “hands-on,” where courting potential sellers, visits to sites, management meetings, and “getting to know you” dinners were the norm.

Buyers adapted throughout the pandemic and Zoom meetings then became the norm. In the end, COVID did not negatively impact deal-making as much as had been feared. With the vaccine rolling out, is long-distance courting going to continue in 2021?

A recent Forbes article discusses what the post-pandemic business world might look like. While it is true that in-person meetings create personal bonds, there seems to be an even split about whether a return to travel will be necessary.

So what do we think the year ahead holds? Certainly, plenty of activity is on the horizon. There is no reduction in dry powder looking for a home, and with the SPAC boom having a two-year timeline to find deals we expect to see competition only increase.

Deals may take longer for a number of reasons, but it will become clearer as the year progresses how much the new administration intends to become a voice in deal-making.

We think there is a risk that increased competition due to a short time frame to make deals and the plethora of SPACs that have been launched means we will see a lot of deal activity with deals consummated in haste. Both of these will put pressure on the RWI market. The potential for greater problems with cultural integration may lead to more M&A failures which in turn will invariably lead to more claims.

We believe the industry will find answers to all these challenges, but it may turn out that 2021 is no less interesting than 2020 was.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents