Guide

Guide to D&O Insurance for SPAC IPOs, 2024 Edition

Special purpose acquisition companies (SPACs) are an alternative way to take companies public—but this route is not without its risks, particularly in the current legal and regulatory environment.

Woodruff Sawyer’s Guide to D&O Insurance for SPAC IPOs, 2024 edition, outlines the risks facing SPACs in 2024.

Additionally, the Guide examines how directors and officers (D&O) insurance can play a crucial role in protecting against these risks and why understanding the current market dynamics for D&O insurance is essential for SPAC directors and officers.

Get instant access to the report now and continue reading for some highlights.

Significant Risks Facing SPACs in 2024

Securities Class Actions

Securities class actions are among the more severe lawsuits SPACS can face. It’s not the SPAC IPO that typically gets sued however—it is the de-SPAC transaction.

These lawsuits commonly reach back to allege wrongdoing that predates the merger, however, hence the need for the SPAC to purchase D&O insurance.

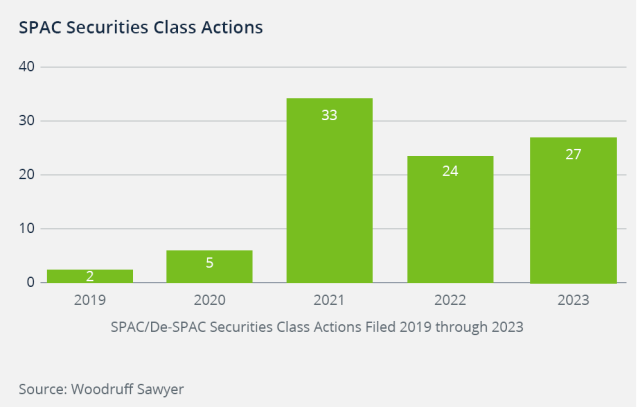

In 2023, there was a 12.5% increase in securities class actions against SPACs from the prior year, with 27 cases.

Plaintiffs bring this litigation in federal or state court where they can sue any of the following:

- The SPAC and its directors and officers

- The private company the SPAC is acquiring and its directors and officers

- SPAC sponsors

- Other parties related to the deal

Most of these suits are filed post-merger, but there are also examples of class action filings before the M&A transaction.

Breach of Fiduciary Duty Suits

A series of breach of fiduciary duty lawsuits in Delaware over the past few years resulted in stringent standards being applied by the courts, making it a challenge for defendants to dismiss the suit. Indeed, many SPACs now prefer to avoid incorporating in Delaware.

Many breach of fiduciary duty suits are brought on behalf of a corporation by shareholders in the form of a derivative suit, and Delaware corporations cannot indemnify these settlements.

As a result, these suits can pose a severe personal financial risk to the individual directors and officers of the SPAC. Without D&O insurance, individual directors and officers may need to cover settlement costs out of pocket.

Merger Objection Lawsuits

Merger objection suits revolve around allegations of insufficient disclosure about an upcoming merger.

These kinds of lawsuits are typically dropped after additional disclosure is filed, and the plaintiffs and their attorneys walk away with a “mootness fee.” While the number of these suits should be waning given recent court rulings, they are still a threat for now.

Merger objection suits are so common that they are often referred to as the “M&A tax” of doing business in the United States.

Regulatory Enforcements

Aside from private litigation, the SEC, the DOJ, and the Financial Industry Regulatory Authority (FINRA) continue to focus on the SPAC market.

Since 2021, these agencies have brought several enforcement and investigative actions against SPACs, their directors and officers, their sponsors, the targets, the target’s directors and officers—and even against SPAC professional advisers.

Last year, the SEC settled another $1 million civil penalty enforcement action against an investment adviser—Corvex Management LP—for failing to disclose conflicts of interest.

Enforcement actions in this arena have resulted in over a hundred million dollars in fines. Consider, too, the enormous legal costs that would have been incurred while defending against the enforcement action.

Of course, D&O insurance for SPACs will not pay for governmental fines and penalties. Unfortunately, the costs of defending an investigation of the corporate entity are also typically not covered by D&O insurance.

However, D&O insurance will pay for the defense of individual SPAC directors and officers, costs that can otherwise be personally bankrupting.

Transferring Risk: D&O Insurance

D&O insurance is crucial for protecting against the substantial liability risks that SPAC directors and officers face.

Notably, the cost of D&O insurance for SPAC IPOs has decreased to more manageable levels in 2024 and is expected to remain stable in the near future.

While increased competition among carriers has allowed for significant price reductions in premiums over the last year, the steady stream of litigation and regulatory risk continues to inform carriers’ appetite for risk.

Considering the dynamic nature of the current D&O insurance market, it is important to consult your insurance broker to obtain the most accurate and up-to-date pricing information.

Get More Insights

Access Woodruff Sawyer’s Guide to D&O Insurance for SPAC IPOs, 2024 edition, and get deeper insights on SPAC liabilities and more, including:

- Additional types of lawsuits SPACs face

- The lifecycle of the SPAC and corresponding D&O insurance activities

- Risk factors D&O insurance underwriters assess

- What the process of securing D&O insurance looks like

- Business combination and D&O insurance logistics

- Questions to ask to secure the right D&O insurance broker

Authors

Table of Contents