Report

Q2 2024 Commercial Insurance Market: Positive Conditions Across Most Segments

Insurance buyers enjoyed favorable market conditions across most segments of the commercial lines market in the first half of 2024. D&O and Cyber led the way in premium decreases, even benefiting companies with claims activity. The Property market is also improving; while rates are still rising, the increases are significantly smaller. Companies with good loss experience and high-quality risk management might even see a flat renewal. However, on the Casualty side, auto, general liability and umbrella placements remain challenging, with buyers likely facing rate increases in these lines.

In this Q2 2024 Commercial Lines Insurance Market Update, we review insurance rates and pricing trends across various segments. Read on for more details by line of coverage.

D&O: Carrier Competition Continues

With an oversupply of insurance capacity and only a modest uptick in IPOs, insurers are still competing for public D&O renewal business, driving rates and retentions down for most companies. Several market-leading carriers are seeking pricing discipline to prevent rates from lowering further.

Litigation in 2024 is trending up. In the first half of this year, 104 cases were filed—10% above the first half of 2023. Litigation is being driven by new and increased exposures, including cyber (data breach); privacy oversight (GDPR); derivative, bankruptcy, and regulatory concerns; environmental, social, and governance (ESG) issues such as climate change; and COVID-19. This, plus the high dollar amount of settlements so far, means the seeds of the next challenging market are being planted now.

Property: A Buyers’ Market

The property market continues to soften in 2024. Carriers remain disciplined and are looking for opportunities to grow line share and write new business.

Before 2024, carriers captured growth from rate increases combined with increases in total insured values. Throughout 2024, we have not seen significant increases in insured values. Increased capacity and carriers’ aggressive growth goals are generating competition, leading to favorable renewals for clients.

Hurricane season is upon us, and all parties are keeping a close eye on events. Of the ~24 named storms projected in the Atlantic, six are anticipated to be major hurricanes compared to an average of three (1991–2020). The big question is: “If a major hurricane occurs, will it make landfall in a heavily populated area?”

Casualty: Large Verdicts and Settlements Impact the Market

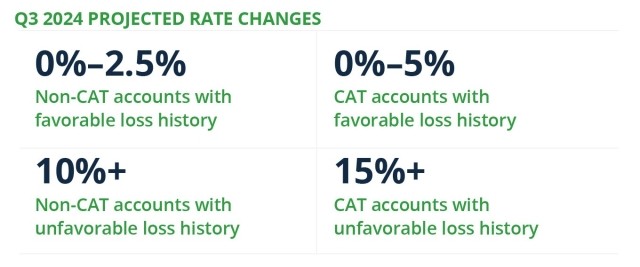

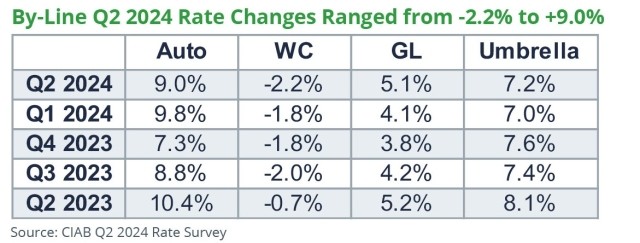

The casualty market remains challenging despite positive signs for certain lines of coverage. Auto, general liability, and lead umbrella markets continue to experience rate increases due to adverse loss trends. In fact, GL and auto rates are up for the 27th consecutive quarter. Workers’ compensation has been consistently profitable and high limit excess is competitive, with robust capacity.

Large verdicts and liability settlements continue to impact the market. Legal system abuse, litigation financing, and creative plaintiff tactics are putting upward pressure on settlements as insurers rush larger payouts to avoid unpredictable juries.

One way that insureds can get better rates is by anchoring auto liability to a profitable line of insurance like workers’ compensation.

Cyber: Small Rate Decreases

Systemic attacks have driven cyber insurance carrier loss ratios higher, causing carriers to hold the line on pricing. However, competition between carriers continues to drive small rate decreases.

Carriers have restricted wrongful collection coverage in response to claims activity. Insurance buyers must demonstrate proper controls around obtaining consent and providing adequate disclosure to obtain non-breach privacy coverage.

For more insights into the insurance trends and pricing changes of Q2 2024, download your copy of the Commercial Lines Insurance Market Update.

Author

Table of Contents