Blog

Protecting Your Revenue with Trade Credit Insurance (TCI)

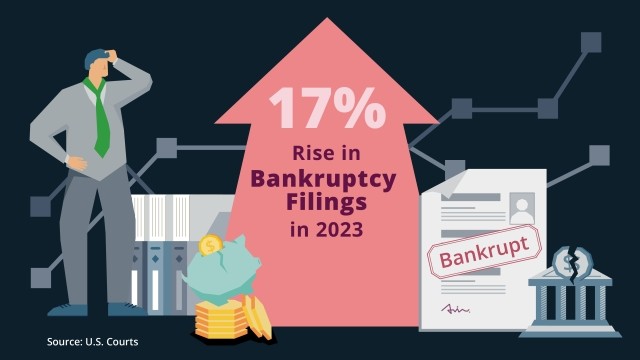

Why do companies go to such great lengths to insure almost every aspect of their business, but fail to look out for the one component without which they couldn't survive? Companies can't live without revenue, yet less than 5% of US companies purchase insurance to account for bad debts such as bankruptcy.

Toys "R" Us folded under a $6.9 billion bankruptcy in 2017, and Claire's faced a $1.9 billion bankruptcy in 2018. If you provided services or goods to one of these companies, their inability to pay you would have a serious impact on your income. Increased bankruptcies for brick-and-mortar retailers (the Amazon effect), higher-than-expected borrowing costs, trade wars, Brexit, and other events are further fueling financial uncertainty. Yet US companies still assume bad debt can't happen to them.

How Does Trade Credit Insurance (TCI) Work?

TCI provides accounts receivable protection from loss due to bankruptcies and delinquent payments.

A TCI policy is typically written to cover a company's entire portfolio of customers. Limits are approved based on the current outstanding balance and peak sales estimate. Policy premiums are based on annual customer sales. You can tailor coverage to protect trade credit risk associated with multiple buyers (a company's largest customers to protect against concentration of risk), a company's foreign customer portfolio, or even for a customer that is either large or concerning—perhaps privately held and not sharing financials.

TCI for Sales and Growth

TCI can open the sales channel to an existing customer. For example, if your company has set an internal limit of no more than $5 million per customer but the insurance underwriter can provide coverage of $10 million, you can now encourage the customer to buy more, assuring that your revenue stream up to $10 million is protected.

TCIs can open the sales channel for new business as well as existing business.

TCI also increases sales and growth related to potential new customers. If a company wants to do business with a prospective customer but can't get financials, a letter of credit, or any sort of payment guarantee (such as cash on delivery) from that customer, the transaction is unlikely to proceed. But if a buyer limit is available from the TCI carrier, not only can a company sell to a new customer, but it can also offer favorable terms, knowing the receivable is insured.

TCI Gives Visibility to Credit Worthiness

TCI also helps augment a company's internal credit function. Financial information on private companies often isn't available, so determining the credit worthiness of a buyer (your potential customer) can be difficult. However, TCI carriers typically keep information in databases with millions of company profiles, or they can reach out and request financials from buyers (your customers). Insurance carriers are usually successful when they request financial information because buyers want to know that trade credit companies have approved them for coverage.

To take the point further, TCI can help you manage risk. Since TCI carriers constantly monitor the financial health of the companies they insure, they are in the unique position to provide timely alerts in the case of negative information. Specifically, if a carrier is aware of adverse financial information for a particular buyer—either from a financial review or because another trade credit client has reported overdue payments—they immediately reach out to all customers carrying limits on the specific company and notify them of the issue. Companies can quickly act on this information and reduce or completely eliminate exposures to a bankruptcy.

TCI insurers will provide timely alerts should negative financial information emerge about the companies they insure.

With respect to the banking component, TCI can assist in either improving or increasing the terms of a company's own line of credit.

TCI provides additional security for any bank loan that is linked to a company's outstanding accounts receivables. This added protection can be useful when trying to negotiate a lower interest rate or a higher line of credit.

How to Get Started with TCI

To get quotes, you typically only need the list of customers to be insured, a recent aging report, and a short application. Carriers can provide a premium and coverage indication usually within a week, though if coverage is for just one or two buyers, they can usually issue a quote within several days.

With the volatility that comes with doing business and the many factors outside of your control—such as your customers' financial soundness, global political environments, and tight credit markets—there's no reason why your company would turn away from protecting revenues, especially when trade credit insurance can also lead to growth and improved risk management.

Insurance Whiteboard Breakdown: Trade Credit Insurance

Author

Table of Contents