Report

Q4 2024 Commercial Insurance Update: A Buyer’s Market Except For Casualty

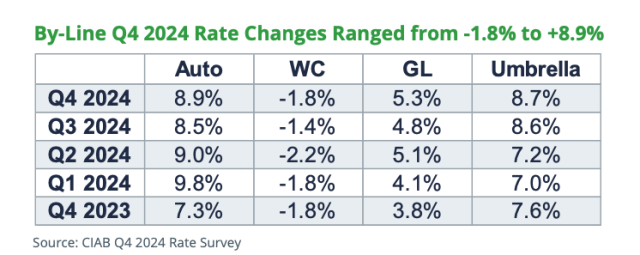

It’s a buyer’s market in every section of commercial insurance except for one segment—the casualty market. Rates in auto, general liability, and umbrella continue to increase, primarily due to legal system abuse leading to large settlements that are stressing these products. Workers’ compensation (WC) is the only bright spot in casualty as its rates continue to decrease.

Fortunately, market conditions are more favorable among other lines. Despite the recent wildfires in Southern California, property rates are expected to remain stable. However, this could shift if more catastrophic events occur later this year.

Additionally, downward pressure on both directors & officers (D&O) and cyber rates should continue.

We explore these and other trends in our Q4 2024 Commercial Lines Insurance Market Update. Here are the highlights of the report.

Casualty: A Challenging Market Continues

Insurers have continued to raise rates for general liability and auto to keep up with loss trends. Additionally, lead umbrella insurers continue to seek rate increases due to sustained large claim activity and limited competition.

Large jury verdicts and liability settlements continue to impact the market as carriers experience increasing loss costs and adverse claims development. Legal system abuse, litigation financing, and creative plaintiff tactics continue to put upward pressure on settlement costs as businesses seek to avoid unpredictable juries.

Anchoring auto liability, which has experienced rate increases for 54 straight quarters, to a profitable line of insurance like WC may improve results for buyers in a difficult market.

D&O: Strong Market Conditions Amid Legal Challenges

Insurance capacity remains plentiful, and competitive market conditions will continue to enable most D&O buyers to secure favorable pricing, retentions, and coverage terms.

Trump administration policies will create both opportunities and challenges for companies. While deregulation and lower tax rates are likely to improve business conditions, companies may encounter obstacles such as potential tariffs, trade disputes, and immigration policy.

Positive signs indicate that IPO and mergers and acquisitions (M&A) activity will rebound in 2025. This trend is driven by increased investor confidence, anticipated deregulation, and improved market stability.

Meanwhile, litigation and settlements present a growing challenge. In 2024, the annual aggregate settlement dollar amount paid out—$4.1 billion—was the highest in the history of securities class actions (SCAs). In addition, the likelihood of a public company being sued also rose in 2024, by 9%.

Property: Building on a Profitable 2024

Most property carriers experienced a profitable 2024 and as competition in the market continues, capacity has increased. Favorable market conditions should continue into 2025.

While we continue to see an increase in the frequency and severity of events, carriers have been able to withstand losses. One example is the devastating wildfires in Southern California, which should not have a significant impact on the commercial property market.

Most buyers are seeing rate reductions at renewal, and they can increase coverage at little or no additional premium. Carriers are more willing to align needed coverage enhancements with the insured’s exposures. However, reducing deductibles remains a significant challenge. A strategic plan, comprehensive marketing effort, and engagement from insureds will lead to the best outcomes.

Cargo and Stock Throughput: An Emphasis on Protection Measures

We continue to see softening rates and an appetite for growth within the cargo and stock throughput market. Carriers are offering flat renewals or rate reductions on renewals with good loss records. Competition also means insureds can achieve expanded coverage.

Insurers continue to diligently analyze catastrophe exposures and insureds’ building constructions and protection measures.

Cyber: The Market Remains Competitive

Market competition led to declining premiums in 2024. However, after a couple of years of rising losses and premium reductions, many insurers are looking to minimize further reductions this year.

At the same time, competition among carriers remains intense, which may continue to drive premium reductions.

Underwriting scrutiny, while variable, remains higher than in the past. Underwriters are placing greater emphasis on data collection and consent practices, as well as how insureds manage third-party vendor risks.

For more insights into the insurance trends and pricing changes of Q4 2024, download our full report here.

Author

Table of Contents