Report

Mid-Year SCA Trends Hold Steady, with Slightly Fewer Filings and High-Dollar Settlements [Report]

As the first half of 2025 comes to a close, the D&O Databox™ Mid-Year Report reveals that securities class action filings are trending slightly down. But this is by no means a major pullback from the plaintiffs’ bar.

Databox research is focused on SCAs filed in US federal and state courts against public companies by holders of common or preferred stock. Public companies and those looking to go public can leverage our Databox reports to assess management liability risks with more precision and clarity.

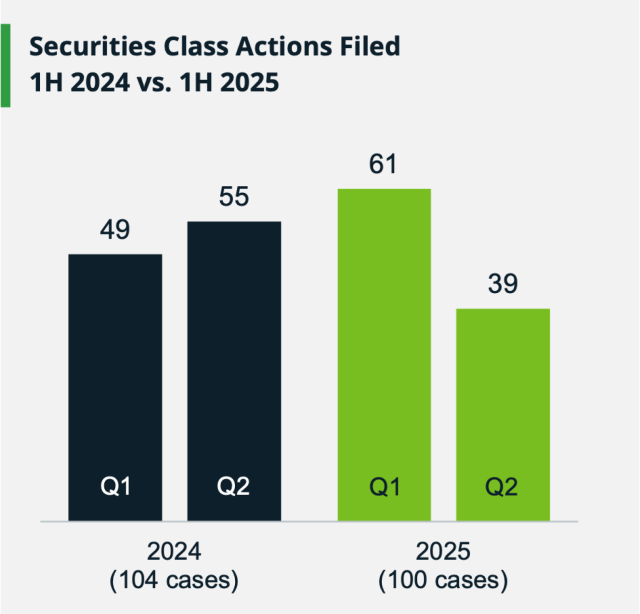

Getting into the data, we saw 100 cases filed in the first half of 2025 versus 104 cases in the same time period in 2024.

If historical trends tell us anything, we can expect a steady stream of filings for the second half of 2025. Looking back at the 10-year average, for example, the D&O Databox shows that 51% of cases are typically filed in the first half of the year and 49% are filed in the second half.

That said, we forecast 200 potential cases filed by the end of 2025, which falls within the average range. For context, the data show that the five-year average is 191 cases annually and the 10-year average is 204.

While we aren’t seeing litigation rates fall in the way we might like, our analysis of the data shows that we can at least all take some comfort in predictability.

Filing Activity by Industry and Size Remains Constant

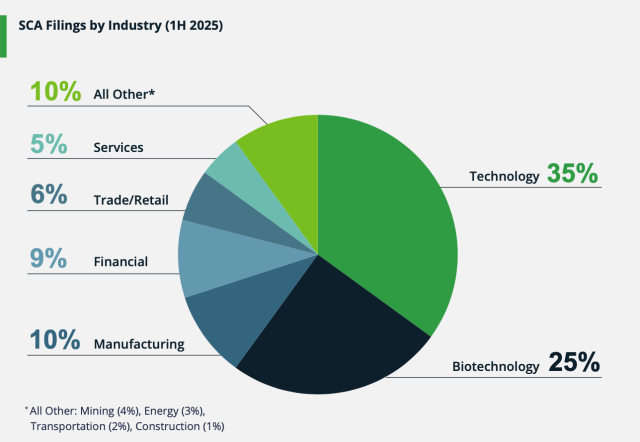

The trend continues: The same three industries lead in filings as they did in 2024. However, the rate of filings against these top three has changed.

Technology, biotechnology, and manufacturing continue to claim the top spots of sectors sued. However:

- Biotechnology SCA filings are up 8 percentage points from 2024 (17% in 2024).

- Manufacturing SCAs are currently down 7 percentage points from 2024 (17% in 2024).

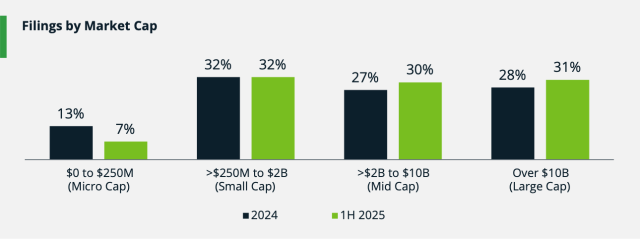

When it comes to SCA filings by company size, we see a relatively even distribution between companies in the small-, mid-, and large-cap ranges—and filing rates are tracking about the same as in 2024.

A note about IPO and SPAC/de-SPAC companies: They are not fueling SCA filing activity as was the case in years past. This is something we discussed in more detail in the D&O Databox 2024 Year-End Report.

Settlement Totals Have Dropped, Yet Big Payouts Remain

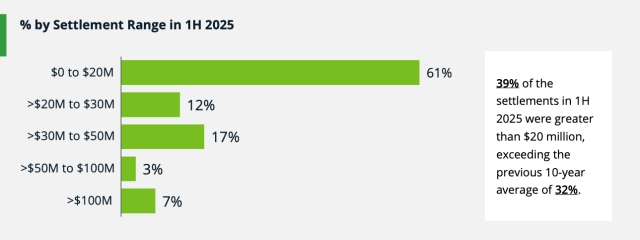

In the first half of 2025, there were 41 settlements totaling $1.1 billion. Contrast that with the same timeframe last year: 40 settlements totaling $2.1 billion.

Keep in mind, however, that 2024 was a record-breaking year for total settlement dollars due to a number of large payouts primarily in the tech sector. The bunching of these settlements may have been happenstance more than anything else.

Having said that, we are seeing in the first half of 2025 a continuation of a material number of high-dollar settlements over $20 million.

An intriguing difference this year is that settlements are not dominated by the technology sector alone. The biggest payouts are coming from the energy, mining, services, and tech industries for issues such as M&A, production and operations, price-fixing, and accounting.

Dive Into the Report for More

For a more complete picture of the SCA landscape, the D&O Databox Mid-Year Report includes:

- A 10-year view of settlements vs. dismissals

- A recap of IPO-related claims and cases involving foreign-headquartered companies listed in the US

- An analysis of the newest litigation threat: artificial intelligence disclosure claims

- More details about the largest settlements of 2025 so far, including case details

- Our forecast for SCA filings, settlements, and dismissals in the remainder of the year

For the full analysis, access the D&O Databox™ Mid-Year Report.

Author

Table of Contents