Blog

The Shifting Landscape of California’s Workers’ Comp Marketplace

Despite California’s continued rising of workers’ compensation costs and some negative trends, its marketplace for workers’ comp. insurance renewals is highly competitive for many industry sectors as of the first quarter of 2015.

Data provided by the Workers’ Compensation Insurance Rating Bureau (WCIRB) in September 2014 and its January 2015 update identify several key factors driving workers’ compensation costs and shaping California’s current workers’ comp. marketplace.

They include:

- Indemnity claim frequency and cumulative trauma injuries

- Legislative structural changes

Indemnity Claim Frequency and Cumulative Trauma Injuries

The industries cited for negative trends in indemnity (lost time) claim frequency in WCIRB’s January 2015 update are construction, agriculture and entertainment.

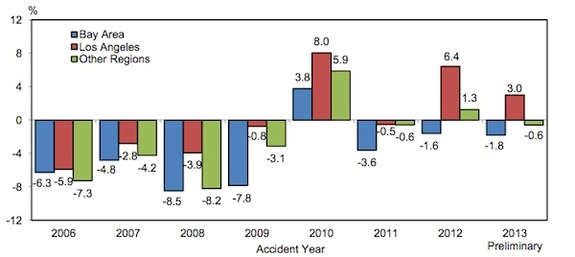

The report further shows that from 2010 to 2013, increases in claim frequency have been concentrated in the Los Angeles/L.A. Basin region, which experienced an estimated 9 percent increase.

This is in contrast to the pattern of other California regions that have either held steady, or as in the case of many other states, demonstrated modest declines in indemnity claim frequency over the same time period. (Notably, the Bay Area’s claim frequency declined by 7 percent).

The report further specifies that claim frequency declined from 2010 to 2013 in the real estate, finance and professional services work sectors.

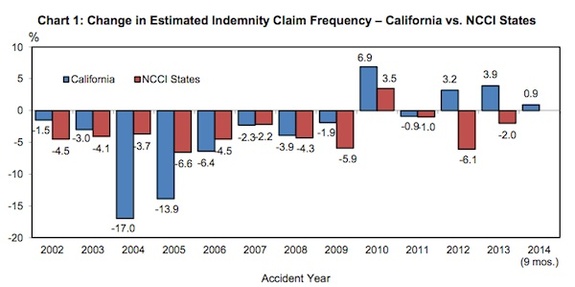

Citing May 2014 data from the National Council on Compensation Insurance (NCCI), the WCIRB report shows California’s indemnity claim frequency (relative to NCCI states) continued to increase in 2012 and 2013, from 3.2 percent to 3.9 percent, before declining to 0.9 percent in 2014.

Countering the claim frequency decline is the trending increase in California’s cumulative injury workers’ comp. claims. WCIRB reports that approximately 13.3 percent of the indemnity (lost time) claims filed in 2013 were estimated to involve cumulative injury, up from the 11.4 percent filed in 2012.

The WCIRB update also reveals that the Los Angeles/L.A. Basin region’s number of indemnity claims involving cumulative injury in 2013 was nearly twice that of the rest of the state.

Structural Changes in Legislation

Now that the Terrorism Risk Insurance Program Reauthorization Act of 2015 is law, losses resulting from an act of terrorism cannot be excluded from a workers’ compensation insurance policy.

In essence, this means that a future act of terrorism (certified by the U.S. government) affecting multiple insurance companies could negatively impact the availability and affordability of workers’ comp. insurance coverage in high-risk areas (meaning most large cities) and high-risk targets (such as airports).

Closer to home, California’s workers’ comp. reforms resulting from the 2012 California Senate Bill (SB) 863 also have translated into structural changes in the workers’ comp. system, specifically fee schedules.

Citing findings from a 2014 Workers’ Compensation Research Institute (WCRI) study, the Insurance Journal reported “large increases in office visit fee schedule rates under SB 863 will likely lead to substantial increases in prices paid in California, as the reforms intended.”

The Insurance Journal quotes California’s director of the Department of Industrial Relations, Christine Baker, who stated that the fee schedules affected by SB 863 “provide consistent, predictable fees for payment.”

She continued, “Because the reforms went to RBRVS [Resource-Based Relative Value Scale] for physicians, the incentives have now shifted to the treating physician who can facilitate return to work and direct to the appropriate specialist if needed.”

In concert with SB 863’s goal of containing costs, California’s Occupational Safety and Health Administration (Cal/OSHA) plan requires all employers to institute a written Injury and Illness Prevention Program (IIPP).

And as suggested by Baker, with SB 863’s shift of incentives towards physicians treating workplace injuries, there is also inducement for employers to look into medical provider networks (MPNs).

As discussed here previously, MPNs are an effective way for employers to contain costs by exercising a degree of control over the physicians attending injured employees, with the goal of expediting their return to the workplace.

While it’s too soon to tell whether legislated incentives have fulfilled the promise of containing workers’ comp. costs, it is certain that for most of California’s regions, the marketplace for workers’ comp. insurance renewals is competitive.

Author

Table of Contents