Blog

COVID-19 Workers' Comp Claims Surge in California

In 2020, California employers faced unforeseen challenges and significant new responsibilities in response to the COVID-19 crisis. Of course, there was the immediate need to mitigate workplace exposure to the virus by equipping employees with PPE and establishing social distancing protocols, but when Governor Newsom signed SB 1159 into law on September 17, 2020, employers also had to report both non-work-related and work-related COVID-19 cases to their insurance carrier—an added logistical requirement at an already stressful time, even without an increase in COVID-19 worker's comp claims.

CWCI has Released COVID-19 Workers' Comp Claims Data

With 2020 now in the rearview mirror, the California Workers’ Compensation Institute (CWCI) has released data validating COVID’s felt impact throughout the year by the state’s employers and across business sectors. The CWCI found that for the 2020 accident year, 103,712 work-related COVID-19 claims were reported to the California Division of Workers’ Compensation (DWC); roughly more than one out of every six workers’ comp claims with a 2020 injury date was a COVID-19 claim. This number does not include any non-work-related positive COVID-19 exposures where the employee chose not to pursue a claim or advised the employer that the exposure was not work-related.

California COVID-19 cases reached 3.281 million as of February 3, 2021, and though 103,712 claims only accounts for 3% of the total reported cases in California, it is significant in that each reported claim must be investigated by the insurance carrier to determine if the exposure was indeed work-related; this includes contact tracing, obtaining test results, and taking employer and employee statements, all of which are extremely time consuming. Many insurance carriers now have designated COVID-19 units to specifically address the influx of claims.

COVID-19 Cases Spiked After Holidays and for Certain Industries

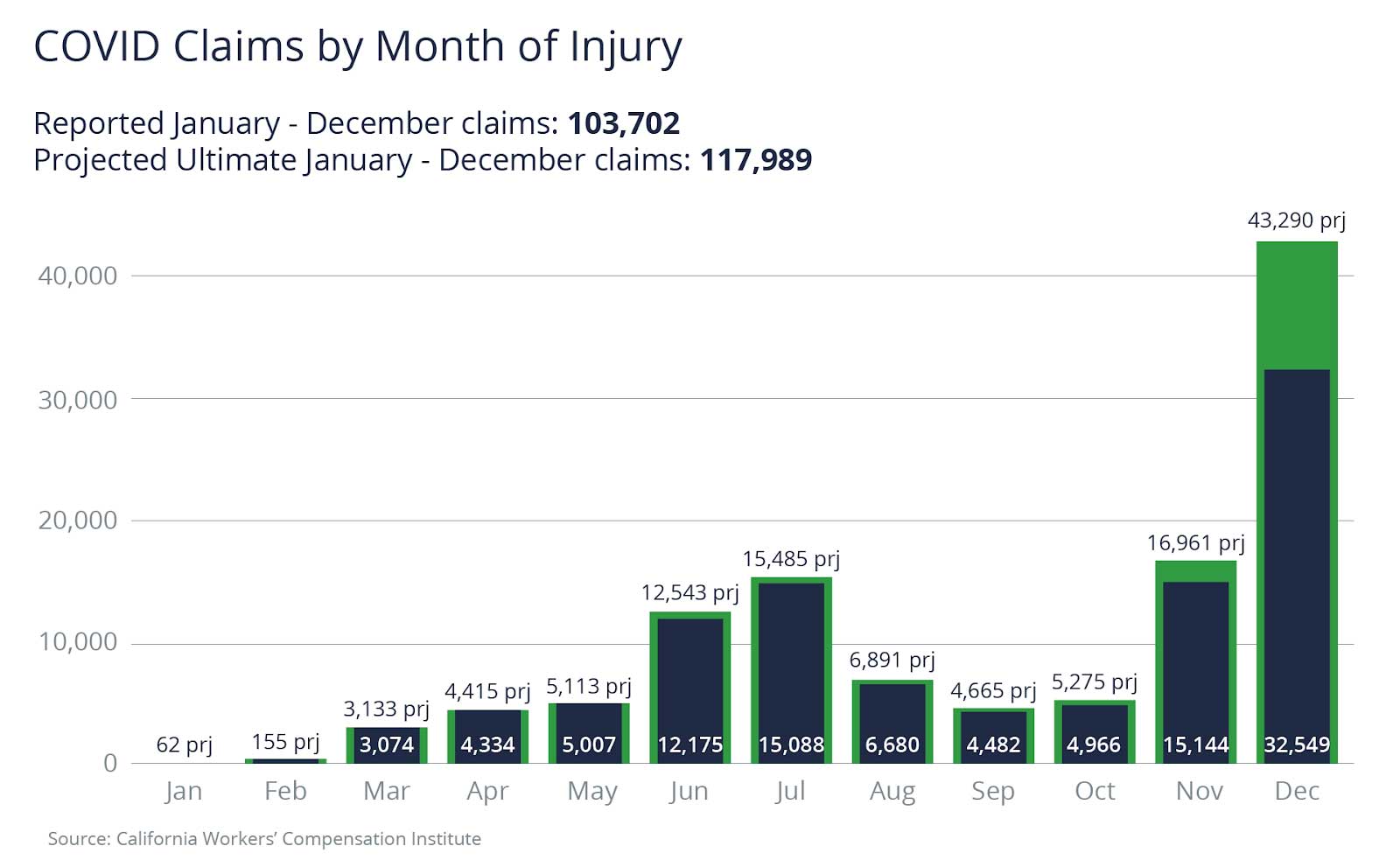

The CWCI data illustrates that several major holidays in 2020 precipitated spikes in COVID-19 cases and subsequent workers’ compensation claims. As COVID-19 surged in the US after the Thanksgiving holiday, the DWC also saw a substantial increase in work-related COVID-19 cases in December, with a record 32,549 reported COVID-19 worker's comp claims. The CWCI projects December cases will reach as high as 43,290, and once all projected cases are reported for the 2020 accident year, the total will be 117,989. As you can see in the below chart from the CWCI, there was also a surge of reported claims in July, most likely the result of Independence Day celebrations. Based on this data, insurance carriers would have also seen an increase in COVID-19 claims.

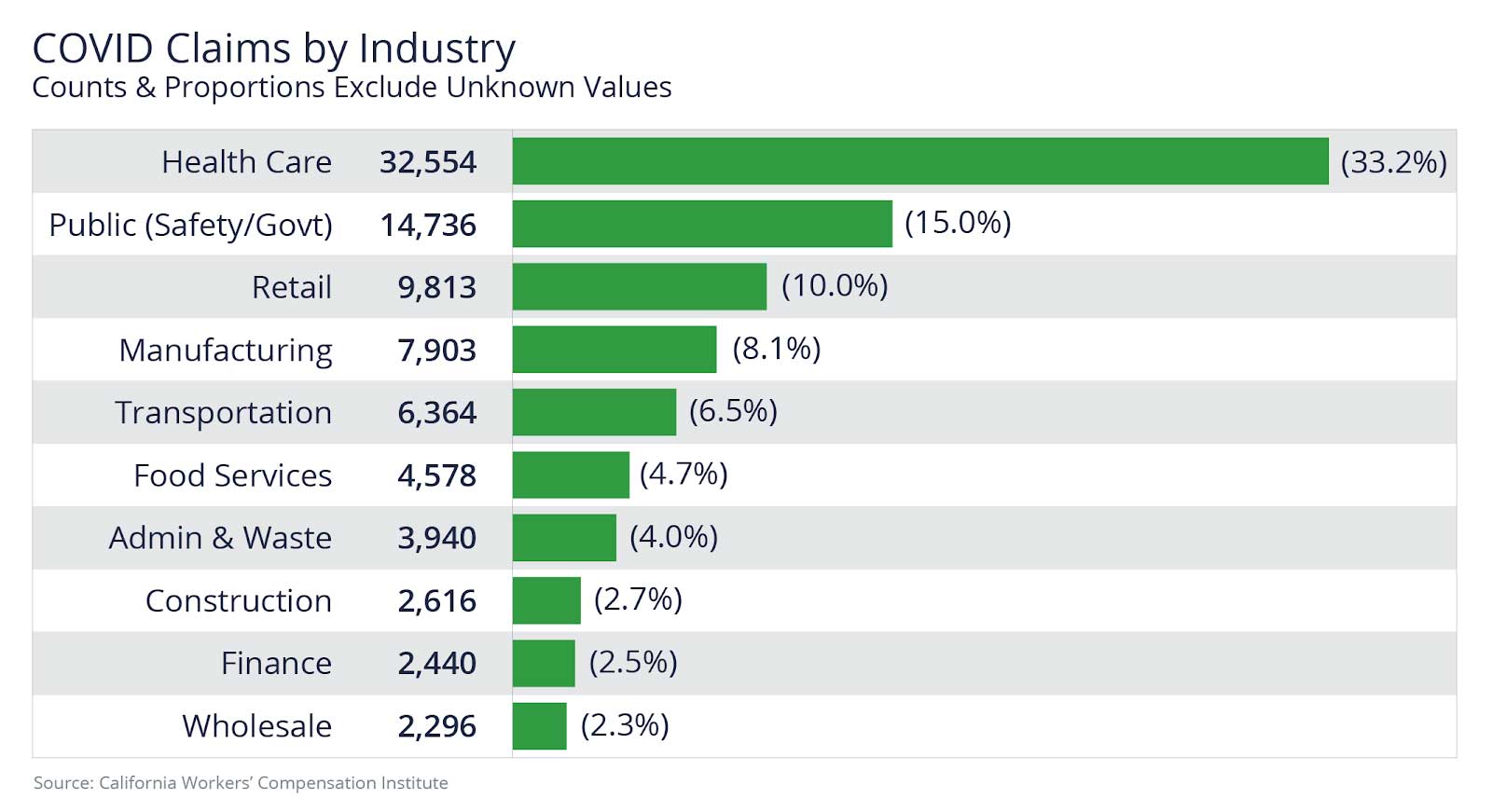

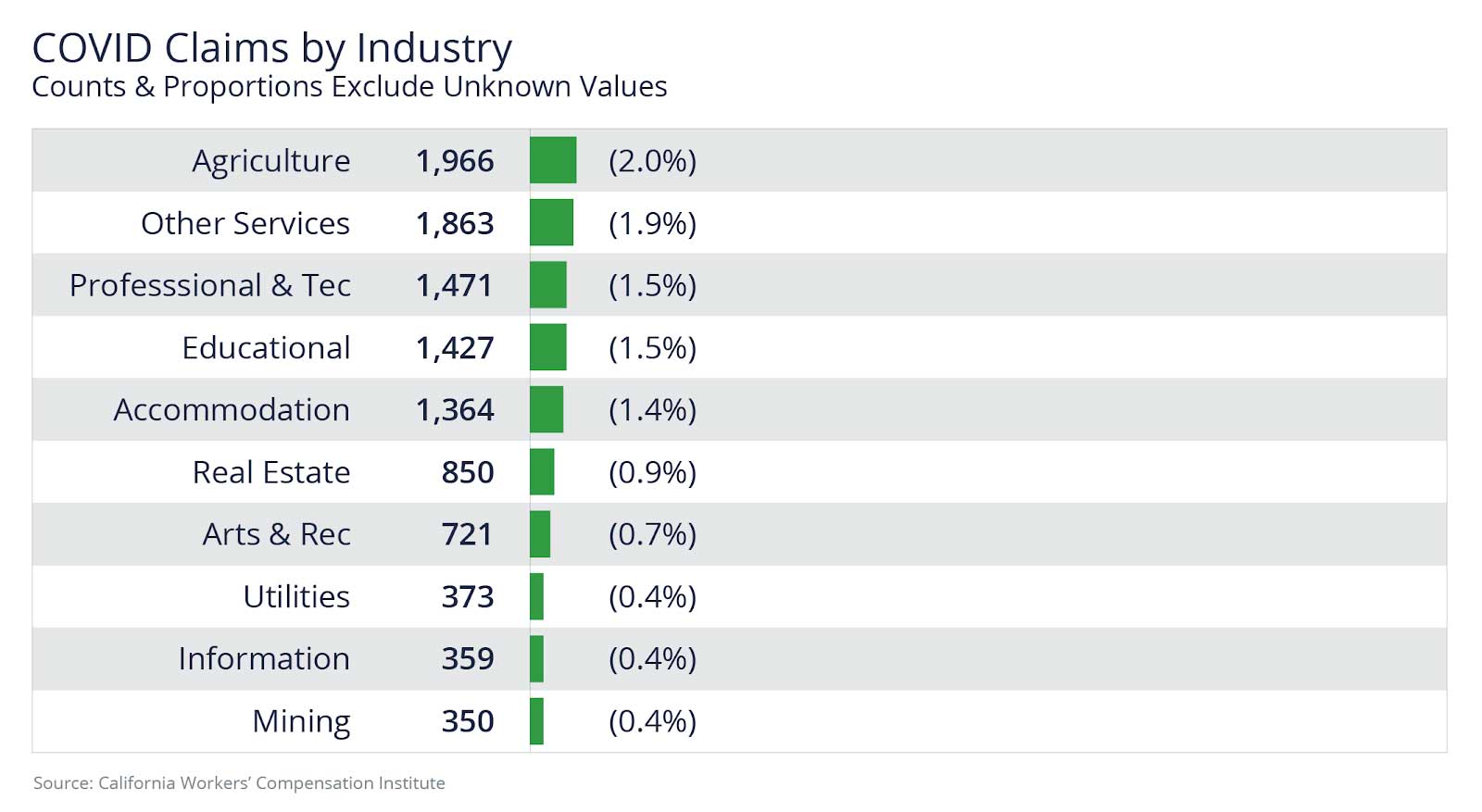

The CWCI further broke down the data by industry sector, and, not surprisingly, the healthcare sector and public (safety/government) workers continue to account for more COVID-19 workers' comp claims than other sectors, with a combined 48.2%. Their share of COVID-19 workers' comp claims showed little change over the last three months of the year, while retail workers’ share of the claims jumped from 8.7% in October to 13.1% in December, most likely related to the uptick in shopping for the holidays. Even though the construction and agriculture sectors continued working throughout the pandemic, they account for only 2.7% and 2% of the COVID-19 worker's comp claims respectively. One can theorize that this is the result of diligent PPE and social distancing protocols, but also much of the work is performed outside where the virus is less easily spread.

Professional, technology, and education were only responsible for a combined 3% of the claims due to most offices implementing work from home (WFH) protocols and schools closing.

CWCI’s interactive tool can also be used to drill down by county—a feature that sheds light on significant trends in COVID hotspots at the end of 2020. As news organizations were reporting a surge in Southern California’s positive cases, the DWC’s data mirrors the general population with Inland Empire/Orange County’s share increasing from 24.5% in October to 28.8% in December, and Los Angeles County’s share increasing from 24.2% in October to 30.1% in December. Interestingly, the Central Valley’s share dropped from 18.9% in October to 15.7% in December, as did the Bay Area’s share from 17.1% in October to 12.2% in December.

The CWCI data shows insurers’ denial rates rose from 33.1% in September to a seven-month high of 37.9% in October, just prior to the year-end surge. Denial data for November and December claims is still too undeveloped for comparison, as many of those claims remain under investigation. As the pandemic rages on, insurance carriers will become more experienced in handling these types of claims and investigations, which could result in a more aggressive stance on denials of COVID-19 claims. It will be interesting to see if there is an increase in denials for November and December when the data becomes available.

The silver lining is that COVID-19 workers' comp claims are excluded from the California Experience Rating calculation with a date of injury on or after December 1, 2019. This is significant in that insurers use an employer’s Experience Modification Rating to determine insurance premium pricing, and it can also affect an employer’s ability to bid jobs. The Workers’ Compensation Insurance Rating Bureau’s (WCIRB) reasoning is that COVID-19 workers’ compensation claims incurred by an employer are unlikely to be a strong predictor of that employer’s future workers’ compensation claim costs, and the inclusion of such claims in an experience modification calculation would not meet the intended goal of experience rating.

COVID-19 Workers' Comp Claims Present Challenges that Need Expert Advice

The 2020 data released by the CWCI affirms the unprecedented challenges California employers, workers, and insurers have encountered due to COVID-19; in 2021, as COVID-19 cases continue to rise in the general population, so will COVID-related workers’ compensation claims. With the new presumption laws under SB 1159, insurance carriers have a very short window to gather the facts and make a compensability decision, which can often lead to denial of claims if sufficient information cannot be obtained during this timeframe.

Until the majority of the general population is vaccinated, COVID-19 cases and workers' comp claims will continue to be prevalent in 2021. Each COVID-19 exposure is unique and monitoring for an outbreak can be challenging for employers. If you have questions about a particular claim or scenario, contact your Woodruff Sawyer Claims Consultant or account team member for assistance.

Author

Table of Contents