Blog

Cannabis SPACs: A Promising Trend?

This blog post was originally published in the American Bar Association Business Law Section March 2020 Month-in-Brief.

Recent events and market news have been a bit stressful, to put it lightly. Amidst all the stress, was it a coincidence that my eye caught a few positive pieces of news coming out of the Cannabis SPAC sector?

On March 2, 2020, for example, Collective Growth Corporation ("Collective Growth"), a SPAC that intends to invest in companies operating in the Federally permissible cannabinoid industry, filed an S-1 registration statement to raise $150 million. The company's CEO is Bruce Linton, a former co-founder and CEO of Canadian-based Canopy Growth, which was the first publicly traded cannabis company in North America.

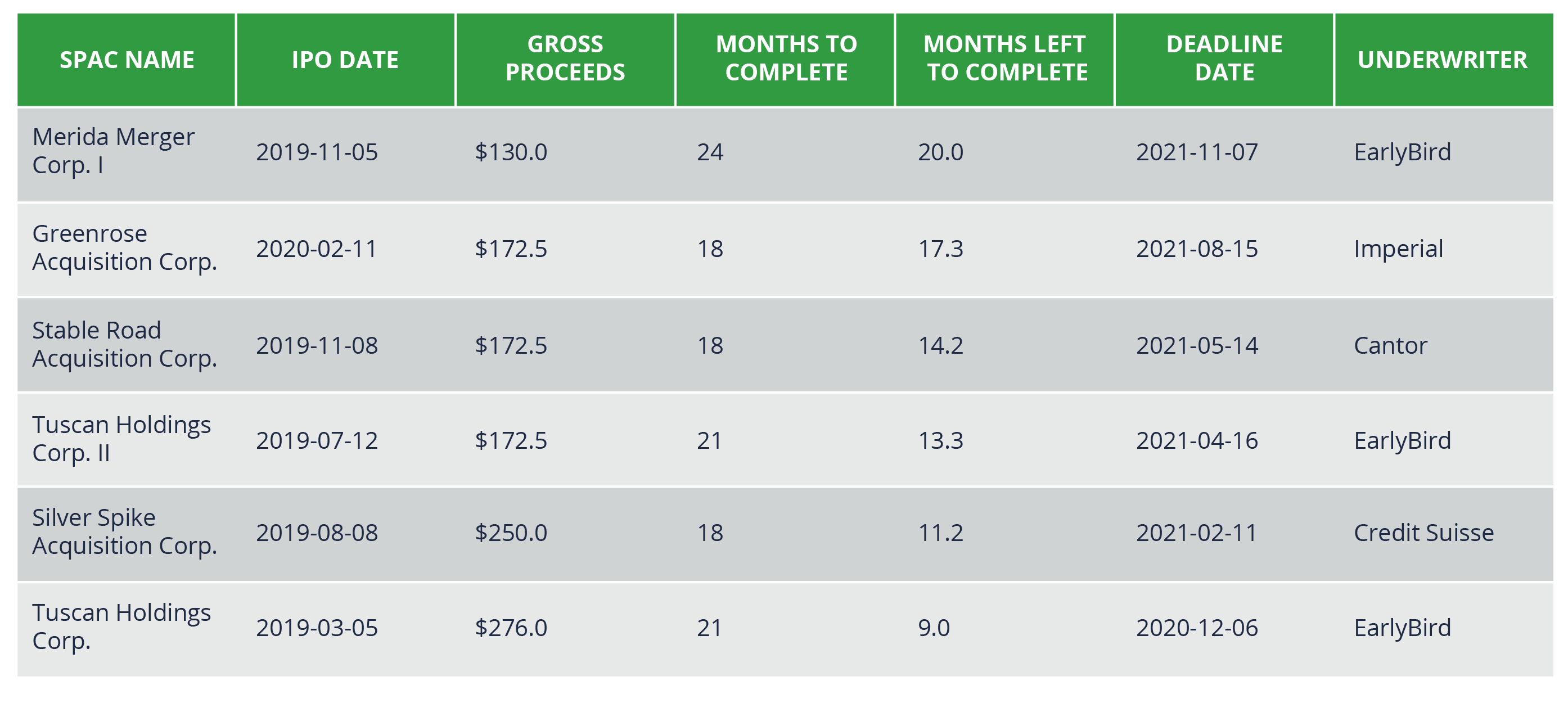

Collective Growth is not the only SPAC looking at the precarious, but at times promising, North American cannabis market. According to data collected by SPACInsider.com, five cannabis-focused SPACs went public in 2019 and one, so far, in 2020. These six SPACs are all still looking for business combinations. They raised a combined $1.17 billion and, by conservative estimates, will likely produce combinations totaling around $3.5 billion.

EarlyBirdCapital, Inc. was the left lead underwriter for three of these deals, likely establishing an expertise level in this area. All of these SPACs are listed on Nasdaq except for Merida Merger Corp. ("Merida"), which is dual listed on the Canadian NEO and Nasdaq. NYSE has thus far failed to attract this particular strain of SPACs.

To date, according to SPACInsider.com, only one of the cannabis-focused SPACs, MTech Acquisition Corp., has gone through a business combination. MTech Acquisition Corp., which completed its $50 million IPO in January 2018 and its business combination with MJ Freeway LLC in June 2019, has not done very well in the market. Its questionable market performance paints a sobering picture for the current cannabis SPACs that are looking for a target. If Merida's price does better as a result of its dual listing and expanded access to both the U.S. and Canadian markets, future cannabis-oriented SPACs may push harder for dual listings.

Companies that are considering U.S. listings only may want to keep a close watch on recent and proposed updates to Nasdaq's and NYSE's listing rules. Nasdaq has historically been a more popular listing venue for SPACs than NYSE because of Nasdaq's slightly less rigorous listing requirements. According to Nasdaq, it has listed 82% of all SPAC IPOs since 2010. In 2017 NYSE tried to attract more SPACs by matching Nasdaq's listing rules and managed to achieve some traction, especially with larger SPACs like Social Capital Hedosophia, which raised $600 million in September of 2019 and later merged with Virgin Galactic in a much-publicized deal.

On March 2, 2020 NYSE filed a proposed rule with the SEC to amend Section 902.02 of the NYSE Listed Company Manual (the "Manual") to waive initial listing fees and the first partial year annual fee for any company listing upon closing of its acquisition of a SPAC listed on another national securities exchange. However, NYSE still requires the minimum market value of publicly held shares at time of listing to be $80 million, while Nasdaq's minimum requirement is $50 million.

On March 9, 2020 Nasdaq held a webinar to discuss its recent and proposed updates to SPAC listing rules. Nasdaq now has a SPAC analyst dedicated exclusively to SPAC listings and is reevaluating its fee listing structure for SPACs.

As for cannabis-related SPACs, neither NYSE nor Nasdaq can list any companies whose activities violate federal law. During the webinar, Nasdaq's representatives mentioned that cannabis-related companies will need to conduct additional analysis on the applicability of all state and federal laws and that Nasdaq may require an opinion from the company's legal advisors as to applicability of federal law requirements. They will also need prior approval from the exchange, much like business combinations with companies that are located in a country with secrecy laws that limit foreign access to business books and records or where PCAOB cannot freely inspect auditors.

Do the rules change once a SPAC goes through its business combination? The general rule is that to remain listed after a business combination, the combined company must meet the same requirements as it did at initial listing. Nasdaq gives newly combined companies up to 15 days to demonstrate compliance with the 300 minimum round lot shareholder requirement. The 300 round lot threshold may become tricky if the SPAC experiences high levels of redemption at the time of the combination.

The company may demonstrate compliance by providing: registered shareholder lists from the company's transfer agent; data from Cede & Co about shares held in street name; NOBO lists; or data from other providers showing the number of account holders (e.g., share range analysis from Broadridge or a list of beneficial holders through a broker/dealer search). If the company fails to demonstrate compliance, the exchange will issue a delisting determination, which could be appealed.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents