Blog

2020 Securities Class Actions Exceed the 10-Year Average [Report]

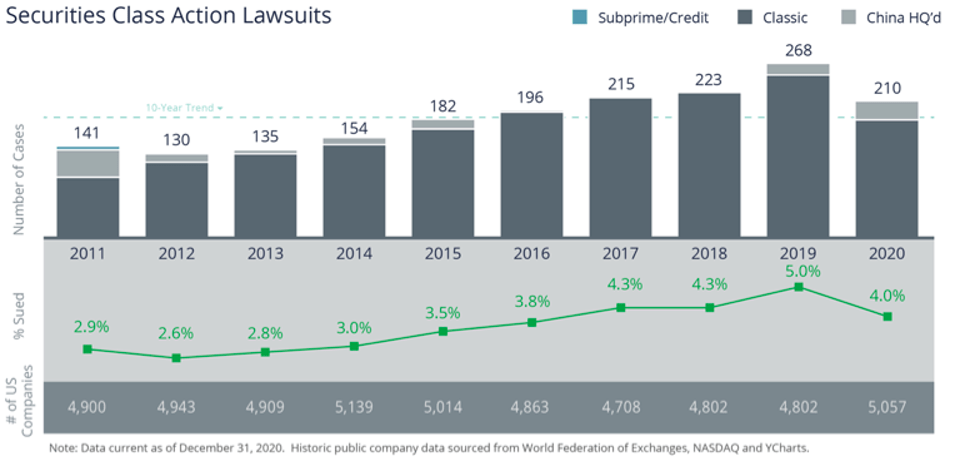

For nine years in a row, securities class action filings have grown steadily with each year breaking a new record. Then 2020 hit and that trend has finally broken.

By the close of 2019, we saw 268 class action filings, up from 223 the year prior. Filings in 2020, however, were slightly down, with the final tally coming in at 210 class action filings. This is according to Woodruff Sawyer’s year-end analysis of securities class action filings from our proprietary DataBox.

That said, 210 filings still exceed the 10-year average of class action filings by 13%, with the average coming in at 186 filings. In other words, the plaintiff’s bar remained committed to filing class actions despite the rollercoaster of 2020.

GET INSTANT ACCESS TO THE DATABOX YEAR-END 2020 REPORT NOW >>

COVID-19 Cases in 2020

Ten percent of the cases filed in 2020 involved related to COVID-19 issues. Factors to these 20 cases involved everything from direct impact of the virus to business disruption, financial impact and more.

In addition to private litigation, there have been government enforcement actions against public companies related to the impact of COVID-19 as well. The Cheesecake Factory is a recent example. You can read about that and more in my recent article on COVID-19 litigation.

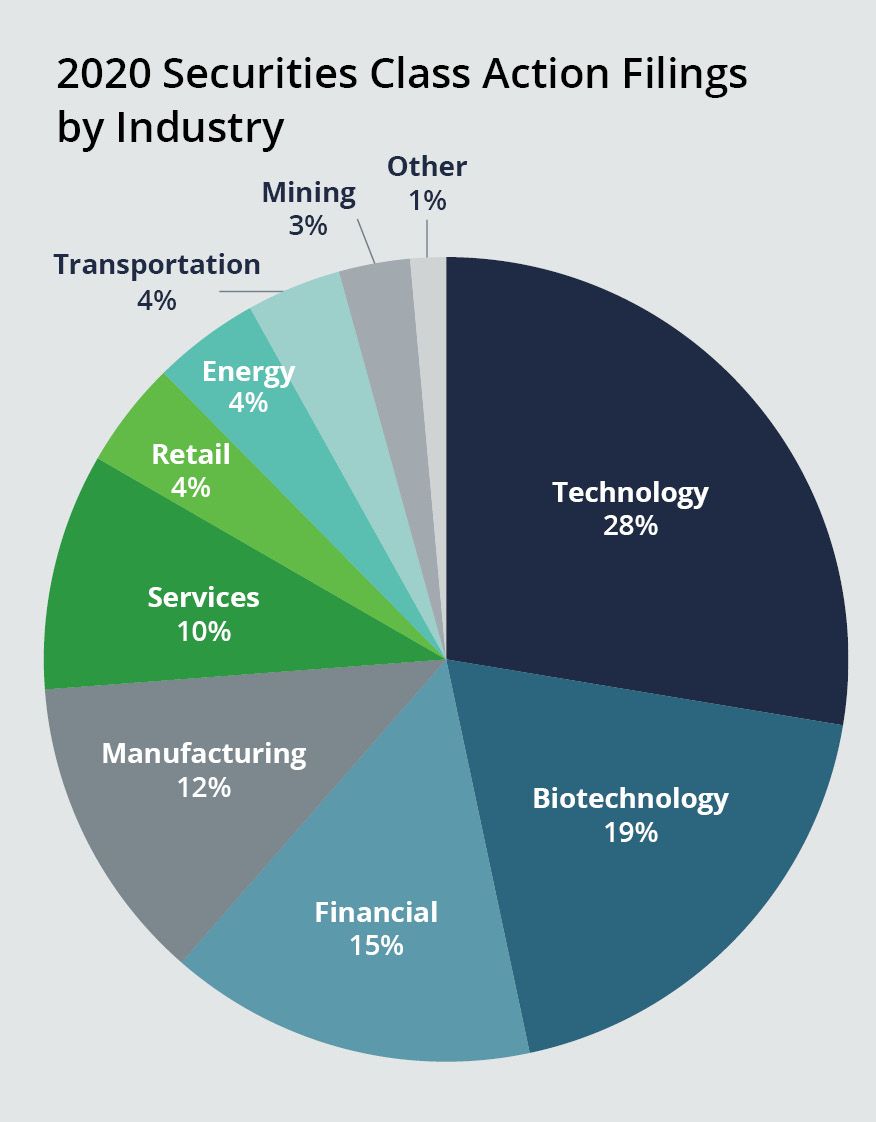

Top Sectors Targeted in 2020

Technology and biotech continue to secure top spots as sectors that are most targeted with securities class actions. Together, these two sectors comprise 47% of all filings. From 2017 to 2019 the financial sector had dropped out of the top three, but moved back up into third place in 2020.

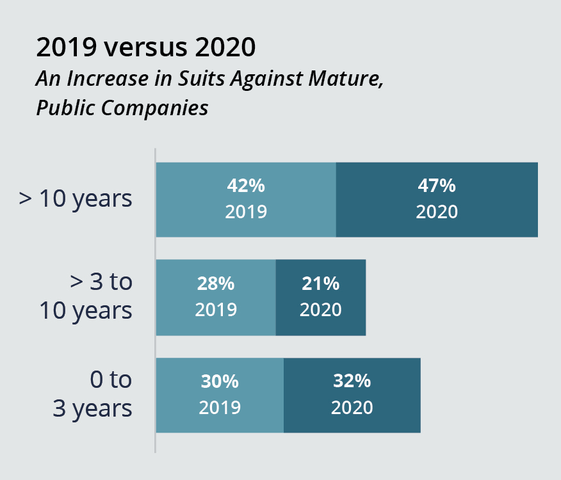

Filings Against Mature Public Companies in 2020

Ten percent of S&P companies were sued in 2020, representing a 10-year high. In addition, more than a dozen high-profile, mature companies were sued in the past year.

There is indeed an upward trend in filing securities class actions against mature public companies, as illustrated below:

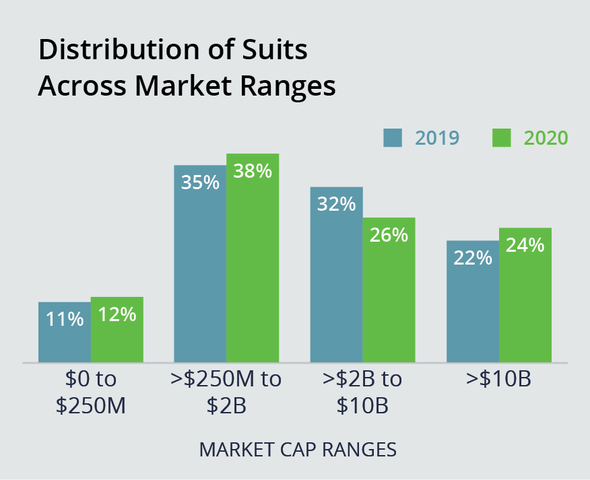

Filing by Company Size in 2020

For mid-cap companies with a market value of $2 billion to $10 billion, there were markedly fewer cases in 2020. We believe the reason for this is due to a drop in frivolous Section 11 lawsuits against them. In 2019, Section 11 suits accounted for 32% against companies in this market cap range versus 16% in 2020.

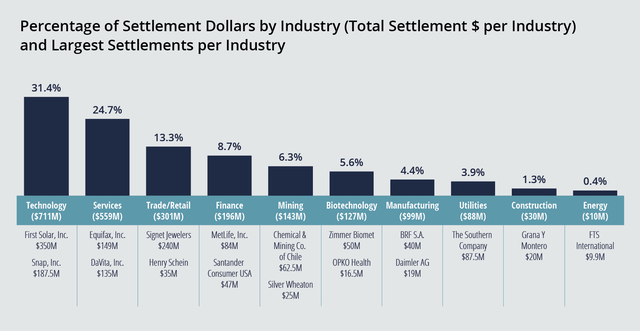

Settlement Activity in 2020

In 2020, we saw a total of 79 settlements with an aggregate of $2.3 billion. The top ten settlements, which accounted for $1.4 billion of the total settlement dollars, are listed below.

| Entity | Suit Year | Industry | Amount | Case Matter |

|---|---|---|---|---|

| First Solar, Inc. | 2012 | Technology | $350M | Manufacturing flaws and warranty claims |

| Signet Jewelers Limited | 2016 | Retail | $240M | Sexual harassment & assault claims |

| Snap, Inc. | 2017 | Technology | $187.5M | User metrics and revenue growth |

| Equifax, Inc. | 2017 | Services | $149M | Cyberattack of consumer data |

| DaVita Inc. | 2017 | Services | $135M | Health insurance scheme |

| The Southern Company | 2017 | Utilities | $87.5M | Production delays and cost overruns |

| MetLife, Inc. | 2012 | Financial | $84M | Accounting issues |

| SeaWorld Entertainment, Inc. | 2014 | Services | $65M | Mistreatment of orca whales |

| Chemical & Mining Co. of Chile | 2015 | Mining | $62.5M | Bribery and tax evasion scheme |

| Community Health Systems, Inc. | 2011 | Services | $53M | Accounting fraud |

By industry, the technology, services, and retail sectors took the biggest hit when it comes to settlements.

What Will 2021 Look Like?

We do not expect the pace of securities class action filings to slow in 2021. And, with approximately 600 securities class action cases yet to be resolved and limited capacity in the D&O insurance market, 2021 will be another challenging year for public companies seeking to obtain D&O insurance.

For a deeper dive into what’s covered in this article plus data on the following, access your copy of the report now:

- Filings against foreign companies

- Filings against newly public companies

- Section 11 lawsuit updates

- What to expect in 2021

GET INSTANT ACCESS TO THE DATABOX YEAR-END 2020 REPORT NOW >>

Author

Table of Contents