Blog

Your 2019 Experience Modification Ratings Are About to Change

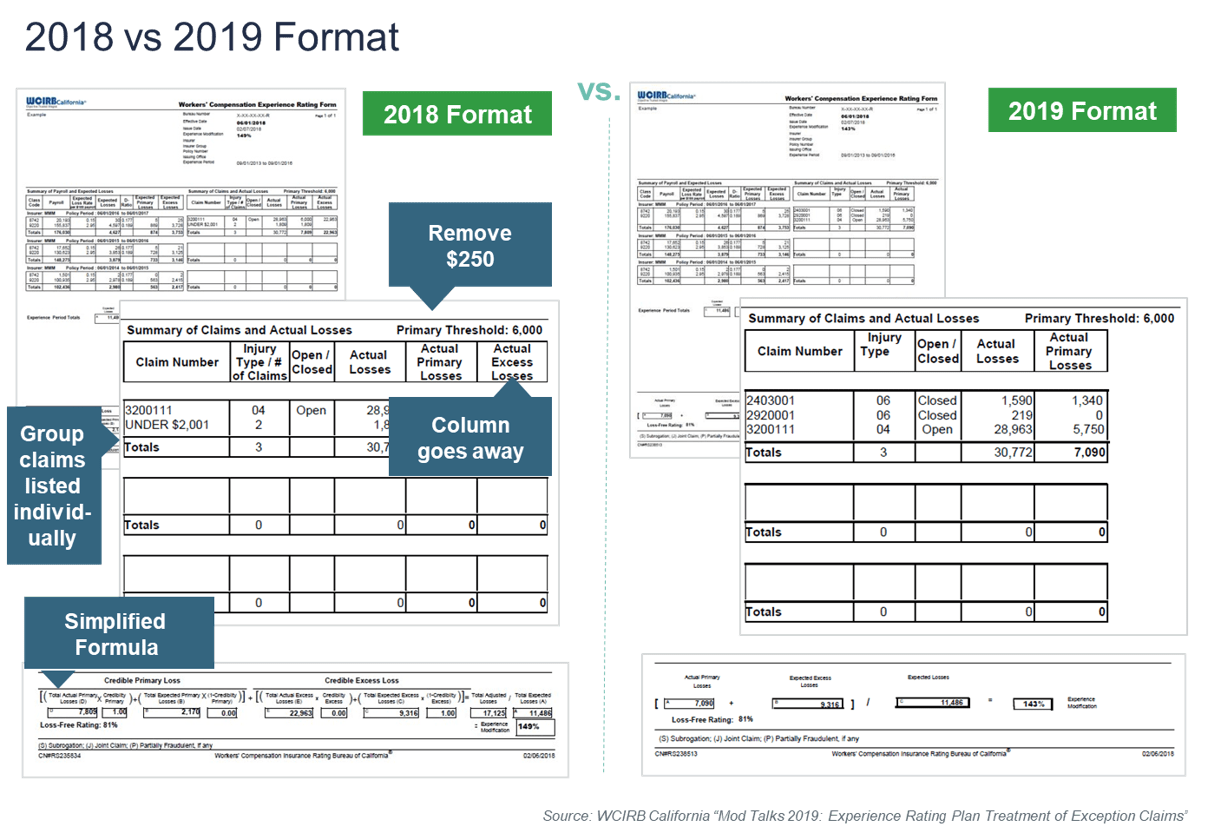

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has proposed several changes that will become effective on January 1, 2019, and will affect your Experience Modification Rating. First, the experienced rating formula has been simplified. Second, the first $250 of every claim will be excluded and the smaller claims will no longer be grouped together, but itemized. The $250 exclusion is intended to remove the incentive of not reporting small or "first aid" size claims and to demonstrate the monetary benefits of reducing workplace injuries and costs.

A Simplified Formula

The WCIRB is eliminating the Primary Credibility and Excess Credibility factors that were inconsequential to the formula, resulting in the following:

Actual Primary Losses + Expected Excess Losses

____________

Expected Losses

Definition of Terms

Actual Primary Losses

Equal to the cost of losses incurred with each loss limited to a policyholder’s primary threshold

Expected Excess Losses

Equal to the average losses expected for businesses of similar size and industry in excess of the primary threshold

Expected Losses

Equal to the total losses expected for businesses of similar size and industry

The First $250 of Each Loss is Now Excluded in the Formula

The WCIRB requires that employers report all claims to their insurance carrier when any medical treatment has been provided by a physician, including those involving “first aid” treatment. These small claims that employers began reporting in 2017 will now factor into the 2019 calculation.

In order to offset the impact of including these smaller claims in the calculation, the 2019 formula excludes the first $250 from a claim’s Actual Primary Loss value.

Why $250?

The WCIRB considered eliminating the first $250, $500, or $1,000 from each small claim (< $2,001) from the EMR calculation. They tested the various thresholds and determined the $500 and $1,000 thresholds eliminated too many claims and had a significant impact on plan accuracy, leading them to the $250 threshold.

A Few Examples

The WCIRB feels that most claims meeting the California definition of “first aid” are less than $250 and by excluding this amount, those claims valued at $250 or less will have a Primary Actual Loss value of $0, thereby removing any incentive to not report the cost of small or “first aid” type claims to the insurer.

For Actual Losses between $250 and the Primary Threshold, the Actual Primary Loss = Actual Loss less $250.

For Actual Losses above the Primary Threshold, the Actual Primary Loss = Primary Threshold less $250.

For example:

Primary Threshold = $20,000

| Actual Loss of $250 | Actual Primary Loss = $0 |

| Actual Loss of $1,000 | Actual Primary Loss = $750 |

| Actual Loss of $20,000 | Actual Primary Loss = $19,750 |

| Actual Loss of $50,000 | Actual Primary Loss = $19,750 |

How will the $250 deduction impact the 25-point cap to a loss-free Experience Rating?

Any claim of $250 or less will not be considered in the determination of whether the single claim cap of 25 points applies. If an employer has two small claims with values of $500 and $300, the 25 point cap will not apply because both claims will have a Primary Loss value of $250 and $50 respectively. However, if an employer has one claim that meets the Primary Threshold and another claim under $250, the 25 point cap will apply.

EMR Worksheet

- Small claims with a value of $2,001 or less will no longer be grouped together, but itemized in order to show the $250 deduction on each claim.

- Actual Excess Losses column will be removed since only the claim value up to the Primary Threshold will impact the calculation.

What Does this Mean?

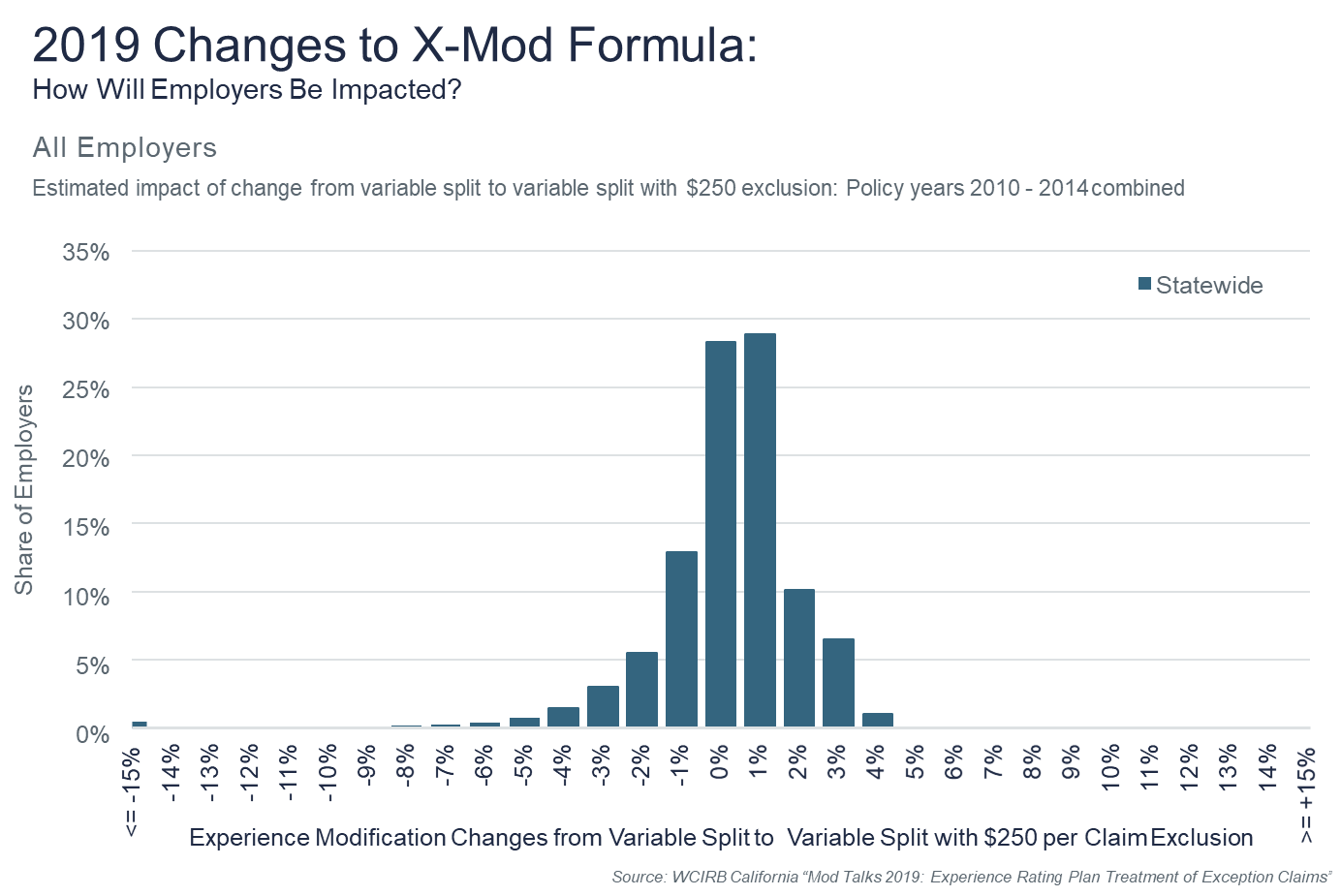

The impact of the proposed changes on an individual employer’s Experience Modification will depend on their claims and exposure history. However, the WCIRB anticipates the impact will be modest. 85% of EMRs will be impacted by 2 points or less with loss-free employers generally seeing a small increase. However, the 2019 Expected Loss Rates filed by the WCIRB reflect a general decrease of 6% from the 2018 rates. This rate decrease will cause the Expected Losses to also decrease, often causing the EMR to go up (the less the expected losses are, the less actual losses an employer is permitted to have). The $250 exclusion should benefit most employers; however, the lower rate filing will more than likely make it a wash.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) anticipates approval of the proposed regulatory changes in September 2018 and will begin publishing 2019 Experience Modifications shortly thereafter. The filing may be viewed or downloaded here.

Feel free to direct any questions to Amy Puffer at 415-399-6374.

Author

Table of Contents