Blog

7 Steps for Choosing a New TPA for Your Workers’ Compensation Program

Whether you’re thinking about moving to a large deductible or qualified self-insured workers’ compensation program or have decided you are ready for a new approach to managing claims, selecting a third-party administrator (TPA) is one of the most important decisions you can make for your risk management program.

TPAs administer and process insurance claims and other aspects of workers’ compensation claims on behalf of both the employer and the insurer to make sure injured workers’ medical and lost wage bills are paid timely and appropriately. (They are considered “third-parties” because they are independent companies owned by neither the employer nor the insurer.)

TPAs also provide critical functions of managing litigation, providing data on claims trends and reviewing medical bills for potential savings. In short, TPAs play a hugely important role in workers’ comp programs.

While all TPAs serve the same general claims administrative function, different TPAs possess different capabilities and strategic perspectives. It is essential that businesses perform due diligence in choosing a new claims management partner. This article offers seven important considerations in selecting a TPA.

7 Important Considerations When Selecting a Third-Party Administrator (TPA)

1. Weigh bundled versus unbundled programs.

Your first step is to decide if you want to go with a bundled or unbundled program. With “bundled” service, a single vendor—often the insurance carrier—acts as the custodian, recordkeeper, and claims administrator. On the other hand, "unbundling” claims administration from the insurance program separates claims services (including medical and litigation management, among other functions) from the risk transfer (the policy) contract.

Bundled programs are most often associated with guaranteed cost plans though they may also involve deductible programs when the insurance carrier mandates the utilization of their in-house claim services. This approach works well when a customer wants to aggregate their services (claims administration and loss control services) with a single vendor partner.

Unbundling claims services to a TPA provides several advantages, one of those being consistency in claims administration should you need to change the insurer for whatever reason. In other words, if after three years with insurer A, you need to move to insurer B, you don’t necessarily need to change claims administrators. As long as you’re with a well-known TPA, often, you may keep your claims with the same TPA, even though the insurance carrier has changed. Another key reason to choose a TPA is the ease of use of customized claims handling. TPA’s work for you, not the insurance carrier, so there’s a lot more flexibility and willingness to keep the customer happy through customized claims service instructions that meet your claim handling needs.

2. Consider types of contracts.

Next, you’ll want to evaluate different formats for the duration and cost components of TPA contracts.

There are three principal types of TPA contracts:

- Life of Contract: This is the most common type of arrangement for large self-insured employers or employers in unbundled large deductible programs. The employer agrees to pay a fixed per-claim charge for the TPA to handle each claim. The per-claim charges vary based on the type of claims (such as medical-only vs. lost-time) and accident state. The employer will only pay one claims handling charge per claim as long as they maintain an in-force contract with the TPA. However, if the employer opts to end the relationship with the original TPA and engage a new claims administrator, the employer will have to pay a new per-claim charge to the new claims administrator to take over the handling of the claims. Life of Contract claims fees are typically 20% lower than Life of Claim fees.

- Life of Claim: These arrangements are also known as “cradle-to-grave” contracts. The employer agrees to pay a fixed per-claim charge for the TPA to handle the claim, just as with a Life of Contract arrangement. However, with Life of Claim deals, the TPA will handle the claim from the report date all the way to claim closure even if the employer terminates the relationship with the TPA. Life of Claim fees are more expensive than Life of Contract fees, but the higher costs guarantee the employer does not ever have to move open claims to a new TPA should the employer decide to engage a new claims administrator. Employers should be somewhat wary of Life of Claim arrangements. Employers who choose to fire their TPA due to underperformance are likely to move their inventories of open claims, thereby eliminating the intended value of the more costly Life of Claim structure.

- Budget Based: This structure is optimal for large employers with rigorous claims handling standards and the desire to pay up for superior services. The employer agrees to pay the fixed annual labor costs for a specific team of adjusters. The total cost includes the adjusters' salaries and benefits, a provision for the TPA’s profit and overhead expenses, and travel expenses for the adjusters to attend meetings. The Budget Based approach gives employers dedicated adjusters and the ability to mandate specific standards for the claims program (such as capping the number of open lost-time claims an adjuster is tasked with managing). There are two noteworthy downsides to these arrangements. First, Budget Based contracts are typically more expensive than the other two structures. Second, because adjusters are dedicated to single clients, the TPA has less incentive to push adjusters to close claims and take on new ones (from other employers).

3. Evaluate medical cost containment.

All TPAs work to reduce the medical aspects of your workers’ compensation claims, but their approaches and skills vary.

When selecting a new TPA, it is critical to understand how the TPA makes money and charges you for their medical management services. Here are two important cost factors to consider:

- Standard Bill Review - Percent of saving arrangements versus flat fee

Some TPAs charge you a percentage of savings achieved during the bill review, while others offer a flat per bill fee for the same service.

Example: An MRI is done on an injured worker, and a bill for $1,000 is sent to the TPA for review and payment. The TPA runs it through their standard bill review protocol and reduces the bill to $550, generating $450 in savings. Assume the TPA has two options: 25% of savings or a flat bill review fee of $12.50.- Under a TPA contract that charges 25% of savings, the TPA bills you / earns $112.50 for this service.

- Under a flat per bill fee arrangement, the TPA would charge $12.50 for the exact same service and savings generated.

- PPO savings

All TPAs have PPO contracts, which generate additional savings for the employer through pre-negotiated provider contracts. Generally, there is very little negotiating that can be done in this category, and it’s common to see TPA fees in the range of 15% to 30% of any additional savings beyond that achieved by the standard bill review.

4. Keep track of administrative fees.

Each TPA has an administrative oversight fee. Also, if you are moving historical claims to a new TPA, you are likely to pay data transfer fees and claims intake fees.

Find out how your TPA charges for access to their risk management information system (RMIS) and how much it costs for each user. RMIS is an online system that assists in consolidating claims, policy, and risk data. TPAs will likely charge to access their own system, as well as to transmit data directly to the client’s own RMIS system if the client purchases one.

Administrative and RMIS fees are often overlooked but are negotiable. Make sure you factor these add-on costs into your final analysis, and don’t hesitate to push bidding TPAs for lower prices.

5. Determine whether or not you should transfer open legacy claims.

This cost and time involved in migrating your claims data can seem prohibitive when you switch to a new TPA. Remember that this historical data is your data, so the decision on whether to move it or not is also yours.

Considerations for migrating claims data when switching Third-Party Administrators (TPAs):

- How difficult or easy will it be to move it again in the future to another TPA?

- Where does this TPA store the claims?

- What is their content management system?

- Does the TPA have an up-to-date operating system?

- Does it have an industry-standard database (versus proprietary)?

- How much of the data is stored in the database versus in a document management system?

- Are they ISO 27001 certified?

Also, keep in mind that you don’t have to take an all-or-nothing approach to transferring your historical claims. You can take a phased approach.

6. Carefully manage the TPA selection and transfer timeline.

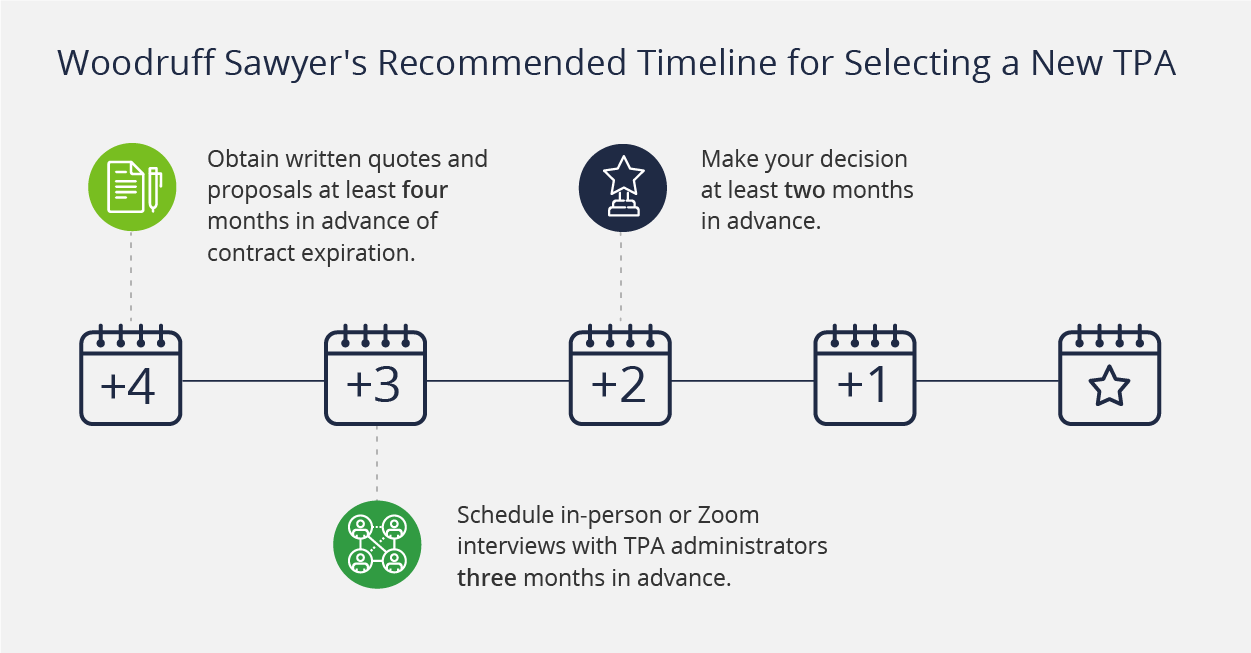

Many TPA contracts specify a 60 to 90-day notice period before cancellation. If you are in the market for a new TPA, you should begin the process at least five months before your current contract expires.

A final but very important step is to introduce your internal team, including stakeholders in claims, risk management, legal, human resources and safety departments to the new TPA team. Starting a new TPA relationship without providing all key stakeholders access to your new adjusting team, along with appropriate claim handling protocol instructions, is essential.

7. Before signing a contract with a TPA, your organization should obtain the following:

- a clear description of the services to be provided

- an overview of fees or charges for TPA services

- contact information for client references

a summary of the TPA’s licensing status (Most states require special licensing for TPAs.) - information on the fraud prevention measures the TPA has in place

Key Takeaways for Choosing a New TPA

- Carefully evaluate all the financial variables. Create an easy-to-read report that compares the organizations you are considering in terms of both line-item and all-in costs and benefits.

- Think about your long-term strategy and objectives. Moving on from one TPA to a competitor is an onerous process that can involve significant additional costs depending on the type of contract you select. Make sure your contract aligns with your goals for the TPA relationship duration.

- Carefully review the TPA’s service commitment and insist on key performance metrics. Ask your TPA relationship manager how they will react to complaints regarding adjuster performance, how they manage staff turnover and what metrics they use to measure the effectiveness of their adjusting teams. It is difficult to enact changes once your TPA contract is in place, so make sure to formalize objectives and standards from the beginning of the relationship.

Selecting a new claims handler can provide huge financial and operational improvements to your workers’ compensation claims program. Getting the selection right requires a careful analysis of an array of financial and operational factors. Woodruff Sawyer’s workers’ compensation claims experts can help guide you through the TPA review and selection process.

Read our latest property and casualty looking ahead guide where we forecast upcoming trends, including workers' compensation considerations, the impact of the pandemic, accelerating climate changes, and litigation trends.

Table of Contents