Blog

The Commercial Insurance Landscape Continues to Evolve: A Q2 2023 Update

The outlook for the commercial lines insurance market remains largely unchanged since the first quarter, with the supply of capital driving pricing behavior in all segments.

In this Q2 2023 Commercial Lines Insurance Market Update, we review insurance rates and pricing trends in the directors and officers (D&O) cyber, casualty, property, and cargo and stock throughput segments. Read on for a summary of our key insights or download the full report below.

Competition Rises in the D&O Market

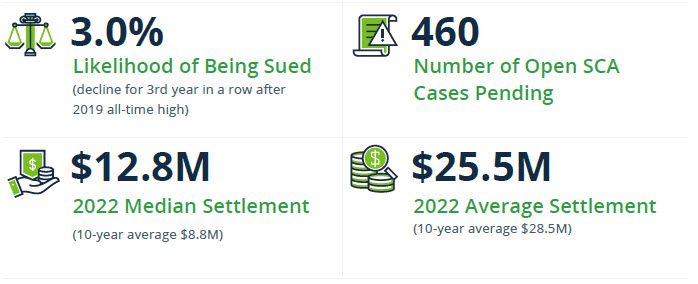

For the directors and officers (D&O) market, rates and retentions are down for almost all companies as an oversupply of insurance capacity and few IPOs drive up competition. Mature public companies are experiencing strong rate relief, and newly public companies that had higher starting premiums are also seeing significant decreases. Meanwhile, securities class action severity remains high, and we expect 2023 total settlement dollars to be significant.

Competition Within Cyber Is High, but Ransomware Claims Are on the Rise

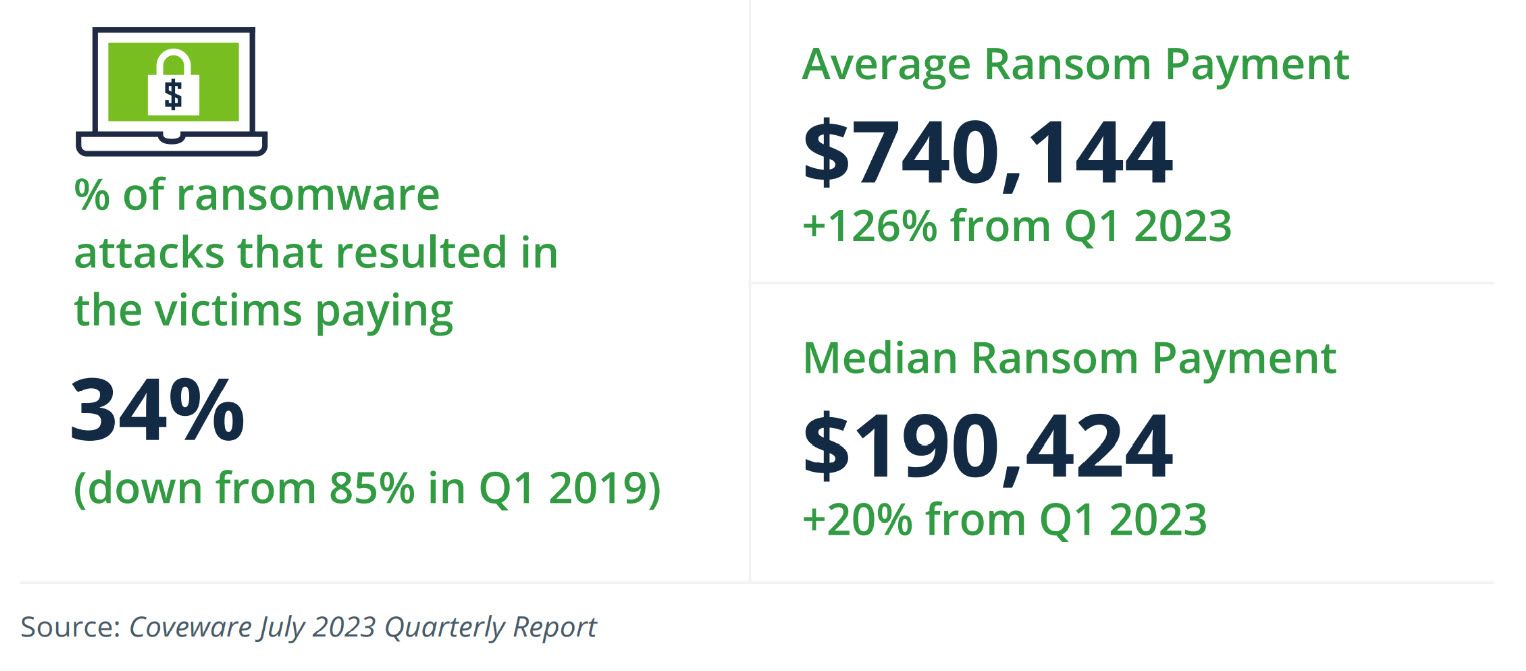

Another segment seeing premium decreases is the cyber market, as more carriers are competing for primary and low excess placements. One reason for the lowered rates: decreased ransomware losses in 2022, which led insurers to chase market share with competitive quotes. However, we have seen ransomware claims activity increase again through the second quarter.

Casualty: Buyers See Biggest Savings in Workers' Compensation Insurance

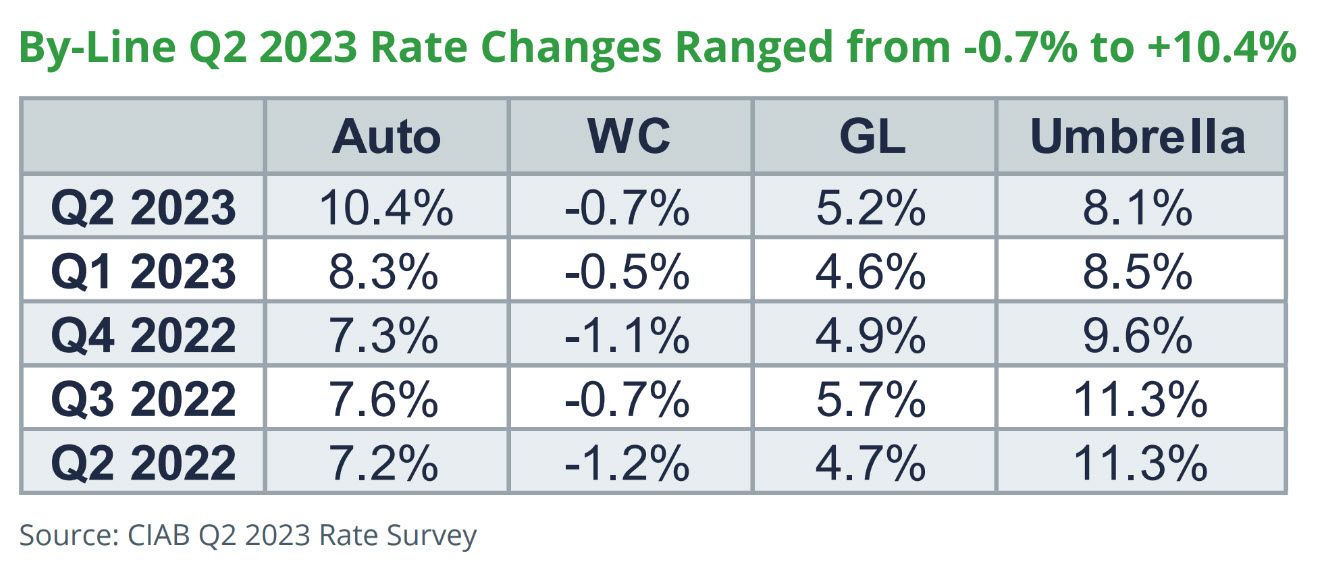

Pricing is stabilizing in the casualty market, continuing a trend we observed in 2022. Workers’ compensation consistently remains the line where commercial insurance buyers can expect to save some money. In contrast, primary casualty insurers continue to seek rate increases for general liability and auto to keep up with loss trends.

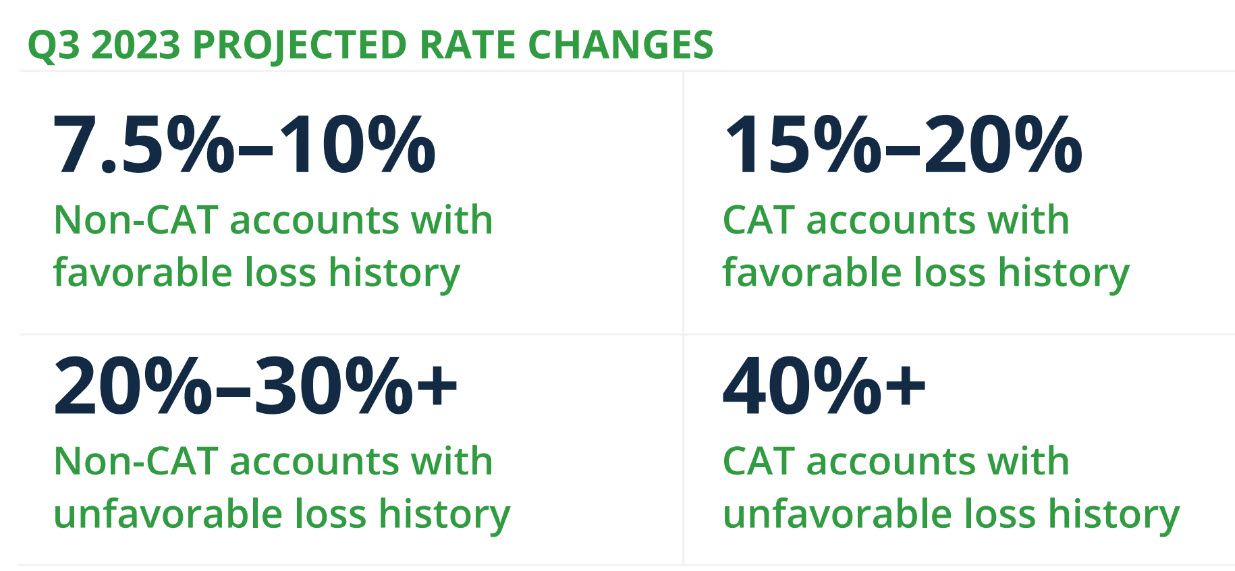

Natural Catastrophes Drive up Property Losses—and Costs

Property remains the most challenged part of the commercial lines market, with the frequency and severity of natural catastrophes driving up losses. In 2022, we reported that many insurers were expecting difficult 2023 reinsurance renewals. That came to fruition during the January 1, 2023 reinsurance renewal cycle as property carriers experienced significant increases in reinsurance retentions and rates. The shift in the reinsurance market means insurance companies retain more risk on their balance sheet. This, combined with increased losses and the current inflationary environment, means property buyers continue to see premium increases.

While the property market experiences rate increases, the cargo and stock throughput markets continue to experience stabilizing rates. Carriers have adjusted their appetites to better manage exposure due to rising reinsurance costs; however, new entrants have entered this market in the last year, and competition continues to build.

For more insights into the insurance trends and pricing changes of Q2 2023, download your copy of the Commercial Lines Insurance Market Update.

Author

Table of Contents