Blog

The Butterfly Effect: How Global Dynamics Are Impacting Workers’ Compensation Claims

Recent national and world events have created a perfect storm for workers compensation (WC) claims.

The move of baby boomers out of the workforce was already shifting demographics when the pandemic sparked the Great Resignation across all age groups. More recently, the war in Ukraine has compounded rising inflation, adding to a mix of factors behind a cost spike in WC.

This article examines the developing changes in WC amid global events, as well as strategies for turning things right side up during topsy-turvy times.

Why Is Everyone So Stressed?

As it turns out, for many workers, remote and hybrid work is not all it was cracked up to be. Various surveys reveal employees working under either arrangement have experienced increased anxiety and depression due to isolation, lack of employer communication and support, inconsistent expectations, lack of structure and routine, and fewer boundaries between work and home. Many employees reported working more hours than when they physically went into the office, leading to burnout.

Since 2021, we have not only seen an increase in employees adding body parts to existing accepted orthopedic injuries, but employees are also filing multiple claims with different or overlapping dates of injury and/or mental stress—either as a compensable consequence of an accepted orthopedic injury or as a standalone claim. Whether employees worked from home, had a hybrid schedule, or reported to a designated workplace, statistics show WC mental health claims increased substantially following the lockdowns, and we do not see this changing in the foreseeable future.

Not surprisingly, the largest pool of stress claims in 2021 was filed by essential workers, with the majority being healthcare workers, according to a study by WorkCompCentral. While some states exclude WC mental health claims, many cover them even if work is only one contributing cause of stress.

Data from the California Workers' Compensation Institute shows a substantial increase in 2020 compared to previous years in compensable consequence and secondary stress injuries filed jointly with physical injury claims. While other injury categories saw fewer numbers, whole body claims, including no physical injury/stress claims, were up 20.3% in 2020, from 107,827 to 130,587.

Due to the exclusions of mental WC claims in other states, data from NCCI is lacking. However, NCCI has observed that several states are starting to consider mental claims, at least for essential workers. This recognition of the importance of mental health may be a gateway to the acceptance of mental claims across the board.

We are also seeing employees filing EEOC complaints and EPL claims in conjunction with a WC claim. Filing in conjunction with stress and other claims has also increased. This primarily includes wage and hour and wrongful termination allegations.

The focus on mental health that the pandemic brought to the forefront is here to stay. The best way to mitigate stress claims and prevent them is to prioritize your employees' mental health. Here are some steps to follow:

- Regularly remind your staff of your concern for their well-being and tell them about the resources you offer as part of your employee benefits package.

- Find ways to check in and engage with employees. This communication will build trust and connection and reduce work stress.

- Strive for better coordination and collaboration across all practice areas, including WC, employee benefits, EPL (Employment Practices Liability), and include labor counsel when appropriate.

- Consider using a single broker for your insurance and employee benefits needs for better collaboration and coordination of benefits.

Since some employees have switched to a permanent work-from-home routine for all or part of their work week, employers should have an ergonomic awareness program in place. This includes education in ergonomics, encouraging employees to take breaks and set work-home boundaries, and checking in often with remote workers to see how they are doing. For additional information, please refer to our previous article, Workers’ Comp for Remote Employees: Here’s What You Need to Know.

The Great Resignation: How Employee Turnover and Staff Shortages Are Affecting Claims Handling

Many employees handled pandemic stress and burnout by leaving their jobs and pursuing either a completely different career path or, if forced to return to the office, moving to a different company with more flexible remote-work options. Many employees are saving time and money by working from home and avoiding commuting to the office. The insurance industry is not immune from this trend.

Adjusters are jumping from one insurance carrier or third-party administrator to another for more pay, better benefits packages, or the ability to work from home full time. It’s too early to know the long-term effects of these workplace changes. According to Berkley's Adjusted podcast, the staffing shortages seen in the insurance industry have caused backlogs and stalled claims due to the time it takes to reassign and train new adjusters. It is possible that caseloads are languishing or, worse, simmering unchecked in a pool of reserves with managers stepping in only to put out fires.

Surveys show that Gen Z workers bring different values to the workplace, prioritizing mental health and work-life balance over salary. These sentiments are reflected in a recent California bill proposing employers pay workers overtime for exceeding 32 hours per week. That bill is on hold for now but is likely to resurface.

With insurance carriers notoriously running lean and claims work already fraught with acrimonious disputes and too-high caseloads, carriers will need to pivot to accommodate worker demands to attract and retain adjusters. Meeting these conditions might be followed by higher administrative claim costs trickling down to premiums.

To prevent any gaps in claim activity, we recommend engaging your broker, who can coordinate claim reviews and provide essential claim oversight and advocacy to move the claims toward resolution. When possible, designate defense counsel to follow through on already-agreed-upon action plans and pursue early resolution when appropriate.

How Delays in Treatment Affect Reserves and Claim Closures

Claims are staying open longer because of treatment delays. Doctors delayed treating injured employees with non-life-threatening injuries because COVID patients took precedence. Due to fears of the spread of COVID, occupational clinics also reduced their in-person office hours, and injured employees often chose telehealth appointments in lieu of in-person examinations. Treating physicians keep injured employees off work longer because they are giving the injured employee the benefit of the doubt and often relying on their subjective complaints when addressing release to return to work. Without a physical examination and objective findings, physicians are more inclined to keep an injured employee off work than risk reinjury by releasing them back too early.

Qualified Medical Evaluators (QMEs), Agreed Medical Evaluators (AMEs), and other medical-legal specialists refused to perform in-person evaluations to avoid the spread of COVID. While telehealth was made available for certain medical treatments, virtual appointments were not possible in the medical-legal space.

We recommend assigning a nurse case manager to assist with encouraging in-person evaluations and better coordination with the treating physician. You should also provide the adjuster with the injured employee’s usual and customary job description. This will lend more context to the employee’s daily work activities and provide the treating physician with a basis for any work restrictions. If you have specific modified duty in mind, you can also provide the adjuster with an updated job description to speed up the return-to-work process.

Inflation and the Impact on Claim Costs

On January 1, 2022, the temporary disability (TD) rate had its most significant increase in decades, from $1,356.31 to $1,539.71 per week. The pandemic-driven recession is behind this increase because the highest proportion of job losses was among low-wage earners. This pushed up the SAWW (State Average Weekly Wage) among remaining workers from $1,383 to $1,570—an increase of 13.5 percent—in 2021. TD is linked to the SAWW, which forms the basis for calculating benefit rates. Other states also saw sizable increases.

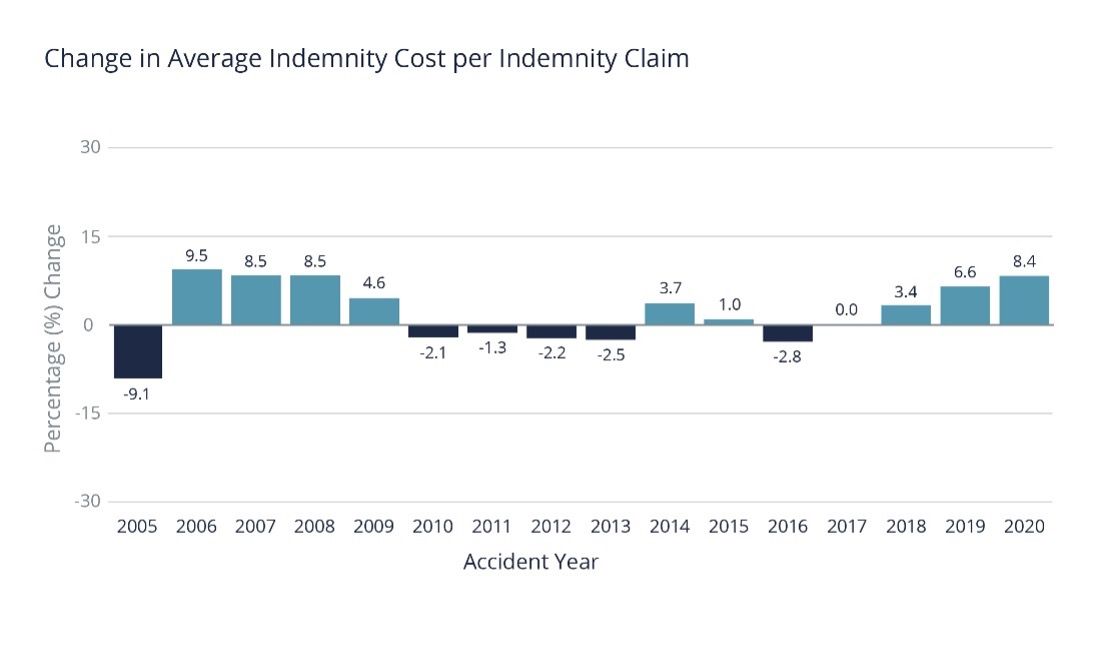

Recent wage inflation has led to a substantial increase in disability costs for lost time.

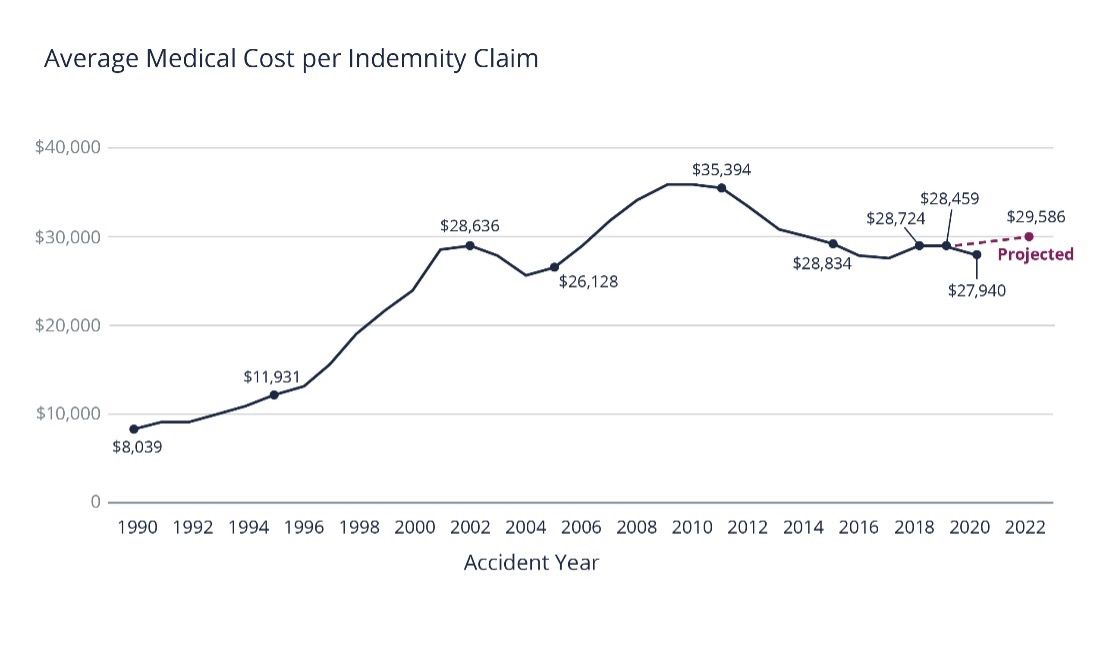

Early in the pandemic, the Workers' Compensation Insurance Rating Bureau of California (WCIRB) reported that average medical costs decreased in 2019 and 2020. These decreases were partly attributed to a reduction in the utilization of medical services, especially high-priced surgeries deferred due to pandemic lockdowns and fears of COVID spread.

The WCIRB projected modest increases in medical care costs for 2021 and 2022. This projection, however, predates the start of the war in Ukraine and may not have taken into consideration other unknown variables.

At a global level, the war in Ukraine has exacerbated the pandemic-triggered supply chain disruptions that have delayed the transport and increased the cost of medical products. In addition to higher gas prices affecting the cost of transporting medical goods, economic experts predict that other factors driven by the war will further inflate costs.

China's reliance on Russia for oil and nickel and the US dependence on China as one of its leading suppliers of medical equipment have created a ripple effect. The greatest impact is on medical supplies made of plastics from oil and stainless steel from nickel. These items include diagnostic and imaging equipment, surgical supplies, disposable syringes, sterilization trays, and surgical hardware.

At a local level, the increase in the med-legal fee schedule will also continue to boost medical expenses, at least in California. Especially in psychiatric claims, medical-legal costs are rising, as are settlement costs.

Are There Any Positive Trends to Report?

On a positive note, the combination of modern technologies and pandemic-related shutdowns ramped up telehealth solutions, mitigating medical costs and treatment delays. Experts believe telehealth is here to stay. As part of the Division of Workers’ Compensation (DWC) modernizing its Official Medical Legal Fee Schedule (OMFS), the Center for Medicare Services (CMS) revised telehealth list was adopted effective January 2022. Telehealth may be a good option when traditional medical treatment is delayed and for patient information gathering, prescription refills, referrals for diagnostic testing, physical therapy, and specialist visits.

Telehealth is about three times less expensive than in-person visits. Different data sources suggest that virtual visits cost an average of $50 to $79; in-person visits usually start at around $176, depending on location.

Research from Integrated Benefits Institute found that two-thirds of virtual health visits among health plan subscribers were for behavioral health issues. Perhaps virtual health could be used for the same purpose in WC to address mental claims.

Additional benefits to virtual appointments are that they save the injured worker travel time to doctor visits and cut down on time away from work. They also save the WC carrier reimbursable mileage to the employee for in-person visits.

What Are Some Solutions to a Hardening WC Market?

While some of these WC claims issues are stabilizing, others remain. In addition, new trends are evolving, prompting some experts to believe a hard WC market is on the way. The WCIRB recently proposed an increase to the advisory pure premium rates, approximately 8% above these rates a year ago. (Please read our previous article on COVID's early impact on Ex-Mods and WC premiums here.)

Along with the strategies mentioned above, some additional interventions may help. These include:

Communication: If claim reviews with your insurance carrier and broker have fallen off track or were rushed through Zoom sessions, get regular meetings back on the calendar. Make sure you collaborate with your claims adjuster(s) and hold team members accountable for taking proactive action to resolve claims. Don't let the pandemic or other excuses become the norm.

Loss Reports: Get a handle on your current injury trends by obtaining a loss trend report from your carrier or broker. Then discuss any services needed to control claim frequency. For example, perhaps it's time to revisit loss control if safety issues or improper ergonomic workstations cause injuries.

Diligence: Whether you've had a material change in your operations or financial position, consider strategic due diligence of your insurance program options. When vetting WC carriers, make sure the carrier recognizes the importance of adjuster wellbeing and provides adequate management support, which will go a long way for good claims administration.

Health and Wellness: Continue to follow COVID-19 safety protocols and take steps to ensure the health and well-being of your employees. Studies have revealed that the comorbidities that increase costs in traditional WC claims (e.g., diabetes, obesity, hypertension) are the same ones that drive COVID costs.

With the proper balance of persistence, creativity, collaboration, proactivity, patience, resourcefulness, and positive expectation, turning WC claims to the right side up is possible. If you have further questions about WC claims, please reach out to your Woodruff Sawyer representative.

Authors

Table of Contents