Blog

Hawaii Insurance Division Approves 8.2% Increase in Workers’ Compensation Loss Cost Rates

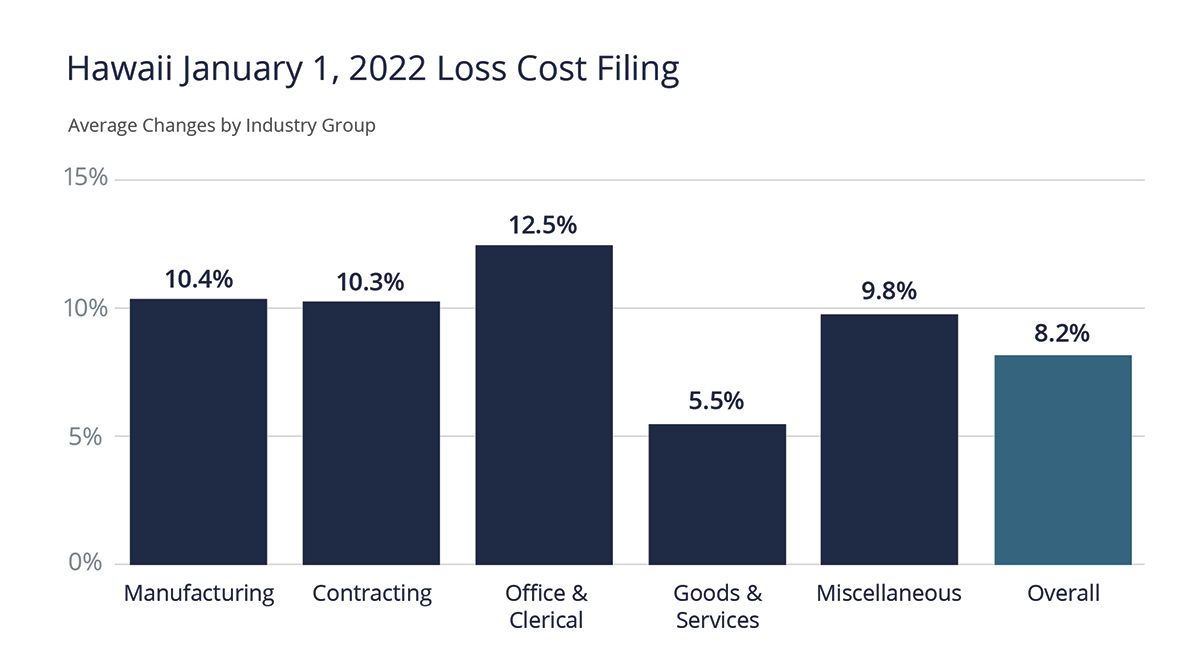

The National Council on Compensation Insurance, Inc. (NCCI) recently requested an 11.2% average workers’ compensation (WC) loss cost rate increase for 2022, subject to approval by the Hawaii Insurance Division. After reviewing the NCCI request, the Hawaii Insurance Division approved an average +8.2% change to the WC loss cost, effective January 1, 2022. The loss cost trend of increases from 2021 has carried over into 2022 and is largely attributed to rising costs for average indemnity and medical only claims, while combined ratios stay relatively consistent. The impact will vary across the different rating classifications, but the below information provides more detail across specific class codes and industry segments.

Source: NCCI Hawaii State Advisory Resources, November 2021

January 2022: Workers’ Compensation Rate Change by Specific Construction Classifications

| Code | Description | 2022 Loss Cost |

Difference from 2021 | 2021 Loss Cost |

|---|---|---|---|---|

| 0042 | Landscape Gardening | 4.72 | -5.2% | 4.98 |

| 1701 | Cement Mfg. | 3.38 | 8.7% | 3.11 |

| 1710 | Stone Crushing and Drivers | 3.76 | 11.9% | 3.36 |

| 2802 | Carpentry—Shop Only | 5.41 | 15.4% | 4.69 |

| 2883 | Furniture Mfg.—Wood | 4.06 | 5.7% | 3.84 |

| 3030 | Iron/Steel Fabrication—Structural/Shop | 6.63 | -2.1% | 6.77 |

| 3040 | Iron/Steel Fabrication—Ornamental/Shop | 6.07 | 18.1% | 5.14 |

| 3076 | Sheet Metal Products Mfg.—Shop | 3.78 | 16.0% | 3.26 |

| 3365 | Welding or Cutting NOC | 3.34 | 5.4% | 3.17 |

| 3724X | Millwright/Electrical Apparatus Install | 4.85 | 24.7% | 3.89 |

| 5020 | Ceiling Installation—Suspended Acoustical Grid Type | 4.15 | 8.9% | 3.81 |

| 5022 | Masonry, Plastering, or Stucco | 5.37 | 13.1% | 4.75 |

| 5102 | Metal Door, Door Frame or Sash Erection | 4.51 | 9.7% | 4.11 |

| 5183 | Plumbing NOC | 2.86 | 7.1% | 2.67 |

| 5188 | Automatic Sprinkler Installation | 3.07 | 8.1% | 2.84 |

| 5190 | Electrical Wiring—Within Bldgs. | 2.67 | 13.6% | 2.35 |

| 5213 | Concrete Construction NOC | 4.76 | 8.4% | 4.39 |

| 5215 | Concrete Construction—Private Residences | 4.47 | 16.1% | 3.85 |

| 5221 | Concrete Work—Slab on Grade | 3.43 | 15.5% | 2.97 |

| 5348 | Tile, Stone, Mosaic, or Terrazzo | 3.37 | 14.6% | 2.94 |

| 5403 | Carpentry NOC | 5.49 | 16.1% | 4.73 |

| 5437X | Carpentry—Interior Work | 3.92 | 9.8% | 3.57 |

| 5445 | Wallboard Installation | 3.97 | 10.9% | 3.58 |

| 5474 | Painting or Paper Hanging NOC | 4.87 | 9.9% | 4.43 |

| 5480 | Plastering NOC | 4.4 | 11.4% | 3.95 |

| 5506 | Street/Road—Paving | 5.37 | 5.5% | 5.09 |

| 5507 | Street/Road—Subsurface | 3.59 | 12.2% | 3.2 |

| 5535X | Sheet Metal Work | 4.99 | 13.4% | 4.4 |

| 5537 | Heating, Ventilation, A/C Installation, Service, Repair and Drivers | 2.89 | 17.0% | 2.47 |

| 5551 | Roofing—All Kinds | 10.94 | -2.9% | 11.27 |

| 5606 | Contractors—Executive Supervisors | 0.96 | 3.2% | 0.93 |

| 5645 | Carpentry—Detached 1 or 2 Family Dwellings | 7.19 | 14.5% | 6.28 |

| 5651 | Carpentry—Dwellings Not Over 3 Stories (2013 n/a; see 5645) | - | 0- | |

| 6204 | Drilling NOC and Drivers | 8.95 | 24.7% | 7.18 |

| 6217X | Excavation/Grading of Land | 2.78 | 7.3% | 2.59 |

| 6229 | Irrigation/Drainage System Construction | 3.46 | 15.0% | 3.01 |

| 6306 | Sewer Construction | 3.77 | 1.1% | 3.73 |

| 6319 | Water Main Construction | 2.96 | 8.4% | 2.73 |

| 6325 | Conduit Construction | 2.93 | 11.0% | 2.64 |

| 6400 | Fence Erection—Metal | 3.92 | 1.3% | 3.87 |

| 7538 | Electric Powerline Construction and Drivers | 3.6 | 3.4% | 3.48 |

| 7600 | Telecommunications Co.: Cable TV or Satellite (all other employees, drivers) | 4.76 | 24.3% | 3.83 |

| 7605 | Burglar Alarm Installation or Repair and Drivers | 1.88 | 11.9% | 1.68 |

| 8227 | Contractors Permanent Yards | 4.73 | 19.4% | 3.96 |

| 8742 | Salespersons, Messengers—Outside | 0.59 | 13.5% | 0.52 |

| 8810 | Clerical Office Employees NOC | 0.28 | 16.7% | 0.24 |

| 9403 | Ashes Collection and Drivers | 12.14 | 14.4% | 10.61 |

| 9519 | Household Appliances—Electrical—Installation and Drivers | 4.7 | 7.6% | 4.37 |

| 9521X | Floor Covering—Installation | 4.13 | 14.7% | 3.6 |

| 9534 | Mobile Crane/Hoisting | 2.93 | -2.0% | 2.99 |

Why Are WC Rates Going Up?

While most NCCI states are experiencing loss cost/rate level reductions, Hawaii is seeing an increase in loss cost rates for a second year in a row. The impact of prior WC decisions is making it harder to deny compensability of a claim and continued treatment, which leads to increases in the overall cost of the claim. Many of our carrier partners agree that costs due to precedence set by prior decisions is what’s behind these increases.

The effects of the COVID-19 pandemic also have an overall impact on the workers’ compensation marketplace. The initial mandates causing the closure of certain government agencies, specifically the Department of Labor, postponed hearings for WC claims and led to a backlog of cases. The costs associated with these delays comes in the form of further lost time/wage replacement payments and continued medical care. The longer a claim lingers, the cost of the claim generally increases.

Shortage of Qualified Labor

Another underlying factor in the higher WC loss costs is the current shortage of skilled workers. According to a recent report by the National Association of Home Builders, the construction industry needs more than two million additional workers over the next three years to keep up with the demand for new houses amid the current labor shortage.

What’s the connection between the labor shortage and WC rates? According to the Bureau of Labor Statistics, the construction industry accounts for about 6% of all injuries that result in loss of work. As skilled workers leave the job force, some contractors are forced to hire less experienced workers to take their places. With insufficient training of new workers, the loss of skilled and trained workers on the job, and bridging the experience gap, the industry is bracing for an increase of injuries at work.

How You Can Differentiate Yourself to an Underwriter

Fortunately, there are some steps you can take to protect your company from the proposed increases we’ve outlined above and separate yourself from the pack as a quality risk in the eyes of the underwriting community.

Safety as a Top Priority. Demonstrating improved safety measures is vital to lowering your overall cost for workers’ compensation. Here are some steps to initiate or restart at your company that could support your team in these efforts:

- Provide employees with essential safety knowledge resources and best practices

- Conduct weekly safety meetings

- Institute safety checks at regular intervals throughout the day

- Create an incentive program that recognizes and rewards good safety practices

- Make Safety a company value and hold everyone accountable

We know your workers' safety is a top priority for you as an employer. Most insurance companies offer incentives for a quality safety program in the form of merit rating or underwriter discretionary credits. In fact, there are several carriers that are unwilling to even offer terms if a contractor does not demonstrate a strong commitment toward a safe work environment for their workers.

Staying Engaged When Claims Arise. An employer’s involvement in a claim is essential to ensuring that the claim stays on track. Here are some ways an employer can do this throughout the claims process:

- Timely and accurate reporting of the claim to the insurance company to avoid late reporting penalties

- Investigating the cause of the incident

- Keeping the lines of communication with the injured worker open

- Working with the claims adjuster

- Planning and developing a timeline for return to work

It takes a lot of effort and dedication to run a business. A key to managing your overall risk profile is finding the right partner who aligns with your business philosophy. They can help identify and develop claims practices and loss prevention programs and aids the procurement of the right insurance program.

If you have questions about your workers’ compensation or anything about your risk management program, please reach out to your Risk Solution Partners or Woodruff Sawyer representative.

Author

Table of Contents