Blog

Property Loss Management: FAQs for Landlords and Tenants

When an incident happens on your commercial property, whether you're a tenant or a landlord, it's time to reach out to your insurance provider. Both parties have mutual obligations—and motivations—to resolve the issue and secure coverage.

As an insurance brokerage, we field plenty of questions from both landlords and tenants about the property loss management process. Here, we share the most frequently asked questions and provide a roadmap for navigating the insurance claims process, from reviewing your lease to determine ownership to working with your landlord/tenant and the adjuster.

What Are the Steps in the Claims Process?

Tenants and landlords often don't know what to expect when it comes to resolving their claims. The process is the same for both parties:

- Identify the damage and report it to your broker. You should also take action to mitigate the loss.

- The broker and the client review the policy, deductibles, and options/strategy to report to the insurer.

- Once the claim is reported, the insurer will assign an adjuster, conduct inspections, and request documentation such as estimates, inventory lists, invoices, photos, and proof of loss.

- The client and insurer will collect vendor and contractor estimates, oversee the completion of repairs, and order stock/inventory if necessary.

- The client can request claim payment advances. These amounts vary by loss, policy, insurer preferences, etc.

- Reopen operations if possible and evaluate the impact on business loss.

- Prepare claim schedules and backup documentation to review with consultants and other experts.

- Submit the total loss costs to the insurer and await review. Offer the insurer a statement of loss or proof of loss.

- Work with the insurer to explain and reconcile differences and provide additional documentation, if needed, to reach a settlement.

- Sign the proof of loss documents, subrogation receipts, and other legal documents, for final payment.

What Should I Expect During Site Inspection and Scoping?

Now that you've reported the claim, you'll need to identify what's yours and quantify your loss. You'll work with your property insurance adjuster to inspect the site and determine the extent of the damage. If you need to make immediate repairs before the adjuster can get there, take photos and document the changes so the adjuster can see the extent of the damages.

Whether the loss is fire, water, or weather-related damage, take action to mitigate the damage. Regardless of ownership, it helps to contact a contractor, plumber, etc., and begin performing clean-up work when it’s safe. The cause of the damage and costs can be evaluated by the adjuster even if some work has already been done.

It's best to do the site inspection once, with multiple adjusters if possible. Often, the tenant and property owner will have their own adjusters, and you may also need to involve other tenants' adjusters if their properties are also damaged.

Here's what to expect when inspecting and scoping the site:

- The landlord or property manager walks around the leased area with the tenant, the adjuster(s) if they're present, and the restoration vendor or contractor.

- Determine where the ownership lines are. Ownership is based on the lease, and usually, there is an addendum outlining the capital improvements the tenant made when they moved in.

- Separate out restoration and repairs on tenant improvements and betterments (TIBs) and restoration and repairs on tenant-owned equipment, furniture, etc.

- Separate out the common area, common walls, and pre-existing building items that the landlord owned before the tenant added their improvements.

- The vendor/contractor scopes the loss and will provide repair estimates. One scope/estimate is for work on the tenant’s TIBs, and another scope/estimate is for the landlord’s property. The insured parties should then sign work authorizations, and once the work is completed, each party is invoiced for their respective costs.

What Else Do I Need to Do When I Have a Property-Related Loss?

Depending on the extent of damages, you may have to call multiple specialists in for repairs. Here are some things to do and consider after a property-related loss:

- Call a contractor, roofer, plumber, or emergency restoration company if the damage is significant.

- Verify contractors’ licenses and request a copy of their certificate of insurance and workers' compensation coverage in case they cause damage, or an employee is injured.

- If the claim is a fire, hire a contractor to board up the scene for safety, to prevent theft or damage, and to preserve evidence. You may need a fence or security guard.

- After a fire, do not make repairs until the fire marshal gives the authority that the scene is clear for repairs.

- After a water loss or other product failure, always save the part that broke or failed. The plumber or contractor can give it to you, and it'll be useful for the adjuster to inspect for subrogation. It should be stored in a safe place, preferably in a box that won't be touched by anyone, until you give it to the adjuster.

- Document the cleaning costs incurred by internal staff, maintenance crew, etc., including any overtime costs.

- Estimate the cost of ceiling and carpet cleaning, including labor and materials.

- Estimate the cost for an electrician to inspect and test for any electrical damage due to water exposure or fire.

- Take pictures of damaged and non-damaged areas. You can send these to the adjuster to show why action was needed to mitigate the loss.

- If the damage is only to the surfaces, obtain an estimate for painting the walls and ceiling if needed.

- Estimate the cost to clean and/or repair furniture. Complete a contents list; payment depends on who owns the contents.

- Does the carpet extend into a large open area? If so, you may incur matching and replacement costs, which will impact the value of claims.

- Always ask contractors or vendors to provide a line-item estimate or invoice, not a lump sum estimate, as the adjuster will not accept it.

For water-related incidents, emergency mitigation vendors will monitor dry-out progress and may partition some areas that are dry but are being “re-affected,” meaning the humidity/water may re-wet dried areas. To effectively dry out, they will need to continuously monitor the area, move equipment around, and partition off some areas with plastic to create chambers and keep the moisture from migrating into other dried spaces.

Who Pays for What?

If any damage occurred to landlord and tenant improvements, each party should track and present their damages in their claim submission to their respective insurers.

Any improvements the tenant installed are usually an insurable interest and covered under the tenant’s policy under BPP/TIBs coverage (business personal property and tenant improvements and betterments). In most leases, the tenant owns the TIBs until they vacate, then the title transfers to the landlord; however, some leases state that the title transfers to the landlord upon installation. Nonetheless, the lease may still require the tenant to insure the TIBs.

| Landlords and property managers often refer to the maintenance and repairs section of the lease to request that tenants fix repairs, but this section pertains to daily/routine maintenance and not “casualty/claims” situations such as fires, pipe breaks, storms, etc. |

A triple-net lease (where one party agrees to pay all property expenses) may have several exceptions to the comments below and requires careful review.

A lease may contain a mutual waiver of subrogation; in this case, each party is responsible for repairs to the property they own—the tenant for their contents and TIBs and the landlord for the building that existed before the lease. Neither party can pursue the other for payments. Keep in mind this is general advice; every lease is different, so there are exceptions.

The landlord and tenant must collaborate with the vendors on the repairs. They may even use the same contractor but must request separate estimates and invoices for each of their respective repairs to avoid delays in the claim adjustment and settlement/payment later.

We recommend holding off payment to vendors on the invoices until the adjuster has approved the scope and costs. It is common for adjusters to renegotiate with vendors/contractors on the approved scope and price, so payment on the full invoice before the adjuster approves it may result in an overpayment to the vendor.

Why Do I Need to Collaborate with the Other Party (Landlord or Tenant) After a Loss?

Maintaining a good landlord-tenant relationship during the claims process will make the entire process simpler and is beneficial for both parties.

Damage may not be limited to a loss for a single party. A burglary may affect the contents of a property (the tenant's), but it might also mean broken windows or doors (the landlord's property).

The lease likely requires the tenants to perform repairs to their improvements and contents. Remember that unless it's to mitigate damage (such as calling someone to repair a broken pipe), the tenant cannot perform repairs on the landlord's property, and vice versa. They also cannot ask for reimbursement after they've already done so. It's best to engage with the other party on the front end.

If a tenant's insurance claim is denied in whole or in part, the landlord should be notified immediately and provided with a copy of the coverage decision letter. If this happens, the landlord could decide to pay these costs and potentially seek coverage under their policy since the landlord has a financial interest in the improvements; however, the tenant's policy is primary.

The lease may allow for rent abatement, depending on the lease language or length of the restoration period. If credited, it would become a part of the business interruption loss on the landlord’s claim.

What Does My Lease Say About Losses and Insurance Claims?

Your policy will respond to damage to your owned property. The "insurance" section in your lease will address ownership and insurable interests’ obligations and must be reviewed; not all leases are alike.

In general, as a landlord, ownership includes landlord-owned items or where you have a financial interest. It may or may not include tenant improvements. Some leases have the landlord owning and insuring everything structural.

Likewise, tenants should claim their structural tenant improvements and business personal property on their own policy. The owner/financial interest in TIBs depends on the lease terms and insurance policy coverages.

| The common mutual waiver of subrogation clause in the lease prevents the landlord and tenant from seeking recovery from each other. However, this clause does not preclude one tenant from pursuing another tenant, a tenant’s vendor, or manufacturer of a piece of equipment or appliance that may have failed and caused the damage. |

Tenants or their insurers can pursue another tenant, vendor, or manufacturer if they can prove the other party is negligent in causing the damages.

Why Should I Report a Claim on My Policy If I Didn't Do Anything Wrong?

The loss is being adjusted through your policy because it provides the broadest coverage to you. The adjuster will apply your deductible and may apply some depreciation due to wear and tear during the initial evaluation. The initial evaluation will result in a partial settlement known as the actual cash value (ACV) settlement, so you can start repairs. When the repairs are completed, you’ll need to submit the final invoices to the adjuster, who can then issue a supplemental payment for the depreciation withheld; that part of the settlement is a two-step process.

The deductible is applied because it’s a term of your policy; however, when there is a responsible party involved and they have insurance, your deductible will be part of the demand for subrogation (claim against a responsible party). Subrogation will occur when your adjuster finalizes your actual cash value settlement, they send a demand to the responsible party for the cost of your deductible and the amount paid to you, their insurer makes a counteroffer, and they reach a settlement. Your insurer then withdraws any costs incurred during the subrogation process and shares with you the full deductible or a share of it, depending on how large the recovery is and the terms of your policy.

For the subrogation to be successful, your insurer will have to prove the other party is negligent. The insurer has experts and attorneys to handle that portion, so the team will do their best to achieve a full recovery if possible.

Going through your insurer is better than going directly against the other insurer in the hopes you won't pay a deductible. The other party’s insurer may not accept liability right away, may deny it, or may prolong the settlement process for months, and you’ll have no money that entire time. As such, going through your insurer is the fastest way, even if you must incur the deductible for now. Secondly, the other insurer is only liable for the depreciated value (ACV, described above), and your policy owes you the replacement value—that is, the full value without depreciation, albeit following the two-step process. Therefore, your policy gives you “new for old,” whereas the responsible party’s liability to you is “old for old”. As you can see, your policy is more generous and faster to get you up and running.

How Do You Determine Liability?

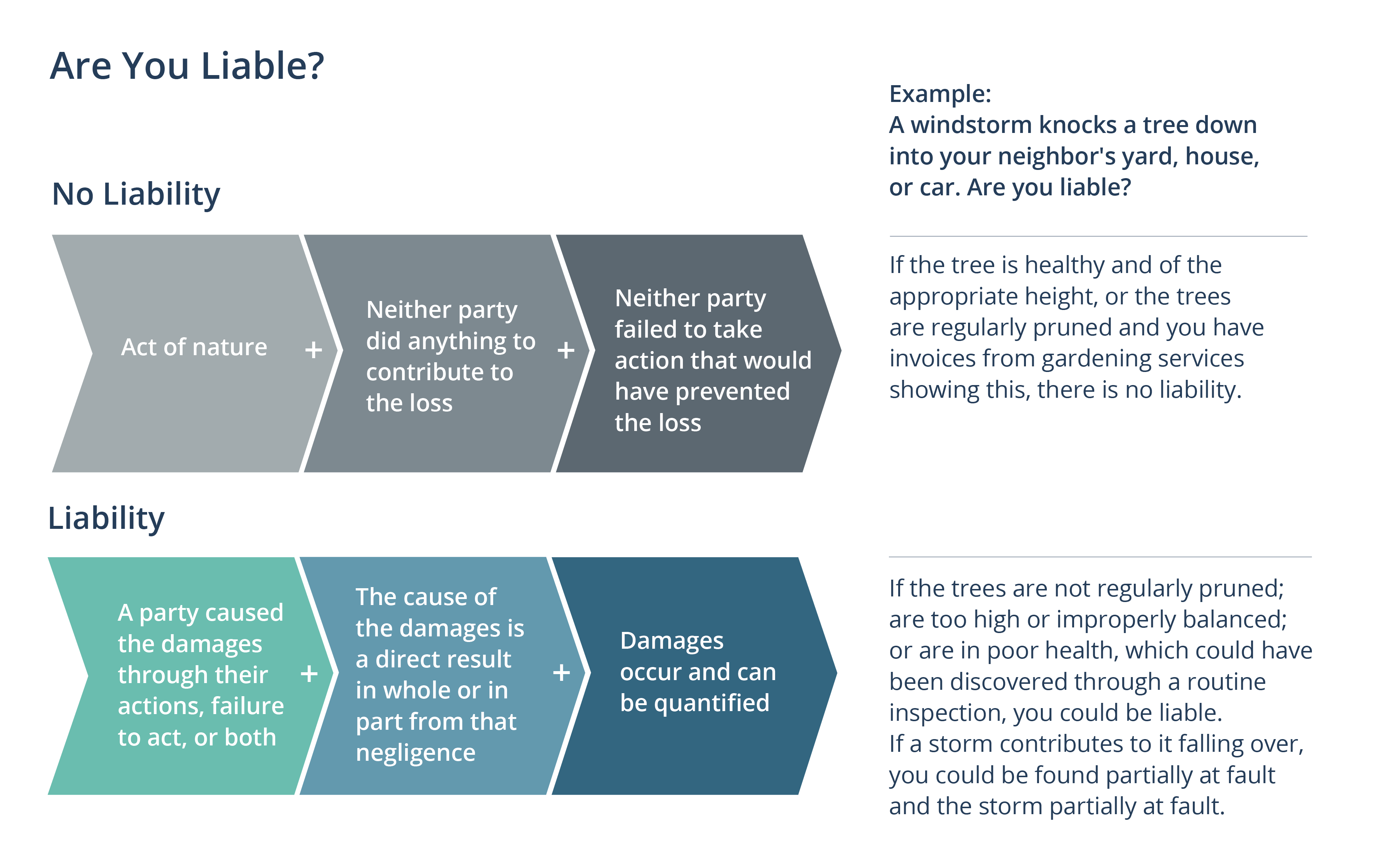

A person or company is liable for damages or loss if they were negligent in causing the damage. There are four prongs for establishing negligence:

- Duty Owed: When a party owes a legal duty to another.

- Duty Breached: The cause of the damages is a direct result of the breach of their duty, through their actions or inactions.

- Proximate Cause: The damages are caused by the actions, failure to act, or both.

- Damages: The damages suffered can be quantified/measured.

These four prongs must all be met, and the party deemed liable (or their insurance provider) must pay for damages. For example, water that migrates from suite A into an adjacent suite B does not necessarily make the occupant of suite A liable, absent a finding of negligence. The same is true for a neighbor’s tree that causes damage to another’s property, as shown in the example below.

How Can I Avoid Coverage Issues with My Insurer?

Do not pay invoices for work done on the other party's property. Making this payment could jeopardize your respective coverages.

For example, if a landlord pays a vendor for work done on a tenant’s property, then bills the tenant, that’s an act of subrogation. The tenant may elect not to pay the landlord back, given the waiver of subrogation in many leases. The same applies if the tenant pays a vendor for work done on a landlord’s property.

Your broker will guide you through the claims process and help you avoid potential coverage issues. At Woodruff Sawyer, our experienced claims consultants are available to walk you through your claim to obtain a favorable settlement.

Author

Table of Contents