Blog

Reducing Risk for Senior Housing Providers as Insurance Costs Increase

Senior housing providers are seeing significant increases in liability insurance costs, forcing them to identify and manage risks more carefully. With life expectancy on the rise, more Americans are aging in place (at home), entering senior living later in life, and requiring higher levels of care (increasing the overall acuity of care). This has led to an increased frequency of severe claims and payouts and has forced insurance markets to deliver steep increases to senior housing insureds or exit the senior housing market altogether.  Most recent data shows that senior housing liability rates have increased on average by 30% in 2019.

Most recent data shows that senior housing liability rates have increased on average by 30% in 2019.

In addition, increased provider competition has driven down profits while regulatory, insurance, and legal demands have increased. All of this is forcing senior housing operators to more seriously address and mitigate risk. Here I will discuss some of the major sources of liability and how proper staffing, training, and wellness programs can be especially beneficial.

Common Claims and What You Can Do to Minimize Risk

The most significant cause for the increase in claims in senior living are resident falls, according to CNA, a casualty insurance company based in Chicago. The most severe senior housing claims include mismanagement of medication, elopement (a patient leaving a care facility without notice), and wound care mismanagement.

Risk Management Programs Exist

As these claims and settlements increase, insurers and insurance brokers have been working with operators to assess their risk management programs in order to reduce the probability of a claim. Insurers look at the controls in place to manage and minimize falls, identifying problem areas and addressing them with training and ongoing audits.

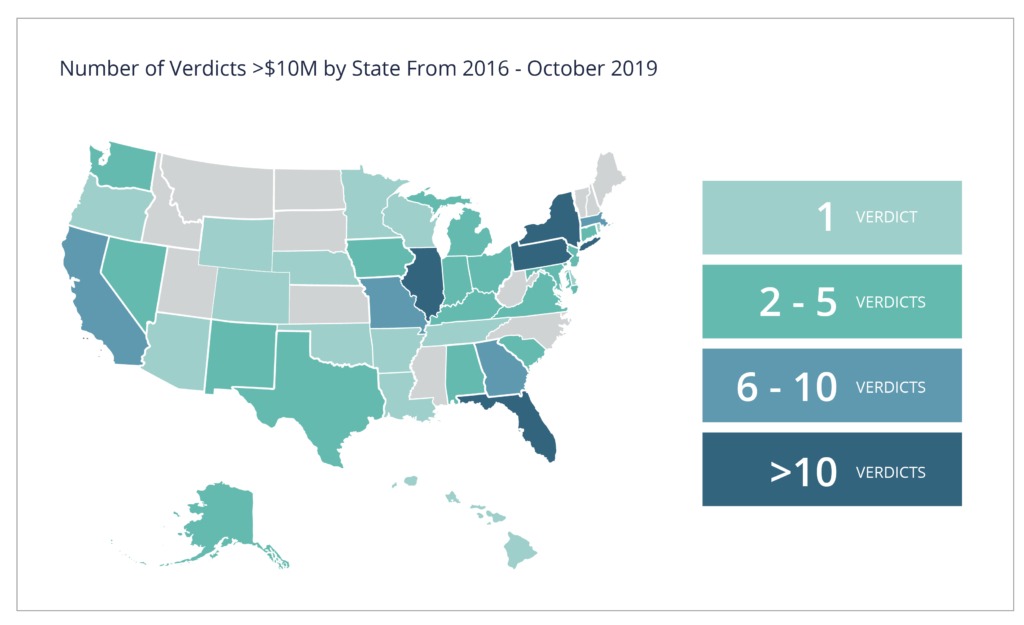

Source: https://www.npdb.hrsa.gov/resources/publicData.jsp, Dec. 31, 2018

Certain insurance brokers provide risk management programs as well, which provide training and educational resources to prevent litigation. As part of these programs, operators get help identifying, assessing, and managing risk in all areas of their senior living organization, such as acuity levels, resident and family expectations, staffing, and costs. An experienced broker will suggest policies, procedures, and strategies to reduce or eliminate risk and provide methodologies to implement risk-reduction strategies. The key to a successful risk management program is crafting a personalized strategic plan to create a culture of risk management within a community.

Staffing Adequately Will Pay Off in the Long Run

Adequate staffing for various resident population mixes (skilled nursing/memory care, etc.) has been a concern in senior housing—especially as residences strive for the optimal resident-to-staff ratio. As seniors are choosing to live at home longer ("aging in place"), delaying their transition to senior living communities, the overall age of senior housing residents and acuity of care trends up, making it harder to find fully qualified and trained staff. This, in turn, creates a gap in the proper care of residents as well as more claims. Today's assisted living staff should also be comfortable caring for not only seniors but potentially younger residents with dementia. Devising an appropriate staffing plan can help lower the likelihood of litigation (more on this below). While it may seem costly to maintain a well-trained, fully staffed community, a severe claim would be far costlier both financially and in terms of reputation.

Addressing Staffing Challenges

Because the majority of senior living caregivers earn between $9–$14 per hour, turnover is high, often leading to overworked employees or understaffed communities. This exhaustion can in turn lead to a higher likelihood of an injured resident and a claim. Staff retention and engagement therefore becomes a central goal.

Operators are finding that leadership development is critical for keeping employees engaged because it allows them to envision their career growth within the organization. Operators are now looking to organizations with high employee retention even outside senior living for leadership development models. For example, Trilogy Health Services from Kentucky has started to implement the very successful SERVE model, which stands for: seeing the future, engaging and developing others, reinventing continuously, valuing results and relationships, and embodying the values of the company. Implementing such models and building leadership development programs for staff help shore up retention and help communities take better care of their residents and avoid claims.

Wellness Programs Lower Your Risk

Wellness programs for residents and staff alike have helped lower the liability and health benefit costs for senior living operators. Most claims come from facilities with higher acuity levels of care, such as memory care and assisted living. Residents are living longer but unhealthier lives, with higher rates of diabetes, dementia, and heart disease. Many residents have multiple medical issues and live in facilities not adequately designed to handle these complex cases. There has been a big shift in focus from simply providing treatment to moving upstream by fostering resident wellness and prevention.

Wellness programs typically include activities such as weight loss competitions, exercise, stress management or resiliency education, smoking cessation programs, and wellness assessments that are designed to help residents or employees eat better, lose weight, and improve their physical health. Keeping lower-acuity residents more engaged with wellness programs helps stave off multiple medical issues down the road. For this reason, it is important for operators to continue to invest in wellness for this population. It is important for employers to focus on wellness programs for staff members as well, which helps avoid staffing shortages due to illness or injury. Staff wellness plans can be devised with the help of an operator's employee benefits broker.

Improve Quality of Care and Your Bottom Line

As the frequency of severe claims continues to rise and as the increased competition, increased regulation from the Centers for Medicare and Medicaid on senior living providers, and legal demands drive down profits, it is vital that operators assess and address risk concerns with the help of risk experts, such as insurance carriers and brokers. Those who are committed to implementing a risk management plan can improve the quality of care delivered to their residents while simultaneously helping their bottom line.

Table of Contents