Blog

5 Things to Consider When Using Surety Bonds for Engineered Timber Contracts

In 2022, the Ascent, a 25-story apartment building in Milwaukee, Wisconsin, became the world's tallest mass timber structure. The Milwaukee tower, which features luxury apartments, retail space, an elevated pool, and a sky deck, edged out the previous record-holder, Norway's 18-story Mjösa Tower (Mjøstårnet), completed in 2019. More recently, the Port of Portland is using substantial amounts of engineered timber in its award-winning new airport terminal (PDX TCORE).

Mass timber (also known as engineered timber or cross-laminated timber (CLT)) is a class of engineered building materials fabricated from layers of wood laminated together and designed to be strong, versatile, durable, and aesthetically pleasing. Plus, it produces a smaller carbon footprint than what is involved in manufacturing concrete, steel, and other building materials.

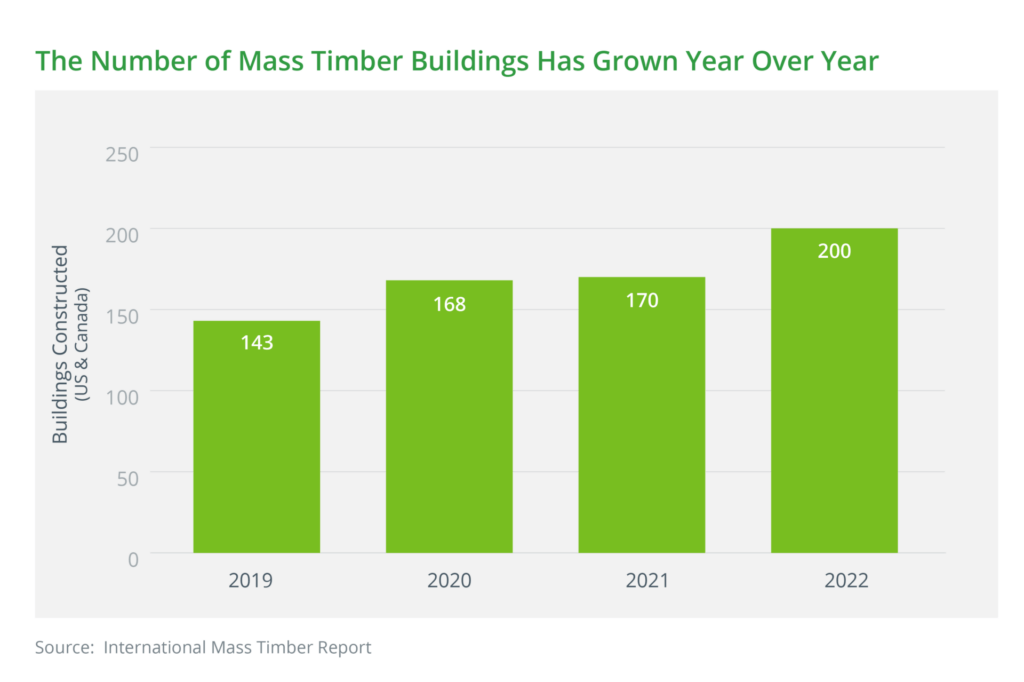

According to an industry report, the number of mass timber buildings is expected to double every two years through 2034.

This bright forecast for mass timber projects highlights the critical importance of surety bonds. Surety bonds, also called performance/payment or supply bonds, help ensure that all parties involved with the building or maintenance of infrastructure projects meet their contractual obligations.

This article explains five factors you need to consider when using surety bonds for cross-laminated timber (CLT) or other engineered timber contracts.

1. Surety Underwriting Qualification

The first step to the surety bond process is similar to applying for a bank loan. Surety underwriting is a credit-driven qualification process.

For any significant obligation and all contract bond requirements, a surety will require full financial disclosure, background information on the organization, and posting of collateral. Previous experience with this type of project will work in your favor.

While this step requires patience as the underwriter will conduct a thorough review, once the qualification process is completed, the program will be established. At this point, each bond request will be within the program parameters of a single project size and aggregate program. Once the bond is issued, it lasts the length of the contract. Depending on the project, this process can go as quickly as three days or take as long as two weeks.

2. Mill Ownership

When applying for a surety bond, it can be an advantage if any of the project's investors are mill owners.

Be sure to indicate if the ownership group is comprised of partial or full mill owners and if there is a connection with a mill operator. Underwriters often find these companies easier to do business with because the owners are more committed to the project's success.

3. Bond Type

There are two types of surety bonds that typically pertain to a construction project:

- A supply bond can give the customer a risk mitigation tool and a possible way to push for pre-payment. We typically advise our clients to push for supply bonds to guarantee their contractual obligation. Supply bonds are cheaper and usually don’t fall under the retention requirement (where the owner keeps a percentage of the contract value [usually 5%–10%] and returns it once you’ve complied with the terms of the contract).

- A performance/payment bond may be contractually required if the job involves more than just supplying a product—such as when installation is required. This type of bond may involve a portion of your payment being withheld due to retention requirements.

4. Fee Timber versus Public Timber

Fee timber is lumber found on all roads and timberland owned by the borrower or a wholly owned subsidiary.

This wood may have better and more consistent pricing than public forestry timber. Many timber companies use both fee and public timber, and underwriters tend to look favorably at this as it shows the company is paying attention to sourcing and pricing.

5. Collateral Indemnity

Collateral indemnity refers to a security deposit or letter of credit the bond applicant (the principal) provides to the surety (bond company)—this can limit or remove the owner from having to provide personal indemnity. The aim of the collateral is to reduce the surety's risk and exposure and make supporting the bond more favorable.

Using a percentage of collateral that correlates with your surety program may be a good idea for start-ups or companies wanting to limit their indemnity. As your company becomes more financially robust, the collateral and rates can be reduced.

Keep Up with a Growing Market

The global engineered wood products market was valued at $18.5 billion in 2022 and is expected to grow at a 9.36% rate to reach $31.7 billion by 2028. The Woodruff Sawyer team is keeping up with this growth and is ready to answer questions on how you can protect your interests in future construction projects.

Author

Table of Contents