Blog

2017: A Record-Breaking First Half of the Year for Securities Class Actions

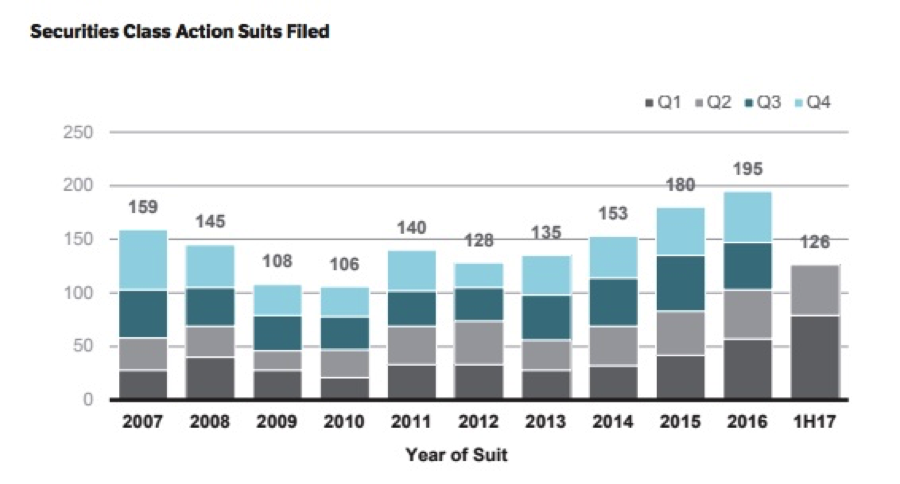

We’re just past the half point in the year, and 2017 is on track to be record-breaking when it comes to securities class action suits. Through the first half of 2017, we’ve seen 126 securities class action filings, according to Woodruff Sawyer’s DataBox™ “Mid-Year Securities Class Action Report.” Indeed, the first quarter of the year experienced a 132 percent increase over the 10-year average.

If 2017 keeps this pace, we may see another new high between 200 and 225 class action filings.

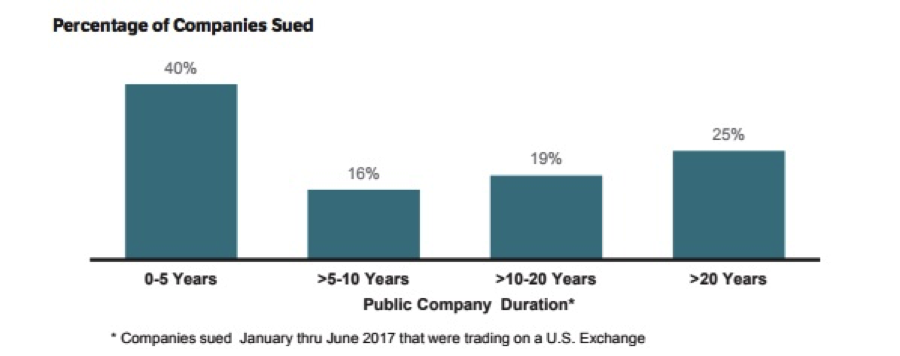

I’ve mentioned before in earlier D&O notebook posts that IPO companies continue to be the target of securities class action suits for a variety of reasons, ranging from strict liability for material misstatements and omissions in their S-1 Registration statements to the challenge of learning to operate as public company.

Woodruff Sawyer’s most recent research shows that 40 percent of the companies sued through the first half of this year have been public for five years or less.

Well-established companies are still at risk—22 percent of the companies sued were large market cap companies over $10 billion. So far in 2017, we have also seen the plaintiffs’ bar target companies such as Caterpillar, Fiat Chrysler, FTD, General Motors, Mattel, Tempur Sealy, United States Steel, and Western Union.

However, smaller market cap companies of $1 billion and less make up nearly half of the companies sued (47 percent).

It’s worth noting that we’re seeing smaller plaintiff firms get in on the action, too. They seem to be focused on suing smaller public companies. In a previous post I wrote on securities class actions 101, I mentioned that all notices of investigation from any law firm should be taken seriously. The fact that you are being investigated by a smaller, lesser-known firm might be an indication that the potential lawsuit is a less robust one, but you’re still going to want to pay close attention.

In the first half of 2017, companies in the biotech sector surpassed the technology sector in terms of the volume of class action filings:

- The biotechnology sector saw 32 cases filed, making up 25 percent of total securities class actions filings;

- The technology sector came in second place with 24 cases filed, making up 19 percent of filings; and

- The manufacturing sector came in third place with 21 cases filed, making up 17 percent of filings.

We’re also seeing the plaintiffs’ bar bring a substantial number of suits against foreign companies (headquartered outside the US)—29 companies as of mid-year experienced a securities class action suit, making up 23 percent of companies sued.

For more trends in securities class actions, download your copy of “Mid-Year Securities Class Action Report,” where you can find out:

- The total amount in settlements at the mid-year mark, and the top five companies with the largest settlements;

- The trend with M&A lawsuits being filed in federal courts; and

- A collection of articles for additional reading related to securities class actions from the D&O Notebook, and more.

Author

Table of Contents