Blog

Can Cameras in Fleet Vehicles Lower Your Insurance Premiums?

Employers with fleets of all types continue to face two challenges: Underwriting rigor in the commercial auto liability insurance marketplace and finding enough good drivers to keep their vehicles on the road.

With "nuclear verdicts" still on the minds of insurers, all insurers that write commercial auto liability insurance require their policyholders to have good fleet controls in place, whether the vehicles being driven are owned by the company, owned by the employee, or are leased or rented. Some insurance carriers have taken this a step further by requiring their policyholders with commercial motor vehicle fleets to have camera-based or other telematics systems in place just to secure coverage.

|

In Brief:

|

Telematics Use Continues to Grow

While more traditional controls such as ongoing motor vehicle registration (MVR) checks and driver training programs are still expected, telematics systems—especially those with cameras—are of more interest to both employers and insurers, and more systems are being put into use every year. These systems are also of great interest to those operating their own commercial vehicles as owner-operators.

According to Berg Insight, there were 2.9 million dash cameras in fleet vehicles in the US in 2021, but this number does not take into account the one-off dashcams in many owner-operator trucks that are not attached to any large provider or ongoing subscription.

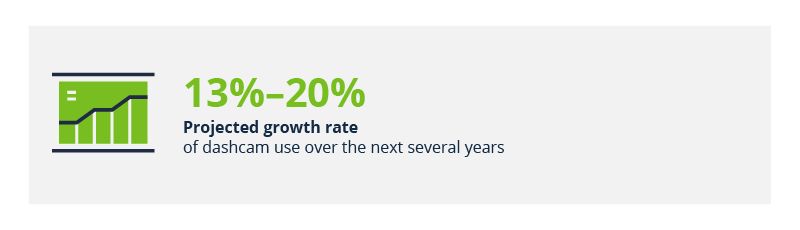

The market for dashcams is projected to continue to grow quickly. Depending on the source, the projected growth rate ranges from a compound annual growth rate of 13% to figures north of 20% over the next several years.

Fleet Camera Systems Often Exonerate Drivers

When it comes to company-owned fleets, there are still some large differences of opinion around the type of cameras that should be in use, who should have access to the data, and how recording is done, which will be discussed later in this article.

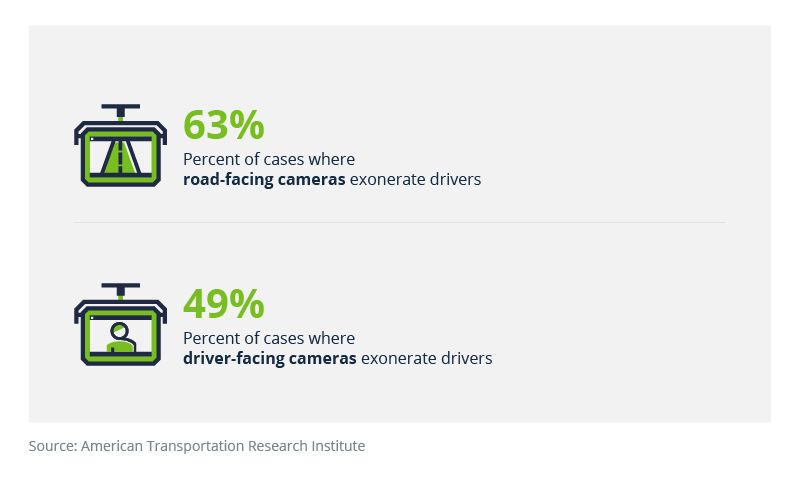

Agreements between telematics providers and insurers (generally to provide equipment purchase discounts to their policyholders) are more common than they were just a few years ago. Insurers are also willing to negotiate to lower premiums based on camera use, and there is talk of future formulaic premium decreases based on camera use with some carriers. Part of the reason for this may be that, according to an American Transportation Research Institute (ATRI) survey, in about 63% of cases, road-facing telematics camera data exonerates the driver of commercial motor vehicles (versus about 36% where fault is found). This, of course, alleviates liability and costs for the carrier and reduces blowback that tends to hit the employer, sometimes in very public ways.

Another newer development: Policyholders and insurers are entering into agreements which base lower premiums on the insurer being given direct access to the data output of the telematics system used by their clients. Some employers are comfortable with that idea and some are not, but when this type of agreement is in place, the carrier offers assistance in areas where the data may show problems. Presumably, this would mean the carrier could issue recommendations and require prompt responses in order to maintain any lower premiums included in the agreement. They could potentially even make decisions about insurability based on a lack of response or troubling data.

Even in the case of a camera proving that the driver was at fault, insurance carriers and defense attorneys tend to agree that they like knowing this early in the process and use the information to seek early settlement, which ultimately can benefit both the insurer and the employer.

ATRI reports that driver-facing camera units exonerate in about 49% of cases (versus 39% where they may indicate fault and 12% where they are neutral), but driver acceptance of driver-facing cameras is not nearly as widespread as for road-facing cameras. It is important to note, however, that the primary use of driver-facing cameras is not always exoneration—it is intended to provide an opportunity for both the driver and the employer to improve safety performance and inform their safety programs and coaching.

The Case for Driver-Facing Cameras

Litigation outcome is not the only measure of effectiveness for telematics and could be seen as being solely reactive rather than proactive. The primary goal of using driver-facing and road-facing cameras is a decrease in hazards and exposure resulting from an increase in good defensive driving habits such as sufficient following distance, decreased distraction, correct mirror checking and adjustment, fewer close calls secondary to fatigue, etc.

Many of these habits are impossible to monitor and effectively coach (or self-coach for that matter) with only road-facing cameras. In the same ATRI study mentioned above, insurers reported a 10–45% decrease in claims among their policyholders that installed driver-facing cameras. Of course, this is dependent on proper coaching and system management to increase good driving habits and therefore eliminate close calls and claims.

Some may feel that professional drivers should not need this type of input to maintain good habits. However, all drivers—and humans in general—benefit from reminders and cues to maintain good habits, and this seems to be supported by the numbers. Key camera providers typically claim their systems reduce accident rates by 50% while cutting claims costs by 60–80% Past independent studies show similar numbers related to decreases in event triggers and incidents.

We want to stress that simply putting a camera in a cab does not result in changes in behavior—or at least not on this scale. The camera system must be supported by consistent and quality coaching, as well as ongoing measurement of triggering events and incidents. Fleets that have exceptional safety records without the use of cameras may see a smaller benefit, but it is unlikely they will see no benefit at all.

Will Employees Accept Driver-Facing Cameras?

As previously mentioned, driver acceptance of driver-facing cameras is not universal. The aforementioned ATRI study bears that out. This doesn't mean employers cannot gain ground in this area, with their drivers eventually accepting and even embracing these systems.

The first thing to realize is that not all camera systems function the same way. Some systems allow real-time streaming or can be triggered by their employer at any time. It is understandable that drivers might find this intrusive, especially with some abuses of this type of system publicized in recent years.

Other camera systems or settings cause the camera to record only when an event triggers them and captures only a specific period before and after the triggering event. Driver, attorney, and insurance carrier responses in the ATRI survey all favored this type of setup, which helps ensure a reasonable amount of privacy for drivers during their time driving and prevents superfluous data from being used inappropriately.

| Perhaps the most encouraging metric in the survey response was that drivers were somewhat more accepting of driver-facing cameras when the company communicated clearly how the cameras worked, chose to record only event-based video, and used the data for safety programs and coaching. |

Ultimately, a holistic safety-focused approach results in benefits to the driver by protecting their reputation as well as allowing them to enjoy a safer and potentially longer career. There are, of course, benefits to the employer through decreased direct and indirect costs and public relations risks. Fewer close calls and triggering events equals fewer actual crashes over time.

Boosting Driver Acceptance: Start with Clear Communication

The dollars and cents argument for cameras in general, and even for driver-facing cameras, is easy to make. The more difficult question is what will happen to your driver pool if you install them? Will there be a mass exodus, or will they stick around?

More and more fleets are using inward-facing cameras and just this year, JB Hunt, one of the largest fleets on US roads announced a successful pilot and that it will begin using driver-facing cameras across its fleet by rolling them out to about 27,000 trucks over the next two years.

As time goes on, fewer fleets will remain camera-free. As already stated, drivers tend to be more accepting of this type of technology if employers communicate clearly and let them know exactly how they will be used and when they are and are not recording. This large fleet group did exactly that in a video directly from its COO, which was sent to all its drivers.

Some employers start with a pilot program to study how the system will work with their specific fleet and how their drivers may react on a smaller scale. If they record exoneration videos during that time, they can use them in driver meetings or in other contexts to gain buy-in for a larger rollout. We highly suggest doing a pilot, but if that is not possible in your situation, consider using generic exoneration videos provided by the camera vendor.

Continued Success Requires a Collaborative Approach

Behavior change programs come with some predictable ups and downs and require changes over time to continue to show successful outcomes. Any large vendor of camera systems should be able to help an employer—from rollout and communication of the new program all the way to employer training on how to coach and logistical management of the data volume entering the system.

To keep things going, companies should strongly consider positive reinforcement systems for drivers who perform well in the system or who show professionalism in specific circumstances captured by the video system.

A successful camera system program is a long-term commitment requiring resource allocation, upper management, middle management, and driver support.

Contact me or your Woodruff Sawyer account team if you have questions about telematics in general, camera systems, or how they might benefit your insurance program.

Author

Table of Contents