Blog

The D&O Market has Collapsed for US Foreign Filers

Historically, IPO companies based outside of the US and looking to list on US exchange found the London market as a main source of insurance capacity. However, that market has recently collapsed for all of the reasons I will discuss in this article.

A Changing Landscape

There are several factors contributing to this reality for both foreign filer IPOs and mature public companies.

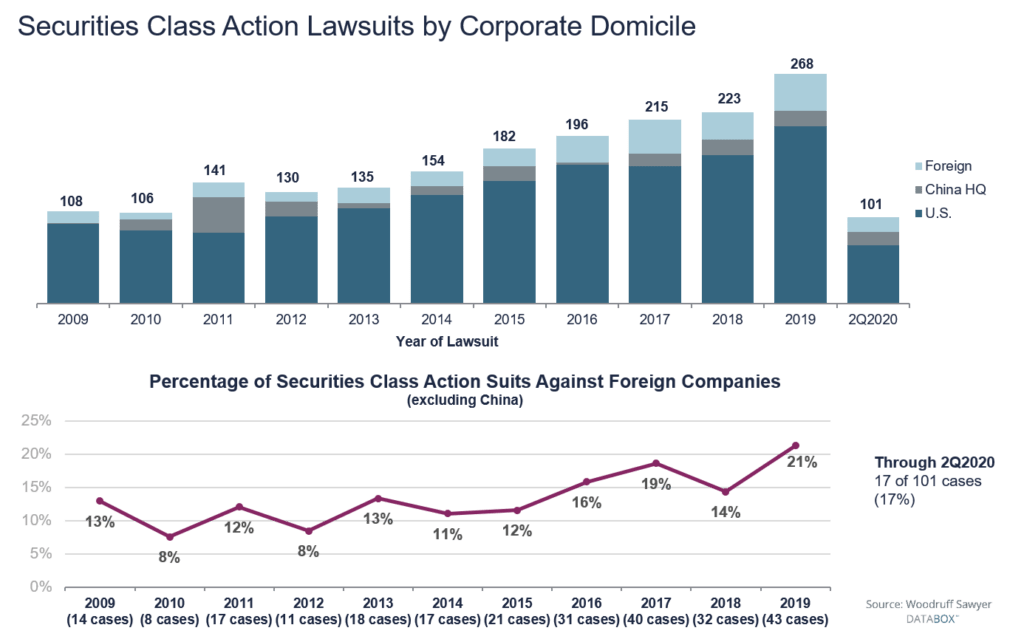

First, insurers continue to face an all-time high frequency of litigation. In 2019, securities class actions filed against issuers of common or preferred stock listed in the US hit an all-time high at 268.

Looking at the breakdown by corporate domicile, just over 20% of foreign filers faced securities litigation in 2019; for all companies the frequency is 5%.

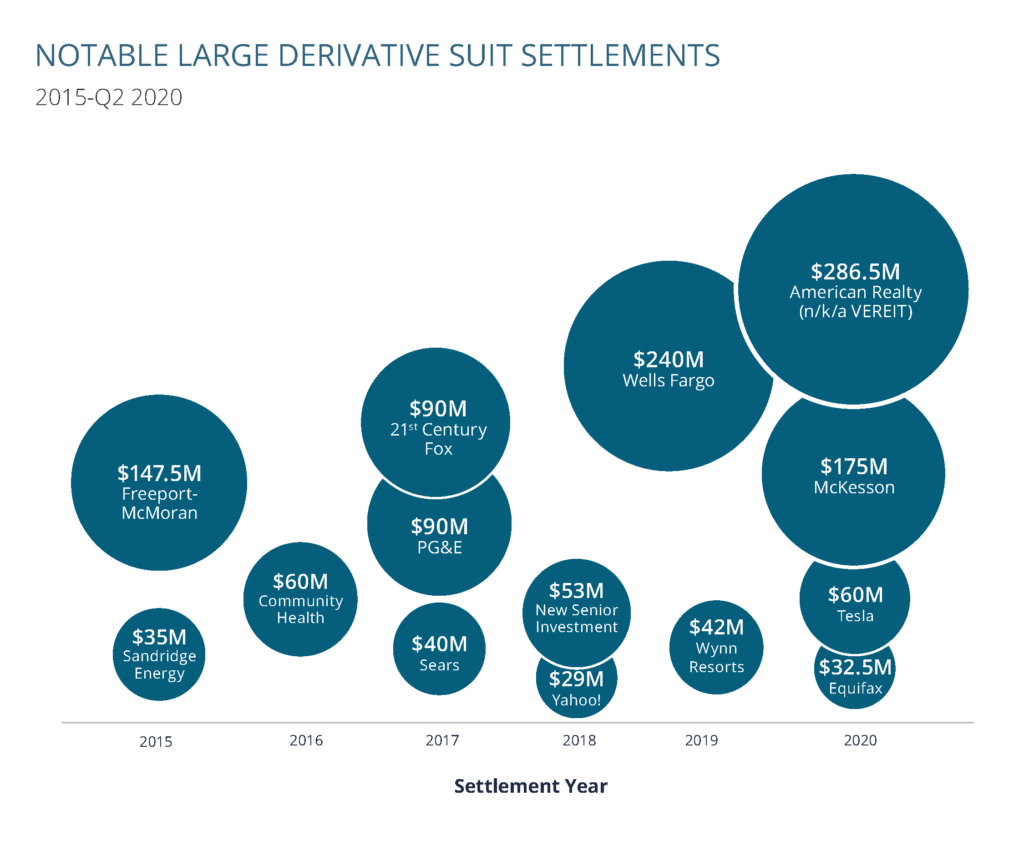

Add to that the fact that claims from past years are settling for very high amounts, causing the insurers to reconcile losses for past underwriting years. In the first half of 2020 alone, 36 securities class action settlements paid out $1.4 billion. Six cases that settled for more than $20 million were in litigation for more than five years.

Then you have the blockbuster derivative settlements, which have decimated A-side pricing models. In 2019, Wells Fargo settled for $240 million in a derivative suit. In 2020, we’ve already seen massive settlements for these types of lawsuits, including one for nearly $287 million involving American Realty.

Adding fuel to the fire is the fact that underwriters are trying to understand the impact of COVID-19, anticipating future litigation and A-side loss from yet-to-come bankruptcies.

Yet another factor contributing to the tough D&O insurance market for foreign filers is that Lloyd’s budgeting cycle is based on gross written premium at the beginning of the year and requires insurers to secure more capacity as they near budget. As premium rates have increased in 2020, renewals and new business takes up a bigger portion of the budget. Insurers have to balance their renewal book requirement for the rest of the year.

Some carriers instead have decided to stop or dramatically reduced the appetite for D&O insurance for US listed companies, thus reducing supply. Several insurers will only provide capacity for US risks at a certain excess point, assuming a program can be built to that level. In more extreme cases, insurers have exited the line of business completely.

How Does This New Market Impact the Renewal Process?

In this constricted D&O insurance market, foreign filers will want to ensure they leave no stone unturned while marketing the insurance renewal. With an understanding of the market, the strategy for internal and external communication takes center stage.

Face time: Virtual meetings with insurers continue to be important to maintain and build relationships.

Differentiation: It is also helpful to differentiate the specifics of your risk profile. Despite this, it still may be the case that there are very limited options.

New relationships: There are some signs that the increasing premium will attract new insurers to the marketplace. Be open to getting to know a new carrier and forming a relationship, they may be competitive and nimble without having to react to legacy claims.

Alternate markets: Unfortunately, US insurers are not able to look at foreign domiciled businesses. There may be flexibility for companies in certain countries such as Cayman Islands and Bermuda. That being said, exploring capacity in alternate markets is recommended.

Preparing for Any Outcome

One of the first things to do is to prepare the board and management for the changes to the D&O insurance marketplace, the costs, and potential reduction in limits. No one likes surprises, so communicating the current trends early is always important.

Strongly consider if this is the year that moving to an A-only insurance program is the right trade off. The unfortunate fact for many companies is that it may be their only option.

If forced into lower limits or an A-only structure either due to capacity limitations or cost, understanding your company’s exposure can be helpful. It’s useful to know what risk you’d be taking on that would have been covered by insurance. Then having a broker who can articulate the company’s exposure so that there is clarity around what is and isn’t covered by the new insurance is key.

Given the cost and limited availability of insurance, executives are understandably looking for alternatives.

Some have taken the position to avoid insurance altogether and rely on an individual for indemnification. This would essentially “replace” (for lack of a better word) the insurance program. There are potential issues with this solution as outlined in an earlier article on the D&O Notebook.

A less controversial, but still novel solution would be to consider a captive now or in the future. If you have a captive already set up, it might be possible to transfer sides B/C risk. Setting up a new captive takes a bit longer, but may become a useful tool in the future. In either scenario, a company would likely still decide to purchase A-only insurance to protect individuals.

Author

Table of Contents