Blog

Fleet Liability: DOT-Regulated, Owned Light, and Non-Owned Fleet Exposures Explained

Employers with light fleets, non-owned fleets, and fleets regulated by the Department of Transportation (DOT) all have commercial auto liability exposure. However, with the increase in large verdicts in recent years, companies may find it increasingly difficult to secure fleet insurance coverage. A good arsenal of strong fleet safety controls can help companies secure insurance coverage and fight large verdicts.

Here are three questions we often hear from our clients regarding fleet liability as well as common controls to mitigate fleet exposure.

Only Trucking Companies Get Hit with Large Verdicts, Right?

It's no secret the trucking industry has been hit with more and more large verdicts for several years—but increasing liability verdict sizes and increased vehicle repair costs are not isolated to trucking. While a large truck certainly can do more damage than a passenger car and there are more laws related to their operation, large verdicts also happen in light fleets.

In 2012, a verdict of $21 million was awarded in Texas; this was an unusually high amount for the time. The case involved a company employee driving a passenger car while taking a business call via a Bluetooth device. This case did not involve a large truck, and the employee on the phone was not breaking any laws. The plaintiff's attorneys attacked the company's policy on cell phone use as being ambiguous, and this drove the plaintiffs’ arguments. The jury considered cell phone use, even via a hands-free device, to be a known risk that the company allowed.

This case illustrates that a lack of controls, or what could be perceived as weak controls around any number of safety elements, can be attacked during court proceedings. It is also harmful to a defendant’s case outcome to have policies that are not followed or enforced, or if it is known the company had or should have had information about the unsafe driving habits of employees but had not acted on that information. In other words, if an employer doesn’t know about an employee’s driving problems, but should, or if it does know and doesn’t act, both can be used against the company after an accident occurs.

|

Knowing whether your fleet is DOT-regulated or not may seem simple, but it can be confusing. Not all DOT-regulated vehicles are tractor-trailers. This group of blogs may help you determine if you have DOT-regulated vehicles in your fleet. Part 1: Watch Your Weight |

Why Do I See So Many Trucking Companies Hit with Large Verdicts in the News?

What we know about large verdicts in DOT-regulated fleets is that the more rules the employer breaks or allows its drivers to break, the higher the verdict can go. The fact that these trucks can, by virtue of mass and momentum, cause so much damage—and that many of the safety practices expected of trucking companies are actual laws—just makes it easier to pursue larger verdicts.

In the case of the now-famous Florida billion-dollar verdict, the drivers of both vehicles were out of compliance with DOT regulations. DOT law violations as part of this verdict include noncompliance with hours of service (hours spent driving or on duty), distracted driving of an unknown type, distracted driving secondary to cell phone use during driving, failure to have a commercial driver's license (CDL), lack of DOT-mandated hiring practices, and inability to read English.

While one verdict a trend does not make, the American Transportation Research Institute (ATRI) stated the following based on 600 case verdicts studied from the years 2006 to 2019:

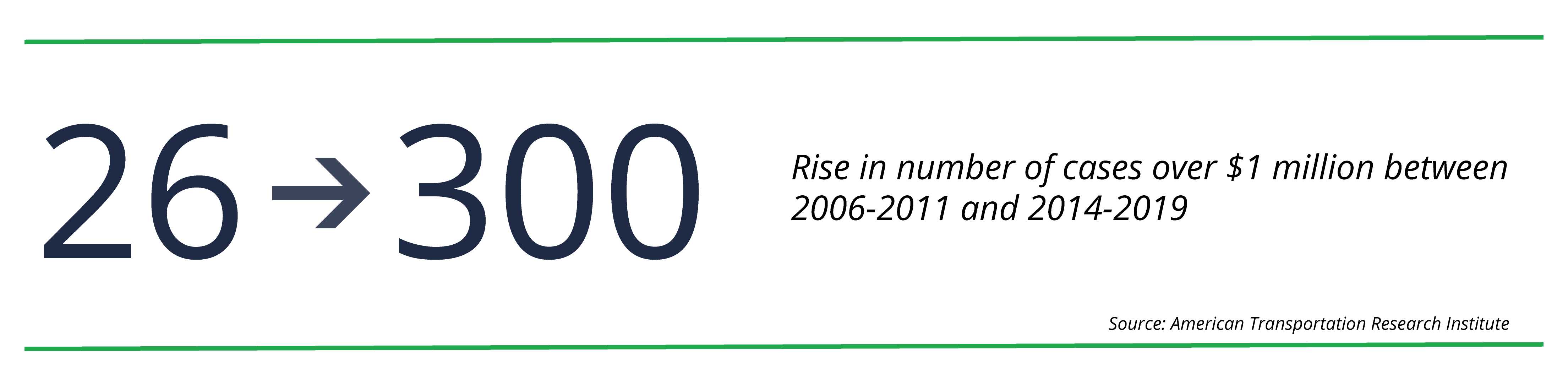

“In the first five years of the data, there were 26 cases over $1 million, and in the last five years of the data, there were nearly 300 cases.”

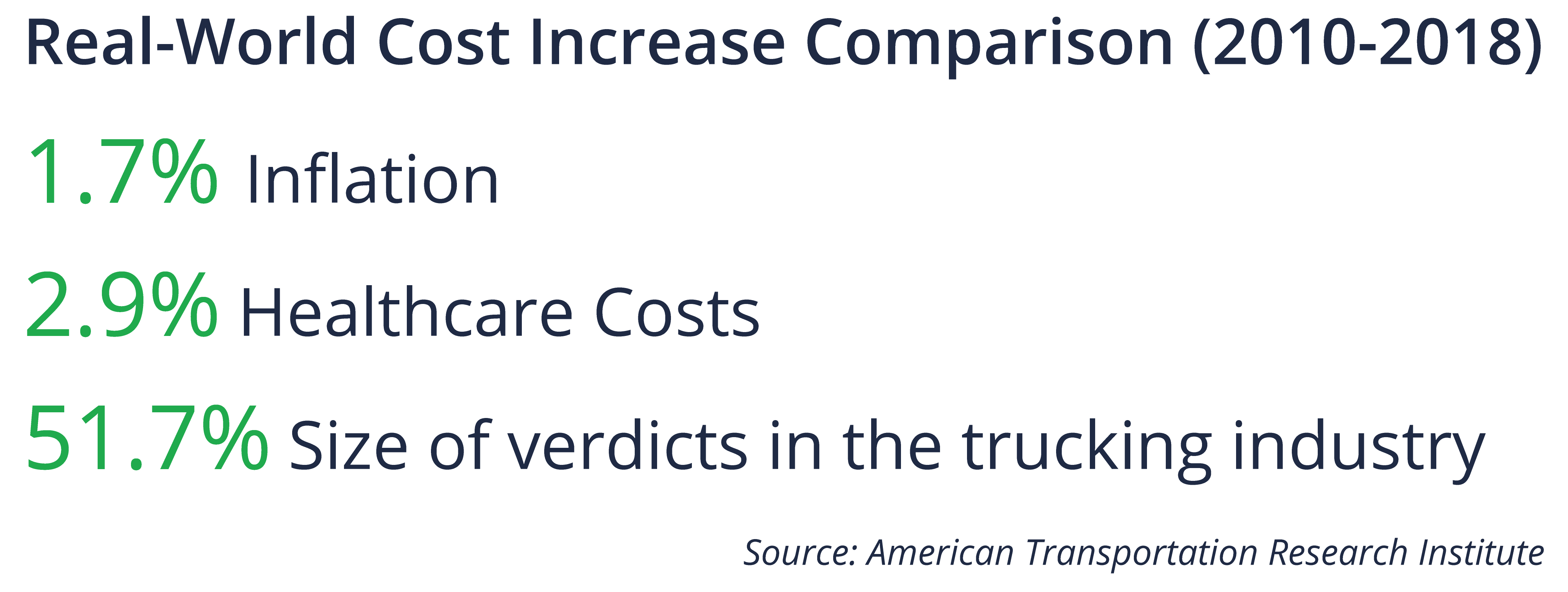

In the same article, ATRI stated: “In response to arguments that nuclear verdicts reflect real-world cost increases, the research documents that from 2010 to 2018, the size of verdict awards grew 51.7% annually at the same time that standard inflation grew 1.7% and healthcare costs grew 2.9%.”

The head of the Woodruff Sawyer Casualty practice along with the head of our data analytics department published an article that describes the volatility and increasing trends in not just verdicts, but the actual ultimate settlement values in these cases. They noted that in the last 10 years, there have been 10 cases that have resolved north of $100 million.

Whether your fleet is light- or heavy, you could easily find yourself fighting a large verdict and trying to publicly defend the safety measures you did or did not have in place—or were or were not enforcing at the time of a fleet accident.

What If We Don’t Own the Vehicle—Doesn’t That Protect Us?

In recent years, many employers have moved toward non-owned fleets and allow their employees to drive their own vehicles or rented vehicles for business. In some cases, these employers also decided to pull back safety policies and processes, thinking they had sufficiently transferred liability risk. While it is true that in certain circumstances, you may be able to use the driver's insurance as primary coverage, this is not as substantial a protection as some may think. Unless you also require a higher-than-legally-required minimum coverage amount and ensure drivers do not have a business use exclusion on their personal policy, that layer of protection may feel rather small—or in the case of an exclusion or lapsed insurance, nonexistent—when a large claim occurs.

Given a $10 million verdict or more, a $50,000 to $100,000 personal policy limit may be of little comfort. In reviewing programs for clients taking this tack, I have noticed a tendency to do away with what might be considered even basic safety measures such as:

- Annual motor vehicle record (MVR) pulls or monitoring

- An objective and enforced minimum MVR pass criteria

- A strong electronic device policy

- Requiring some level of defensive driving training

The absence of such prevention methods can compound a company's risk and even cause carriers to avoid writing its commercial auto insurance. At the end of the day, an employer's expected level of diligence regarding who is driving for business is no different if it owns a vehicle than if it's just compensating the employee for driving their own vehicle.

For employers with light, non-owned vehicle fleets being used for business, the best thing they can do is maintain a safety program as if they owned the vehicles in question.

Common Controls to Mitigate Fleet Exposure

In the current atmosphere, certain controls can apply to all kinds of fleets. Another way of thinking about controls are as defense mechanisms and prevention tools. Controls for a DOT fleet tend to be mandatory and if not followed, can quickly and easily lead to large verdicts, the inability to conduct business due to the possible loss of a DOT number, and government fines. Controls for light fleets, whether owned or non-owned, tend to be expected and linked to liability, but they are largely voluntary. This can create a false sense of security.

The following is a list of some of the controls an insurer, jury, or a carrier loss control person might expect to see in place for light fleets, even if the vehicles are owned by the employees driving them.

Below are some basic light fleet controls to consider:

- Annual MVR checks or, better yet, ongoing monitoring services

- An objective pass-fail criterion against which to compare MVR results

- A clear and enforced electronic device use policy. It pays to put time and research into this policy to ensure you are truly protecting yourself. Remember that the public does not always regard hands-free as risk-free.

- A clear list of rules that must be followed, including items such as seat belt use, following the posted speed limit, not conducting business travel with others in the car unless they are part of the business being conducted, never driving while impaired or fatigued, etc.

- Periodic defensive driving training and reminders

| Telematics have been something used mainly in owned fleets, but that is changing with some types of telematics. For example, there are phone-based programs that can be used in any vehicle. |

Additional Fleet Control Measures to Consider for DOT Regulated Fleets

- Conduct a mock DOT audit. Keep in mind that this type of audit conducted by a third party may result in recommendations you will need to address. You can obtain this type of service from some insurance carriers, consultants working with or for trucking associations, or independent third parties. Depending on the scope, this could be an overarching audit that addresses all regulatory areas, including the ones below.

- Maintain driver qualification (DQ) files. This can be a place to start if you wish to look at compliance on your own. You can use the Federal Motor Carrier Safety Administration's outline of DQ file requirements. This does not cover all regulations, just those associated with mandated driver hiring and recordkeeping. When the DOT does roadside inspections, two frequent violations they find are the lack of a CDL when operating a CDL-regulated vehicle and expired medical cards; both can be identified by reviewing DQ files. Some companies choose to use a third party to monitor these files and alert them when something in the file comes due for replacement or update.

- Keep abreast of driver vehicle inspection report (DVIR) compliance. Ensure drivers are completing DVIRs, employees are keeping records, and managers are addressing and recording defects that affect safety before putting the vehicle on the road. If not, you will need to take quick action to remedy this.

- Stay in compliance with hours of service (HOS) regulations. Hours of service has been a hotly debated regulation and still confuses some organizations. In any large case, the prosecuting attorney will secure a copy of the driver logs. It's vital that you are in compliance or you've identified where you may be exempt. You can look at this on your own, but someone with extensive experience with hours-of-service regulations should be the one doing the check.

Author

Table of Contents