Blog

6 Ways to Reduce Your D&O Insurance Premiums

The big news for some public companies—even mature, stable public companies with nary a whiff of a problem—is that they may not get a decrease in their D&O insurance premiums in 2019.

For some companies, a flat (no price increase) renewal for this cycle will be a win. In some sectors—especially life sciences and technology companies—some are looking at significant year-over-year increases in premiums in 2019. The same is true for foreign filers listed in the United States.

In our 2019 Looking Ahead Guide: D&O Considerations for the Next Calendar Year, we reported that, in 2018, 40% of companies experienced an increase in their renewal pricing at an average rate of 9.7%.

While it's too soon to tell what the average increase in 2019 will be, we have already seen that some companies are facing modest increases while others are looking at double-digit increases.

Why the increases in premiums? Many of the insurers that write the primary layer of D&O insurance have stated that claims and related costs are making it impossible to keep writing D&O insurance policies without raising premiums.

Indeed, we've seen a 20-year high for securities class actions against public companies. We've also reported on the results of things like the Cyan decision, and the prevalence of derivative suits, including tricky cases such as the recent Yahoo derivative suit settlement and the Wells Fargo derivative suit settlement.

The carriers are not being shy or quiet about the need to re-price premiums for D&O insurance. In its Q4 2018 Earnings conference call, AIG—a major underwriter of US D&O insurance spoke at some length about its D&O insurance losses, an unusual move for this enormous, highly diversified company

In a recent report, TransRe, a major re-insurer, makes no bones about the situation:

It should come as no surprise to followers of the US Public D&O liability market that our proprietary analysis reveals pricing inadequacy—the level of compensation in the market is not commensurate with the risk being taken.

Brian Finlay, head of North American Treaty for the TransRe group that handles D&O, said in an article in response to how much correction is needed, "If you correctly account for the prolonged price deterioration and nominal loss cost trend, at minimum 35 to 40 percent across the public D&O portfolio."

As a result of these conditions, major carriers have pulled back and this has resulted in increased premiums and self-insured retentions.

With this in mind, some companies are asking: Are there creative ways to reduce your D&O insurance spend? Yes.

Here are 6 ways to reduce your D&O insurance premiums in 2019, including a few exotic ideas:

- Reduce your total insurance limits.

- Increase (dramatically) your self-insured retention.

- Reduce balance sheet protection while increasing the purchase of standalone Side A

- Only purchase Side A insurance.

- Implement co-insurance.

- Consider some exotic options, such as the use of a captive or an indemnification trust

Let's look at each in closer detail. To do so, it's useful to know the difference between Side A, Side B and Side C insurance in a D&O insurance contract. You will find a refresher here.

1. Reduce Your Total Insurance Limits

If you typically buy $100,000,000 in insurance, for example, but you really only need $80,000,000, you can easily reduce your premium by reducing your limits.

But is such a move prudent or foolish?

Some companies have actually been overbuying insurance for years. There can be various reason for this:

- The company was once much bigger and just got into the habit of buying large limits.

- The company based its purchase decision on peer data or other data analysis done poorly.

- A high-profile board member demanded elevated levels of D&O insurance as a condition to joining the board.

- The board is just risk-averse and feels better having super high limits in the D&O insurance program.

It was easier to justify purchasing high limits when pricing was more favorable to insurance buyers.

In a harder market, a prudent way for a company to consider reducing overall limits would be to take a fresh look at its D&O risk profile. Better data and more informed analysis might lead to a lower limits decision.

A good starting point is to use objective settlement data to run various scenarios and compare these results to the limits being purchased. Using Woodruff Sawyer's proprietary database to model various settlement scenarios is a good place to start this analysis.

Another consideration as a company takes a fresh look at limits of insurance is whether or not its insurance needs have changed over time.

For example, a company that once purchased a lot of balance sheet protection (Sides B and C insurance) because it had little free cash might find itself with less need for this as the company matures.

There are different ways to reduce a company's limit of insurance. For some, the best course might involve chopping off layers at the top of the insurance program. There are other ways to do this as well, some of which I discuss below.

2. Increase (Dramatically) Your Self-Insured Retention

When you increase your D&O insurance program's self-insured retention (similar to a deductible), you are agreeing that when a claim hits you will spend more of your money before the balance sheet protection of your D&O insurance program (Sides B and C) responds.

As a reminder, the self-insured deducible must be eroded before Sides B or C of an insurance program will respond.

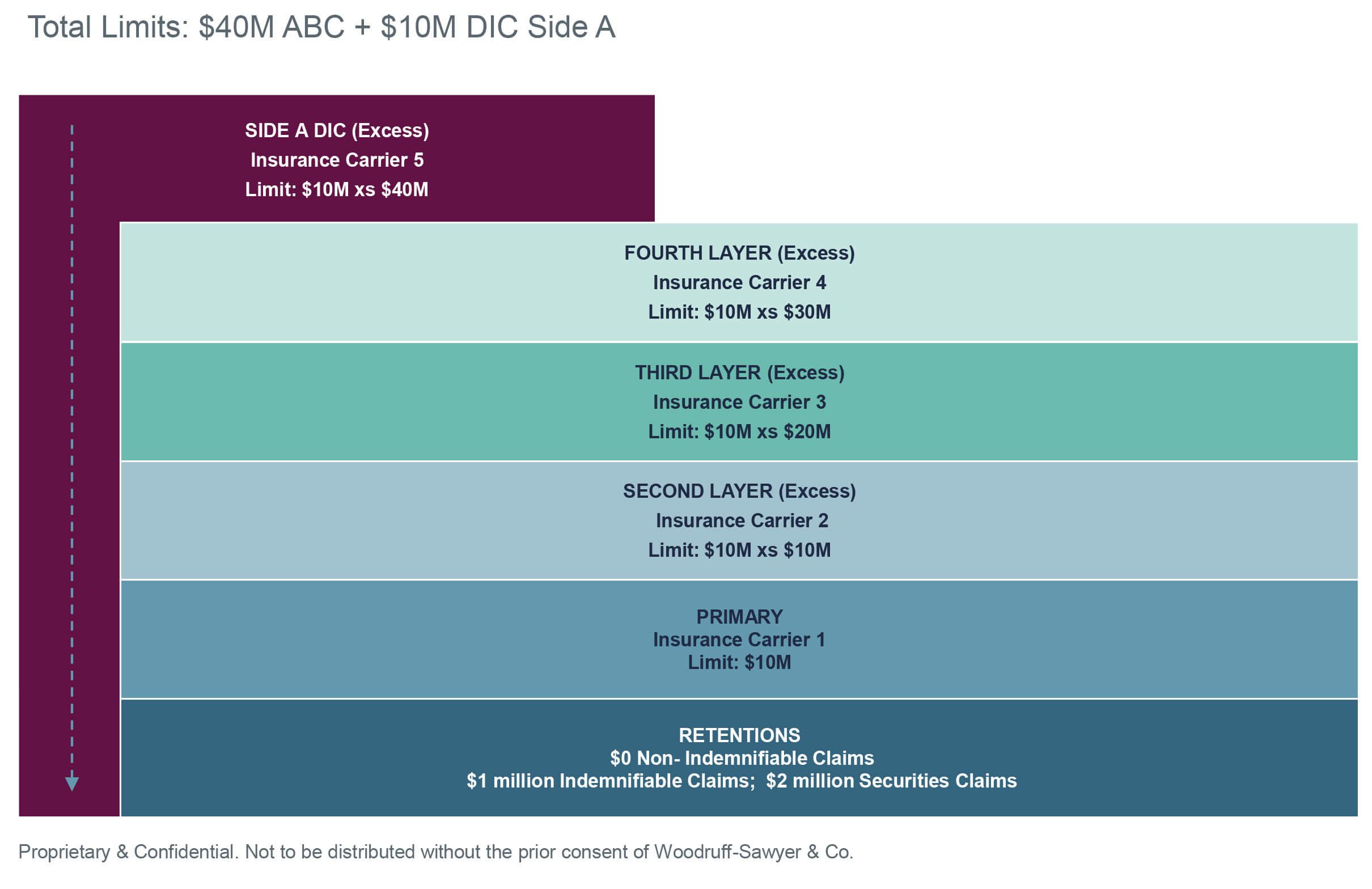

If you picture a D&O insurance policy as a tower comprised of layers, the limits at the top are traditionally less expensive than the layers at the bottom.

This is why increasing the self-insured retention tends to lead to lower pricing for the first layer of insurance. Any carrier would prefer to be further away from spending its first dollar, so a large enough self-insured retention will reduce the pricing of the first layer of insurance that you purchase.

Be apprised, however, that in the current market you may have to take a very significant self-insured retention in order to see a decrease in price.

Indeed, in the current D&O insurance market, some companies are seeing their carriers impose self-insured retentions higher by several million dollars than what they had the previous year in addition to an increase in price.

The downside, of course, is that you are absorbing more of the risk in litigation.

Say, for example, you're a company that feels strongly that the chance of using your D&O insurance is low. You might consider increasing self-insured retentions and viewing your insurance as catastrophic coverage by purchasing a good size limit above a large self-insured retention.

On the other hand, if your company cannot withstand paying very large legal fees for any period of time, a larger self-insured retention would not be prudent.

3. Reduce Balance Sheet Protection While Increasing the Purchase of Standalone Side A

The Side A portion of a D&O insurance policy responds on behalf of directors and officers when the corporation cannot indemnify them (but the matter is still insurable).

In the United States, Side A insurance is most likely to respond to the settlements of breach of fiduciary duty suits brought derivatively, or in corporate bankruptcy.

Sides B and C insurance are more likely to be used than Side A and as result, Side A insurance is usually less expensive. If a company is comfortably solvent, balance sheet protection may be less important.

A company could save money by reducing the amount of Sides B and C insurance it is purchasing, and perhaps adding more standalone Side A insurance.

This is a very common decision made by companies that have a billion dollars or more of free cash on their balance sheet. Companies with less than that tend to want to insure the balance sheet.

However, given the cost of D&O insurance in the current market, companies may want to consider this an option.

Keep in mind, though, that what D&O insurance does is absorb the volatility of litigation expenses. In any given quarter, a company may find that it doesn't have the cash reserves on hand it thought it would when it made the decision to drop the balance sheet protection.

For more, you can check out an earlier article I wrote on how much Side A you should buy.

4. Only Purchase Side A Insurance

Maybe you've done the analysis and determined that you no longer want to purchase balance sheet protection. Now what?

On the other hand, if you are confident in your company's cash position for the foreseeable future, this might be the right choice for you.

Once you've decided to purchase only Side A insurance, the next question is: How much should you buy?

It helps to start with a reminder of where Side A insurance is helpful. Side A is helpful when something is insurable but not indemnifiable, such as bankruptcy claims against directors and officers or the settlement of derivative suits.

While the category of what is insurable but not indemnifiable is broader outside of the United States, it is fairly narrow within the US. As a result, it can feel like you don't need very much, particularly if bankruptcy is not really an issue.

The challenge, however, is with derivative suits. The defense costs for derivative suits are indemnifiable (i.e. not covered by Side A insurance), but Side A covers derivative suit settlements.

So how should you model settlements? Unclear.

Unlike securities class action suits, there is no obvious measurable amount against which the settlement is decided. Yahoo's recent derivative suit settlement for $29 million is a bit of an anomaly when it comes to measurable loss, as I've discussed.

There is also the concern that derivative suit settlements may be getting bigger, as I discussed in a post about the recent Wells Fargo derivative suit settlement.

Historically, companies that only purchase Side A insurance purchased a lot if only because it was so inexpensive. This may be changing, putting more pressure on finding a sensible way to calibrate the limit to be purchased.

5. Implement Co-Insurance

Experienced brokers remember a time when co-insurance was a serious consideration—and the concept is making a comeback.

In the D&O insurance context, the concept of co-insurance is that after the self-insured retention is exhausted, the insured and the insurance carrier will each pay a fixed portion of each of the next dollars for as long as co-insurance applies.

There are two types of co-insurance: limit-reducing and loss-reducing. Limit reducing co-insurance is favorable to the carriers because it means they are putting up less limit.

For example, a 20% co-insurance on a limit-reducing basis means that after the self-insured retention is exhausted, the insured pays 20% and the carrier pays 80% of each next dollar until the total specified limit has been reached.

If the limit were $5 million that means the carrier would end up paying at most $4 million or 80% of the specified $5 million limit.

By contrast, if your insurance contract specifies 20% co-insurance on a loss-reducing basis, the insured has the same obligation to pay 20 cents for the carrier's every 80 cents. But the carrier's maximum obligation is the $5 million limit specified by the contract.

Of course, carriers would prefer limit-reducing co-insurance, while insureds would prefer loss-reducing co-insurance. In some cases, carriers may not be willing to provide loss-reducing co-insurance if they are trying to reduce their total exposure to a company's risk. This will end up being ''a price/willingness negotiation between two arms-length parties.

It might be less obvious why a carrier would bother with loss-reducing co-insurance until you remember the time value of money: A carrier will end up paying its limit more slowly in the loss-reducing scenario than if there were no co-insurance.

The other reason carriers like co-insurance—be it loss-reducing or limit-reducing—is that carriers believe that co-insurance helps align the incentives of an insured and the carrier when it comes to paying for settlements. The thought is that an insured might be less quick to demand that the carrier pay an overly large settlement if the insured has to pay part of each dollar of that settlement.

6. Get Exotic

There are a number of exotic ideas that get re-examined during hard markets.

One such idea is using a captive insurance company for your D&O insurance risk. In a captive, a company can self-fund its insurance program.

The benefit of doing this is similar to the reasons some companies choose to use a captive in other situations: It's a way to afford broad coverage terms with year to year cost stability. Note that many captive benefits are also similar to simply choosing to retain a significant portion of your risk––the captive is simply the tool through which the risk is funded.

One downside to using a captive is the need to fund it properly. As a reminder, D&O losses can be quite severe, especially in the current litigation environment. As a result, funding a captive properly means signing up to pull significant amounts of cash out of the company and into the captive—cash that in some cases might be better used elsewhere.

The use of captives for D&O insurance is unusual. The reason is that captives are more traditionally used for low-severity, high-frequency types of risk; for example, workers' compensation. D&O insurance programs, on the other hand, tend to be responsive to low-frequency, high-severity situations.

Again, given the current market, using a captive for your D&O insurance could be something you speak about with your expert insurance broker. For a captive to make sense, though, you need to have it running for several years. In other words, if you think that D&O insurance prices will go down, a captive would not makes sense.

Finally, it's not entirely clear what will happen to a particular captive in the case of corporate bankruptcy. The nightmare scenario is that a corporation goes bankrupt and the bankruptcy trustee attempts to seize the assets of the captive, including the assets that were supposed to backstop the directors and officers in the case of bankruptcy.

This issue has to be addressed carefully and in some cases, the right move might be to continue to purchase Side A insurance while using the captive to replace the balance sheet protection provided by Sides B and Side C of a traditional insurance policy.

Another idea in the exotic category is the use of an indemnification trust.

The idea of an indemnification trust is that a company would put up a significant amount of capital into a trust instrument. The pool of money would be available for the directors and officers should they need it.

This approach clearly would work for balance sheet protection (Sides B and C). Moreover, if the trust truly is separate from the company, it should theoretically be able to respond to pay the cash settlements of derivative suits.

The concern, however, is that indemnification trusts may not work for the Side A exposure of a bankruptcy. The worry is that in bankruptcy a trustee could seize the principle of the trust for the benefit of the creditors, leaving directors and officers exposed.

(Read more about protecting directors and officers in a bankruptcy with D&O insurance.)

In insurance circles, people speak freely about Microsoft, headquartered in Washington state, and its use of an indemnification trust.

As a reminder, indemnification trusts tend to be creatures of state law, and it has been argued that Washington State contemplates that indemnification trusts like those used by Microsoft are bankruptcy remote, which is to say the money in the trust would not be seized as an asset of the bankrupt corporation.

The concern is that bankruptcy is federal law. It's not clear that an indemnification trust in the end would be bankruptcy remote. Given Microsoft's cash position, it would be understandable if their independent directors decided to roll the dice on this question.

Other companies might take a more conservative route of using an indemnification trust in combination with a Side A policy, perhaps written so that it would only respond in bankruptcy.

Putting the risk of settling a large cash derivative suit settlement on an indemnification trust—and explicitly pulling it out of a Side A insurance policy—would normally have the impact of reducing the cost of the bankruptcy-only Side A insurance policy for a highly solvent company.

The ideas in this list range from sensible to more obscure, though they're worth pondering as creative solutions that might save some money in a hardened insurance market in 2019.

Whiteboard Breakdown: Standalone Side A, Difference in Conditions Policies

Author

Table of Contents