Blog

SPAC Litigation by the Numbers: Surprisingly Positive Trends in 2022

Tumultuous, exasperating, difficult, nerve-wracking, and frustrating are all apt descriptions of the 2022 SPAC market and the hard data yields some surprising trends and conclusions.

Tumultuous, exasperating, difficult, nerve-wracking, and frustrating are all apt descriptions of the 2022 SPAC market. We’ve summarized some of its ups and downs in our year in review blog post from October and have touched on them again in our December podcast with Doug Ellenoff.

In this blog post, we’ll examine the hard data, which, in some cases, is yielding surprising and—dare we say it—positive trends and conclusions.

SPAC Lawsuits by the Numbers

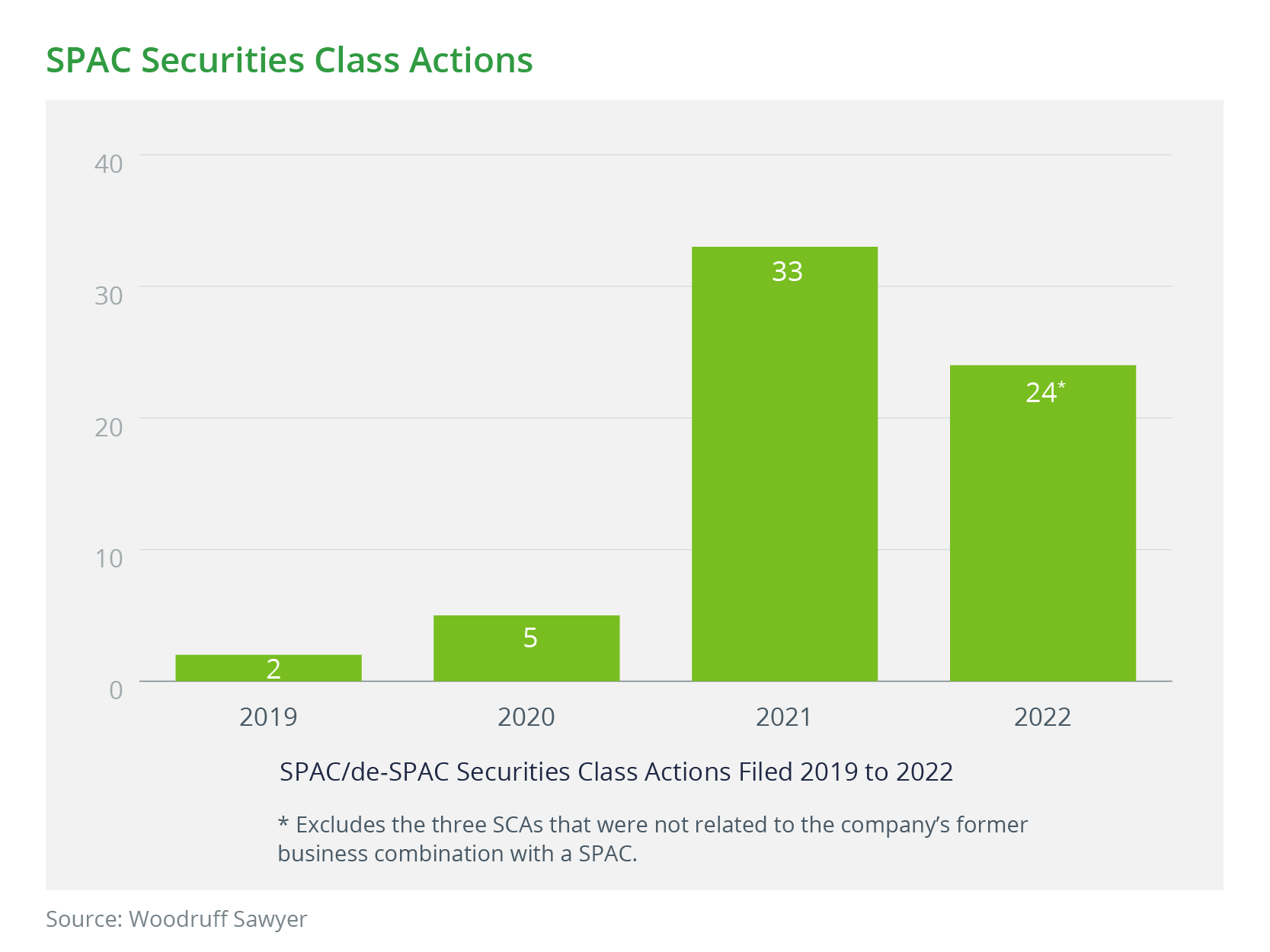

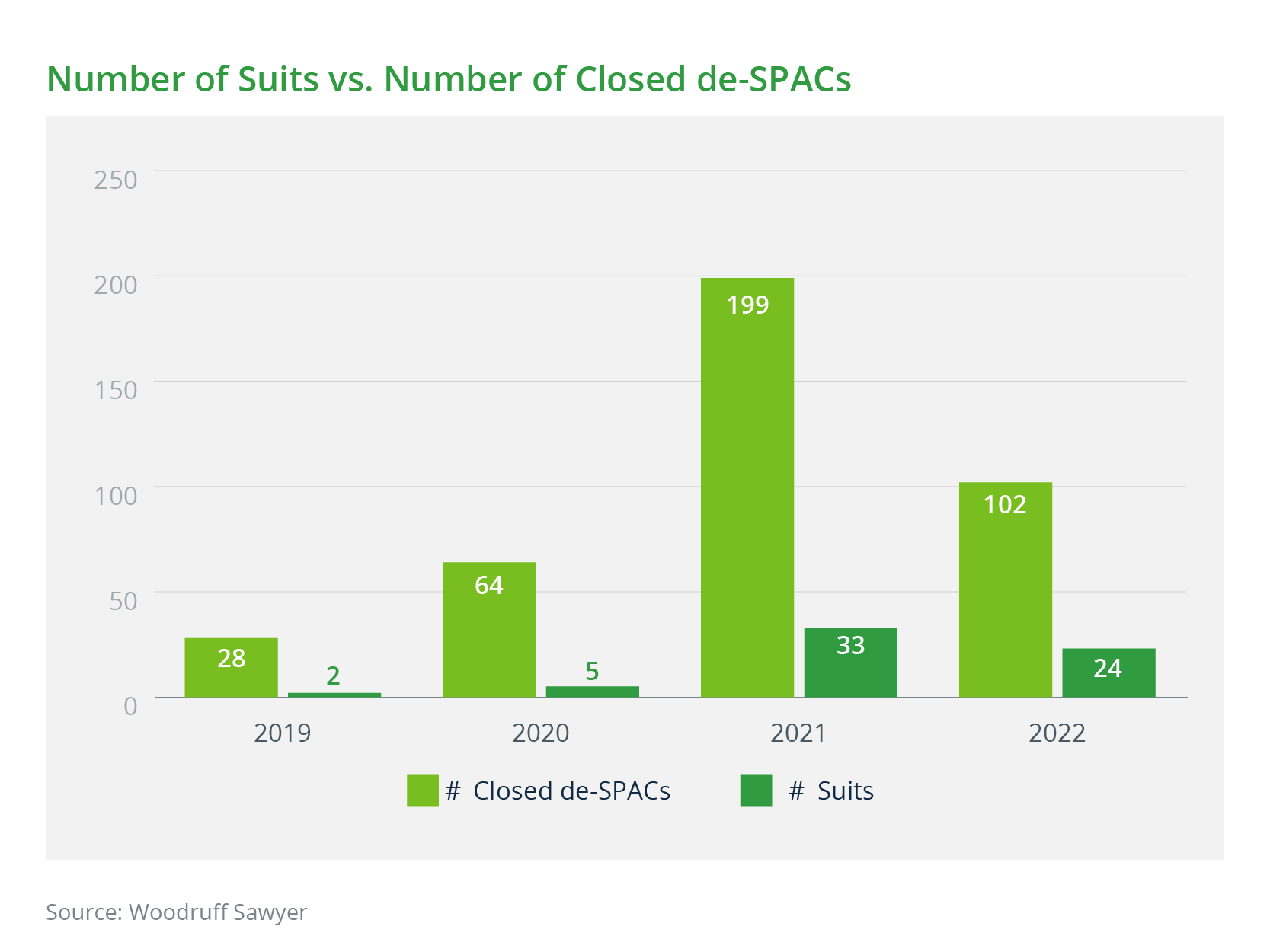

In 2021, there were 199 closed transactions, a number that is almost double the 102 de-SPACs that closed in 2022. In 2021, we observed 33 securities class actions (SCAs), which were filed following 2020, a year with only 64 closed de-SPACs. Based on the average time after the merger (nine months) or the SPAC IPO (22 months) that it takes for an SCA to materialize, we were expecting a much higher number of SCAs in 2022. But, in fact, only 24 SCAs were filed in 2022—a 27% decline from 2021 numbers.

Reasons for Decline in SCAs

What could be causing the decline in the number of SPAC securities class action lawsuits? First is the increased sophistication of SPAC market participants, including SPAC teams and their advisors, over the last two years. This sophistication grew out of both new, more experienced teams and advisors entering the market and out of the increased experience of all those teams and advisors as the SPAC rush of 2020 and 2021 progressed. Many ended up handling more SPAC transactions, both on the IPO and the de-SPAC side, than they ever had before, and, naturally, they learned from previous missteps. This is the so-called self-correction that we referred to in our previous posts and podcasts.

The second reason for decreased litigation volume is the overall decline of the financial market in 2022. Many companies, including those that went public via a traditional IPO and a SPAC, have been experiencing disappointing performance. When the entire market is hurting, it is difficult for a plaintiff’s attorney to claim that one particular team or merger did particularly badly.

The third reason could be the proposed SEC rules, which came out in March 2022. Even though these rules are still not finalized, many adopted them as a playbook and quickly adjusted their disclosure and transactions to comply.

SPAC Litigation Compared to SPAC Activity

Taking a look at the number of SCAs and the number of de-SPACs in each year leads to the interesting graph below. Although some SPACs and their targets were sued prior to the completion of the merger, the majority of SPAC-related SCAs occur post-merger. It typically takes a few months—nine months on average—after the merger occurs for a lawsuit to be brought. Understanding the lag between a SPAC merger and the lawsuit, it is interesting to see the decline not only in the absolute number of SCAs from 2021 to 2022 but in the number of SCAs relative to the number of completed mergers in each of those years.

Funky Suits

Of course, the SPAC SCA is not the only type of lawsuit that exists. We saw quite a few new types of lawsuits against SPACs in 2021 and a few more novel fact patterns that resulted in disputes in 2022. For example, we saw a few skirmishes around a merger termination fee when the SPAC team decided to keep the fee without sharing it with its investors (e.g., FAST Acquisition Corp., Concord Acquisition, and Pioneer Merger Corp.)

Other types of unusual suits that we had not seen many of in the past include:

- A suit by an executive of Digital World Acquisition Corp., a SPAC tied to Donald Trump, alleging fraud at the SPAC and asserting that the executive was frozen out of the deal.

- A suit against a parent of Quantum Fintech Acquisition’s target for sabotaging the target’s deal with the SPAC.

There have also been a few derivative (and some direct) actions filed against the directors and officers of a SPAC for breaches of fiduciary duties in proceeding with a merger that later turned out to be unsuccessful. The usual themes for a derivative suit, which is typically filed in tandem with an SCA, include rushing into a transaction, failing to conduct proper due diligence, entering into a deal outside of the SPAC’s targeted industry, and the SPAC omitting information relating to potential dilutive effects of the merger.

Likelihood of Getting Sued

One of the questions we often get from clients is focused on the likelihood of their team or venture getting sued. The answer to this question is meant to assist the teams in deciding on the amount or type of the directors and officers (D&O) insurance they will ultimately purchase. The answer is not simple, but some recent data we collected may be instructive.

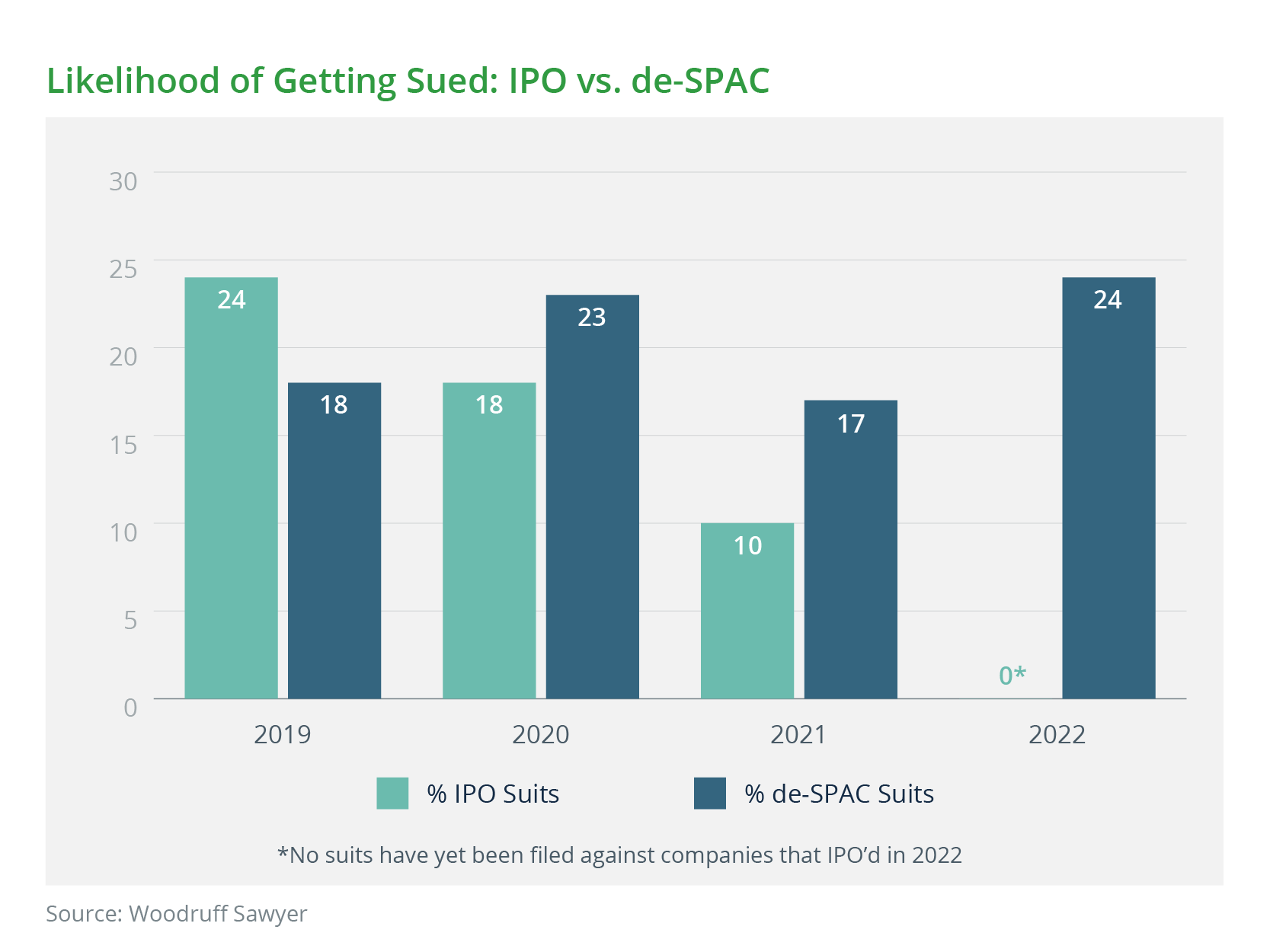

Companies that go public via a traditional IPO are more likely to get sued than mature public companies, and companies merging with a SPAC are more likely to get sued than those going public via a traditional IPO.

As a rough estimate, one can expect about 3% of companies that had been public for 10 years to become subject to an SCA. That number is significantly higher for newly-IPO'd and de-SPACed companies. The reason is simple—new public companies are more likely to stumble out of the gate.

An interesting risk question is whether there is a difference in likelihood of a lawsuit for companies going public via a traditional IPO and those choosing the SPAC route. The answer is yes, and the graph below illustrates that difference.

Although there is indeed an increased risk of a lawsuit for companies going public via a SPAC rather than a traditional IPO, that differential in risk is not enormous.

Settlements

Now let us turn from lawsuits to settlements. There have been very few publicly disclosed settlements, and some of them did not stem from an SCA, so it is very difficult to draw conclusions about trends. The ones that made the news include:

- Akazoo: SCA settlement totaling $38.8 million in October 2021. This action involved bad diligence and fraud.

- Triterras: SCA settlement of $9 million in April 2022. The action was filed after a short seller report raised issues with disclosures about a related party.

- Multiplan: A direct-action breach of fiduciary duty claim that settled for $33.75 million in November 2022. After a short seller report raised issues with the company’s largest customer, the suit was filed in Delaware. The judge denied the motion to dismiss, and the parties settled.

- TradeZero: Private action settlement of $5 million in December 2022. A SPAC (Dune Acquisition) entered into a merger agreement with TradeZero. The merger fell apart and Dune sued TradeZero.

It is worth remembering that outside of the actual settlement amounts, some of which in the above cases were covered by a D&O insurance policy, the defendants had to also pay substantial attorney fees. When deciding on the limit of a D&O policy, it is worth factoring in the potential costs of the attorney fees, which will be due whether or not the lawsuit ends up being frivolous or ultimately gets dismissed.

Regulatory Enforcement Actions

The other piece of the risk puzzle is, of course, the risk of regulatory enforcement actions and investigations. With the SEC taking an openly hostile stance towards SPACs in 2022, many of us expected to see a barrage of SPAC-related investigations and enforcement actions. That expectation has not yet been realized. While there have been a few investigations reported, there have been fewer than a handful of enforcements. Here are some examples that made the headlines:

- Momentus: Settlement total of $8.04 million in July 2021. The SEC alleged that Momentus and the founder mislead Stable Road, the SPAC with which it planned to merge, about its technology and national security issues and that Stable Road had failed to perform its due diligence to identify those issues.

- Nikola: Settlement total of $125 million in December 2021. The enforcement was preceded by a short seller report and an SCA and centered around misleading statements about Nikola’s products, technical advancements, and commercial prospects.

- Perceptive Advisors: Settlement of $1.5 million in September 2022. This was SEC’s first enforcement action against an investment adviser. The SEC charged the adviser with violating the Investment Advisers Act in connection with its involvement with SPACs.

- Gordon: Administrative charges settled against CEO in 2019 for $100,000. The SEC charged Benjamin Gordon, the former CEO of Cambridge Capital Acquisition Corporation, a SPAC, with failing to conduct appropriate due diligence to ensure that the SPAC’s shareholders voting on the merger were provided with accurate information concerning the target’s business prospects.

An interesting way to think about these settlements and enforcement actions is through the lens of the enterprise value of the SPAC business combinations that were completed in the last few years. The total expenditures on private settlements and government enforcement actions run in the millions of dollars and constitute a tiny fraction (likely no more than 0.05%) of the billions of dollars in enterprise value of closed de-SPACs.

Now, it is true that the SEC typically takes several months—if not longer —to bring and conclude an enforcement action. Considering that the SPAC market went into overdrive in late 2020 and two years have already passed since then, it is interesting that the SEC’s enforcement division has not been able to locate more examples of situations worth pursuing. Could it be that aside from the less than a handful of egregious cases that have been flagged thus far, the rest of the SPAC market teams and deals are operating within regulatorily acceptable parameters?

Update on the D&O Insurance Market

All of the above data is interesting not only in an academic sense. It has real implications on the risk and risk mitigation decisions that SPAC sponsors, their target companies, investors, and deal teams make. Those decisions inevitably involve decisions on the size and structure of each outfit’s and team’s D&O insurance. Higher risk yields lower availability of coverage and higher premiums. But aside from the risk itself, the availability and premiums are also dictated by the state of the overall insurance market.

After many months of an almost impossibly hard SPAC D&O market, substantially diminished deal volume both in the SPAC world and the traditional IPO world has caused many carriers to reconsider their stance. In the last few months, we have witnessed a palpable easing of terms and even of pricing. Of course, carriers are keeping a close eye on each new case and enforcement action. However, if litigation and enforcement trends continue to hold at the current level or decline further, we are likely to enjoy a period of reasonable D&O insurance pricing for SPACs in 2023.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents