Blog

SPAC Notebook: A Year in Review

It’s been a year since we launched the SPAC Notebook, our monthly column and podcast series, which helps our readers negotiate the risks and traps of the special purpose acquisition company (SPAC) market.

Below, we look at the ups and downs of the past year and offer our thoughts on where SPACs are headed.

Q4 2021: More IPOs, More Lawsuits

In October 2021, we saw an increase in the types of lawsuits being brought against SPACs. Securities class actions and derivative suits joined the standard merger objection suits in the litigation roster. A month before, we witnessed a rarely seen collective outcry from the legal community against suits alleging non-compliance with the Investment Company Act.

All this activity came on the heels of an intense volume of new SPAC filings and IPOs, which legal, financial, and accounting advisors were having a hard time managing.

From the insurance side, the D&O market for SPACs became difficult, with premium prices jumping higher and higher and D&O underwriters unwilling to negotiate terms or offer coverage.

To keep up with demand, some non-US exchanges changed their rules to attract SPAC activity, and many SPAC teams started to explore possible listings and targets outside the US.

In November 2021, even though IPO activity rebounded after a slow summer, redemptions soared. Many SPAC teams had to adjust their structures and plans before publicly filing their S-1s and proceeding to IPO. These adjustments helped loosen up the market but created some concerns for D&O insurance underwriters.

Optimistic SPAC teams started shortening their investment periods from 24 months to 18 months, or even shorter. Now, looking back on those decisions nearly a year later, in a difficult market where many SPACs failed to zero in on a viable target, that particular choice might not have been the best.

In December 2021, we were again taking a close look at SPAC litigation activity as well as SEC enforcement actions and investigations. Many claims centered around misrepresentations, disclosure failures, and inadequate due diligence. In addition to the increased numbers and types of SPAC lawsuits, hefty settlements (e.g., a $35 million partial settlement in Akazoo) and regulatory fines (e.g., an $8 million fine in Stable Road/Momentus) dampened the holiday season for several SPAC teams.

Q1 2022: D&O Insurance Costs Stay High

January of 2022 came around, and we were all suffering physical and mental fatigue from the crazy pace of deals in 2021. The cost of D&O insurance for SPAC IPOs continued to stay at elevated levels, and many SPAC teams were trying to find ways around the souring market by pushing for shorter policy terms, trying to offload some of the upfront costs into their tail policies, and opting for less coverage. Looking over the litigation activity in 2021, we made some predictions on the number and types of cases and enforcement actions we were likely to face in 2022. Now, almost at the end of 2022, I am glad to say that our fears of a significant increase in litigation activity have not been realized. That might be due to two factors.

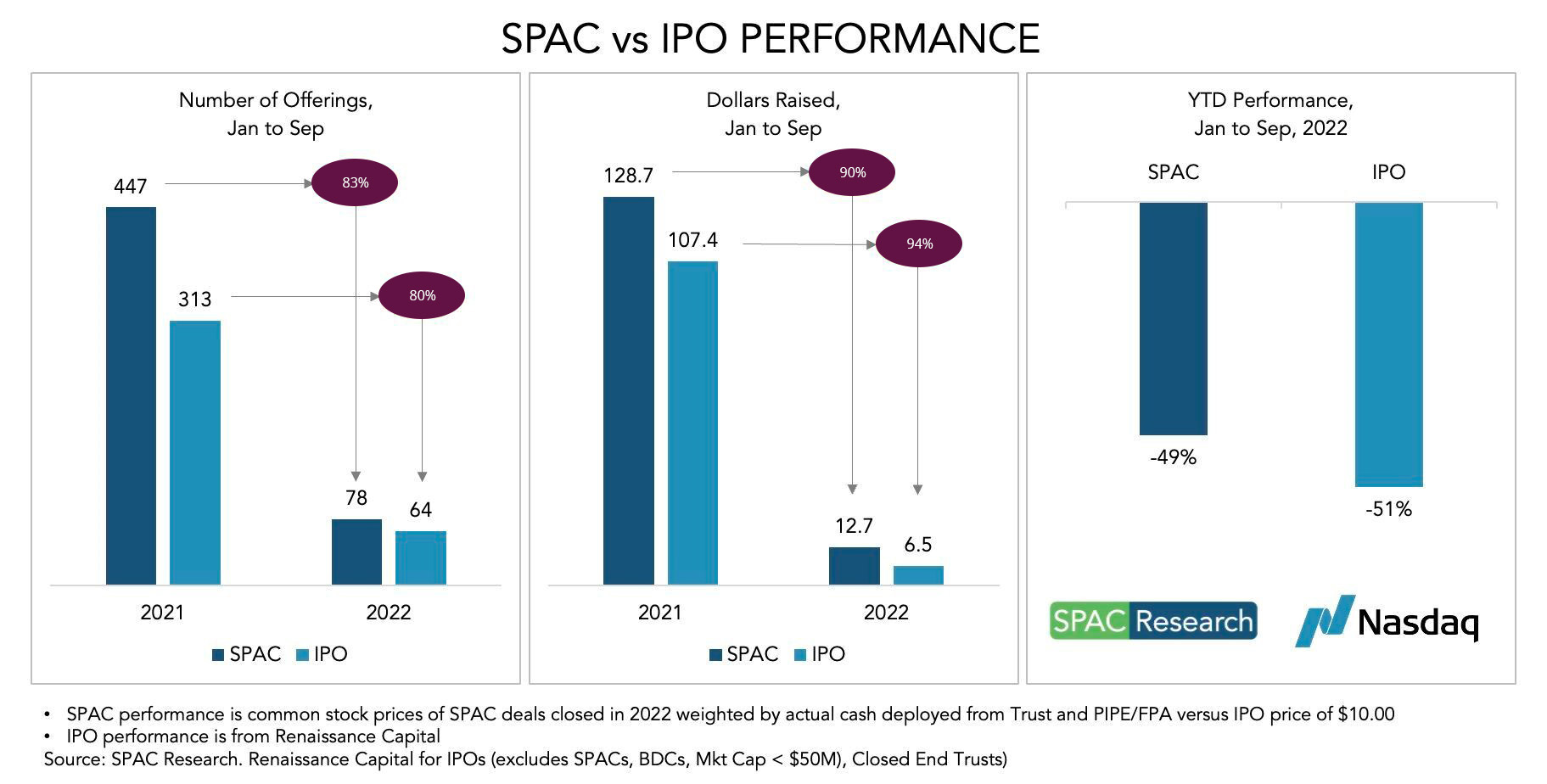

First, the entire market, not just the SPAC market, performed particularly poorly in 2022. According to SPAC Research, SPAC performance was down 49% through September of 2022. But if you look at traditional IPOs, they performed even worse: down 51%. It is much harder to bring a claim based on bad performance against a specific company if the entire market is wallowing in losses.

The second factor in the reduced number of lawsuits in 2022 as compared to 2021 was the weeding out of unsophisticated teams and behavior in the SPAC market. By the time the SEC issued its proposed rules in April 2022, most SPACs were already putting forth all necessary disclosures and had the right advisors and mechanisms in place to avoid egregious missteps.

| The lawsuits we saw in 2021 that were based on outrageous fact patterns were just not there in 2022, as more experienced SPAC teams and their advisors had curbed irresponsible behavior. |

The MultiPlan case was the talk of the town in February 2022 when I had the honor of sitting down for a podcast with Doug Ellenoff, the founder of Ellenoff Grossman & Schole and a SPAC veteran. Doug touched on many issues and questions swirling in the SPAC market and predicted difficult days ahead. He was correct, of course. The MultiPlan case continued to make waves in the market, and many started wondering how it would affect the availability and pricing of D&O insurance.

We tackled that question with my colleague, Priya Huskins, in our March 2022 post. In March 2022, I also came upon another example of a SPAC lawsuit that could have had markedly different results had the parties thought of taking advantage of the benefits of a reps and warranties insurance (RWI) policy. This is a mechanism of risk mitigation that has been woefully underused in the SPAC market despite it being table stakes in over 90% of all private M&A deals.

Q2 2022: The Market Slows After the SEC Releases Its Proposed Rules

In April 2022, the SEC finally came out with its list of proposed SPAC rules. I spoke with Mike Blankenship, managing partner of Winston & Strawn’s Houston office, who specializes in SPAC transactions, to discuss the proposed rules and SPAC market pressures. We agreed that the SEC’s main goal seemed to be to bring SPAC deals in line with the rules and parameters that exist for traditional IPOs. Some of the rules, mostly around disclosure, made a lot of sense, but some (e.g., the Investment Company safe harbor) looked like they hacked together a last-minute solution that was likely to cause more problems than it was trying to solve.

Mike and I also agreed that the market reaction to these rules was not going to be positive and that they were going to cause an even further slowdown in market activity. We ended up being correct in our assessment. In some ways resembling the images of zombies I see sprawled around my neighborhood ahead of Halloween, the SPAC teams are in the midst of a painful, slow crawl toward an indefinite future. With just an occasional odd deal making it through the IPO, and many proposed deals dying on the vine, the mood now, in October 2022, is as somber as could be.

There was no improvement going into May of 2022, when we witnessed a continued decline in SPAC activity. The macroeconomic and political situation around the world, the increasing inflation and interest rates, and the non-existent PIPE (private investment in public equity) market did not improve matters. The trends we noted were that the number of securities class actions was holding steady, the number of suits stemming from short seller reports had decreased, and the SPAC team was being named in two-thirds of all SPAC lawsuits.

In June 2022, the who’s who in the SPAC world gathered for the annual SPAC conference in Westchester, New York. Uncertainty was the underlying theme, as the following topics dominated individual and panel discussions:

- Proposed SEC rules outrage and disappoint

- More disclosure is generally okay

- SEC is overreaching on liability and making investors pay

- SEC is passing judgment on SPACs

Many participants thought the current narrative around SPACs was resulting in the public fixating on the negative performance of SPACs and not considering the entirety of the financial market. Many pointed out that SPACs happened to hit their peak at the end of a years-long bull market but were getting unfairly singled out when the entire market collapsed.

Some speakers stressed that the SPAC vehicle—faulty or not—was extremely successful in getting hundreds of these kinds of companies into the public market in the last two years.

Q3 2022: Liquidations and Extensions Require a Focus on D&O Insurance

In July 2022, I sat down with three SPAC experts Sarah Mitchell, a partner in the Dallas office of Vinson & Elkins in the mergers and acquisitions and capital markets group; Rebecca Fike, a partner in the Dallas office of Vinson & Elkins, who rejoined the firm earlier this year after spending 10 years at the SEC in the enforcement division; and Kristi Marvin, a founder of SPAC Insider, a data and analysis firm to get their thoughts on how to avoid sour SPAC deals. We discussed what to do to prepare for the looming mass of liquidations, and we agreed on the importance of due diligence and that SPAC teams need to talk to their advisors early to avoid unnecessary costs and risks.

SPAC liquidations and extensions were top of mind in August and September 2022. Both scenarios call for careful D&O insurance planning and negotiation, so I offered some thoughts on those two topics to teams who are considering extending or liquidating soon. I realized that while carefully analyzing the financial side of the equation for an extension or a liquidation, SPAC teams often forget to focus on the SPAC’s and SPAC team’s insurance coverage.

Thinking about the correct way to approach tail coverage is incredibly important for the dozens of SPACs looking to liquidate by the end of the year, when the new 1% excise tax may materialize into an additional out-of-pocket expense for SPAC teams.

What’s on the Horizon for SPACs?

Now that 2022 is almost at its close, we’re looking ahead to what the future may hold for the embattled SPAC market.

| Bitter economic conditions, political unrest, repeat regulatory hits, the uncertainty of the proposed SEC rules, loudly touted examples of a few bad apples, and continued media negativity have left the SPAC market tattered and bruised. |

Looking at the numbers, as of the end of October 2022, according to SPAC Insider, we are at just over 80 SPAC IPOs for the year. That’s a far cry from 613 SPAC IPOs in 2021. However, while new IPOs have slowed to a trickle, in September and October of 2022, we saw an uptick in announced and completed SPAC mergers (deSPACs).

The wave of liquidations (33 so far in 2022 according to SPAC Research) should work itself out before year-end, and that will leave fewer teams competing for deals. This, however, will not be enough to move the needle on the economic situation in the US and around the world. While we will continue to solve new problems that just keep on coming this year, it may take months before we see a recovery.

I, as usual, remain optimistic that the SPAC market will find a solid footing as a strong alternative to a traditional IPO. All my colleagues and friends in the SPAC market seem to be of the same opinion and all of them—lawyers, bankers, auditors, and other advisors—keep seeing the demand for the SPAC vehicle as a capital markets tool.

I am confident SPAC market participants will find new strategies to push ahead with their transactions and will establish a workable rule book for a successful SPAC deal. And we, here at the SPAC Notebook, will continue to monitor and report on their progress and to solve new risk conundrums along the way.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents