Report

Mid-Year Update on Securities Class Actions [Report]

Woodruff Sawyer’s Mid-Year D&O Databox Report looks at the state of securities class actions against public companies for the first half of the year.

Woodruff Sawyer’s Mid-Year D&O Databox Report, just published, looks at the state of securities class actions against public companies for the first half of the year.

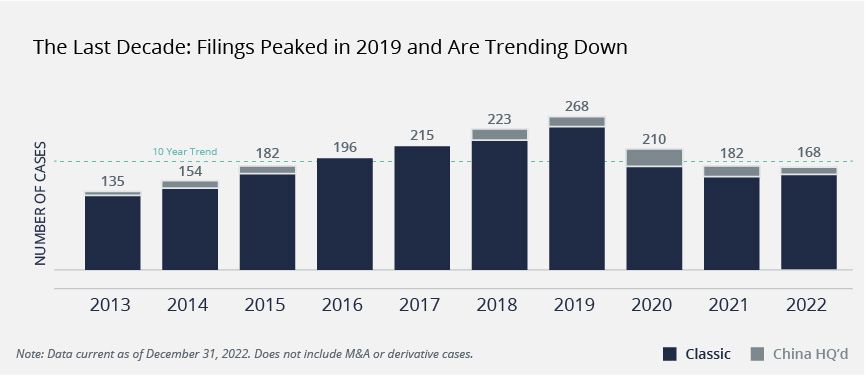

The last time we analyzed the data, it was year-end 2022, and securities class action filings were down significantly. Indeed, they were at the lowest point since 2015, totaling 168 filings in 2022.

Six months later, it looks as though the streak of fewer class action filings may come to an end in 2023.

In the first half of 2023, filing activity has been steady and slightly ahead when compared to the first half of 2022 (up 7%).

If everything continues as we’d expect for the remainder of 2023, it’s likely that filings will be as much as 13% higher as compared to 2022.

With that, we forecast that by the close of 2023, there will be 190 cases filed; this is closer to the 10-year average we’ve noted from 2013 to 2019 of 193 cases filed per year.

What's Different in 2023?

In the first half of 2023, the composition of companies being sued has changed compared to the prior year, while settlement activity and dollars remain high.

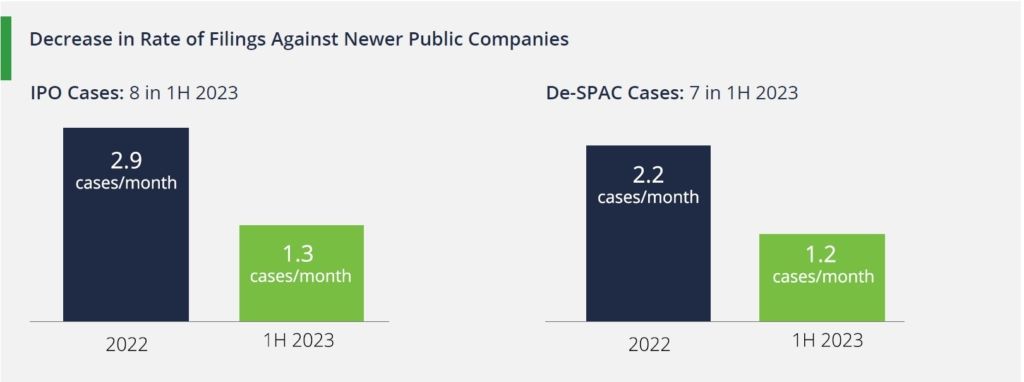

Fewer IPO Filings

There has been a decrease in the rate of filings against newer public companies this year compared to 2022.

Given the fact that there has been a significant slowdown in IPO, SPAC IPO, and de-SPAC activity in 2022, this is not surprising.

In 2023 so far, we have seen approximately 1.3 cases filed per month against IPO companies versus 2.9 cases per month during 2022.

Increase in Mature Public Company Filings

By contrast, companies that have been public for three or more years have seen an uptick in filings in the first half of 2023 compared to 2022.

The most mature companies in our analysis, public companies older than 10 years, have experienced a 19-percentage-point increase in filings for the first half of 2023 compared to all of 2022.

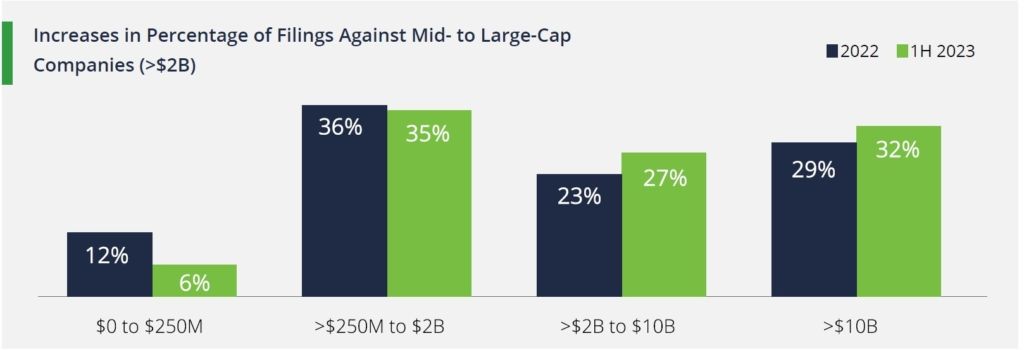

Increase in Mid- to Large Cap Company Filings

For companies valued at $2 billion and beyond, there has been an uptick in filings in the first half of 2023.

Our data shows that 59% of the suits filed in 1H 2023 are against mid- to large-cap companies.

Increase in Settlement Payouts

There have already been $3.1 billion in payouts in the first half of 2023. This surpasses the total settlement dollars we saw in 2022 of $2.4 billion.

In fact, this is an unprecedented amount paid out in the first half of the year as compared to the last decade in the first six months of each year.

While a majority of settlements stayed under $20 million, high-dollar settlements over $50 million comprised 17% of the settlements in 1H 2023.

When it comes to settlements by industry, the manufacturing, financial, and technology sectors take the top three spots, respectively.

Learn More

Download your copy of Woodruff Sawyer’s 2023 Mid-Year D&O Databox Report for more details on:

- Which high-profile companies are being sued.

- Which industries are being sued the most.

- How many cases are COVID related.

- How many foreign filers are getting sued.

- The top 10 settlements of 1H 2023.

Author

Table of Contents