Blog

Managing the Impact of Rising Auto Liability Claims Volatility – Part II

In this article, we present updated data on large auto claims and suggest how to get ahead of continued challenges related to auto coverage.

Last year, we documented the steady trend of increasing catastrophic auto liability claims since 2012 and explained some of the legal and social factors driving up the cost of these claims. In this article, we present updated data on large auto claims and suggest how to get ahead of continued challenges related to auto coverage.

Inflationary trends continue to impact commercial auto liability losses and defense containment costs (DCC) in a material way. Both social and economic inflation also continue to drive rates and skepticism in underwriting.

Read on for details on how you can proactively manage auto risk and protect your company from inflated rates and surcharges because of mega settlements. We’ll explore these questions:

- What does the latest large case data tell us about the trends in commercial auto liability claims over $15 million in total costs?

- What should risk managers consider in building their insurance programs?

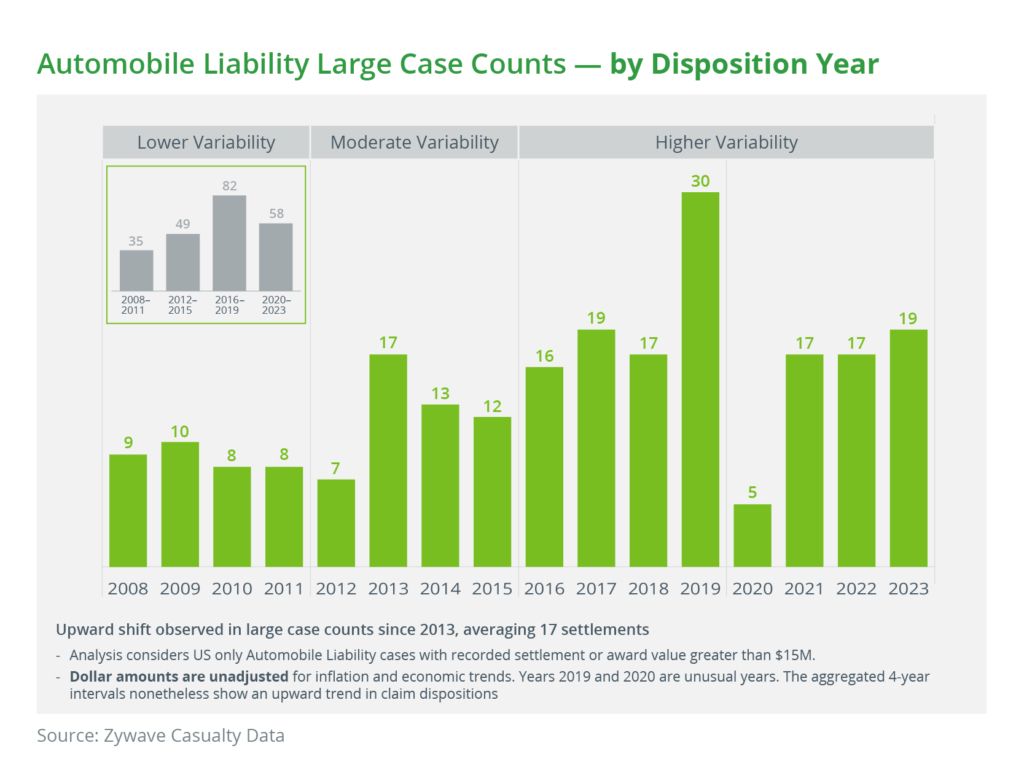

Annual Large Auto Claims Remain High – Findings by Disposition Year

One helpful way of analyzing liability case data is to organize claims by disposition year–the year in which cases are resolved either via a settlement with plaintiffs or a court's verdict. Disposition year accounts for both the time it takes for claimants to file lawsuits and the time for cases to be litigated and settled.

We continue seeing, on average, 17 large auto liability cases per disposition year. The 2020 disposition year remains an outlier with only five large cases. We believe that court closures due to the COVID-19 pandemic are the primary drivers for this low volume. The disposition year 2019 also remains an outlier, with 30 large case settlements. However, in 2021 and 2022, we see 17 large case settlements, respectively, in line with expected estimates. The year 2023 continued the expected trend of holding claim counts.

The number of cases, coupled with large settlements due to social inflation and increasing medical/vehicle repair will continue to strain auto insurers who are increasing premiums across the board regardless of driving history. Clients with safety management programs including technology/data to support safe driving will see fewer substantial increases. Continued emphasis on driver safety, incentives for safe driving, including regular employee training and background checks, will create more confidence in underwriting, resulting in better pricing for insureds.

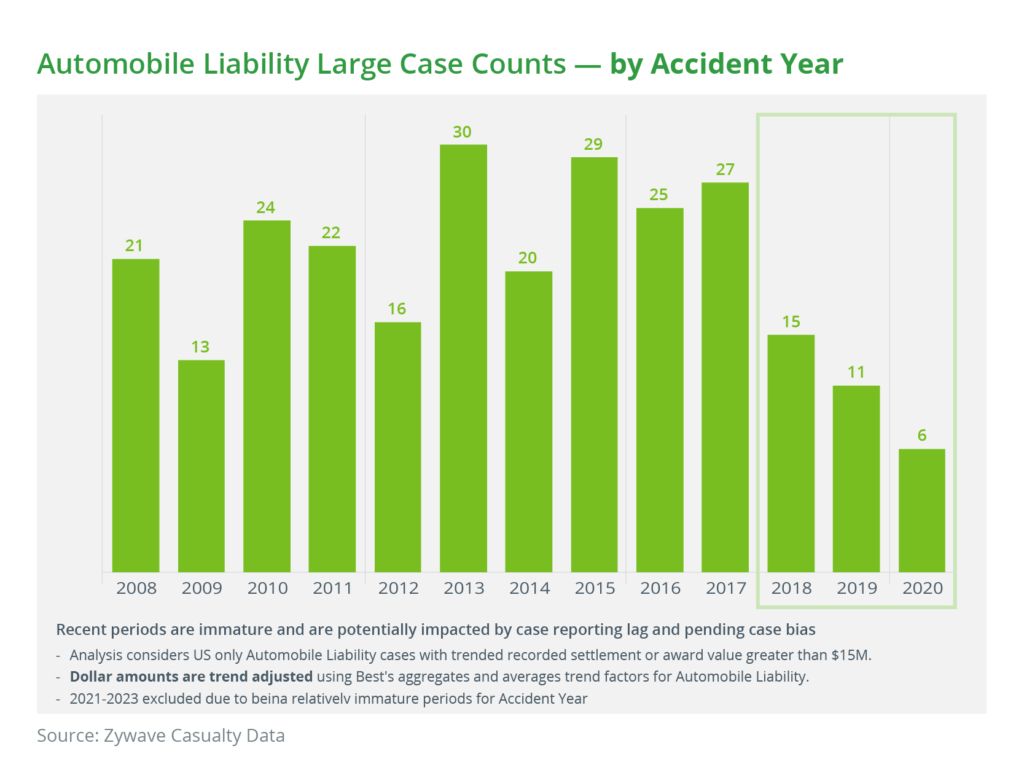

Accident Year Trends Paint a Different Picture

Examining large loss trends by accident year the year in which the accident that led to the litigation occurred–is also useful in understanding the trend in the number of accidents themselves. However, recent periods in the accident year analysis are immature and will appear understated due to the lag in claimants filing lawsuits and courts processing cases.

A long-term trend is understated in the accident year for the most recent years. It is worth noting that there is only a 13% increase in large auto accidents over a 10-year period (2008-2017), and the number of cases in 2018-2020 dropped off significantly. However, it is critical to remember that a material number of large auto cases occurred in the last years of the period (2018-2020) that have yet to result in lawsuits resolved in or out of court.

As claimants and corporations resolve these cases (which are currently absent from the Advisen data), the number of large claims for the recent years will rise in line with the trends by disposition year.

Ultimately, large loss counts will continue for the foreseeable future,and safety management/loss prevention are not only critical but required control factors by an insured.

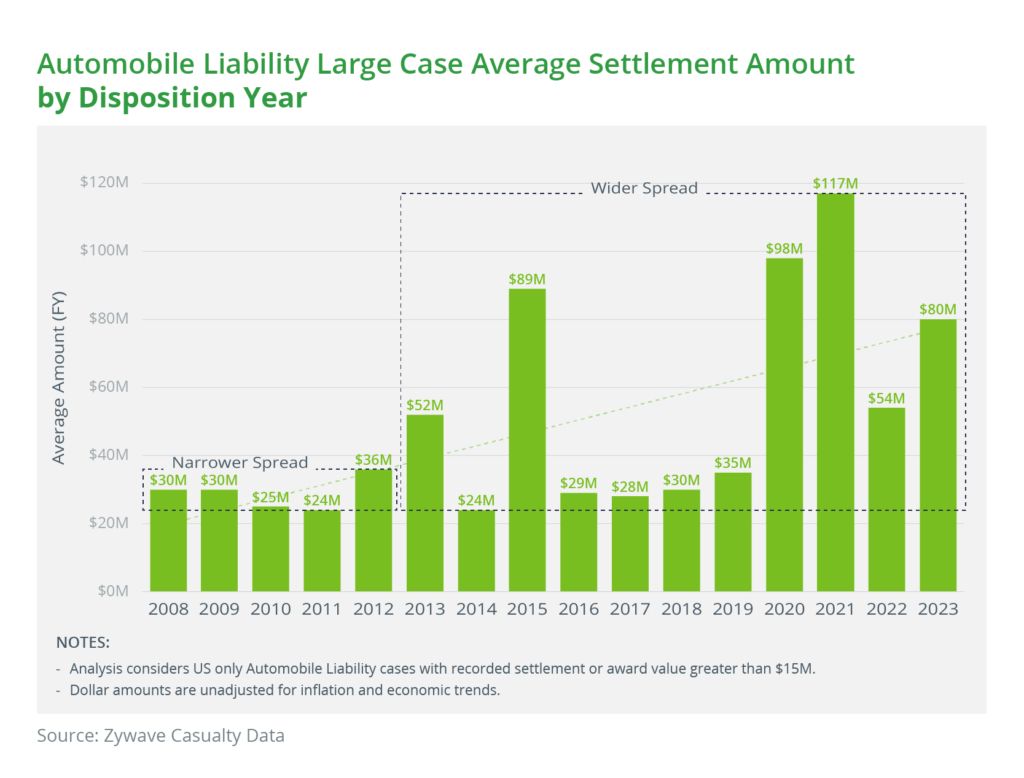

Average Case Size Continues to be Unpredictable

In terms of the average size of large auto accident settlements, it is hard to point to a clear trend. While the annual averages jumped in 2020 and 2021, those years were skewed by massive outlier claims.

What is obvious from the analysis is a huge increase in the variability of large claim severity, indicating that auto liability risk continues to become more unpredictable. Recent 4 years indicate that average case settlement in the north of $50M is holding, which is concerning. This may create loss ratio pressure for commercial auto liability insurers.

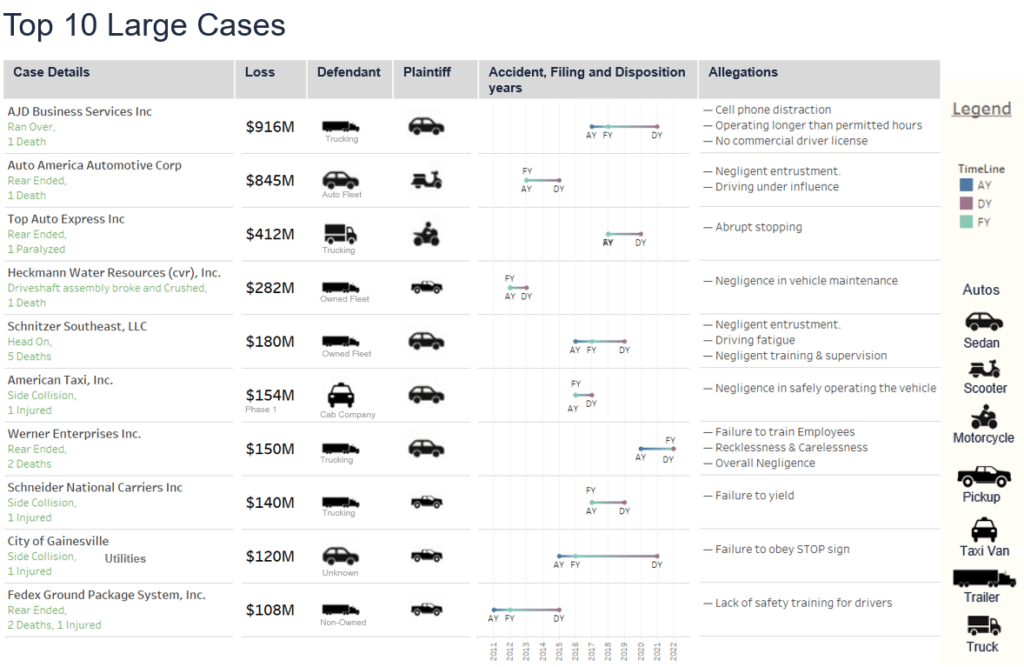

The Top 1O Large Cases in the Past Decade Resolved in Excess of $100M

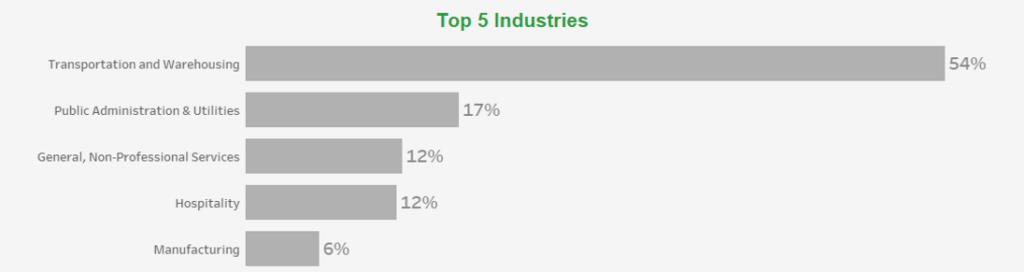

Just under 50% of the top 5 cases are attributed to transportation and warehousing industries, followed by mining, quarrying and oil/gas extraction industries comprising 24% of cases. Common allegations continue to be in the areas of:

- Negligence in vehicle maintenance

- Distracted or negligent driving

- Lack of driver training

In the Top 10 large cases since 2011, the average settlement duration is 3-5 years.

Predictably, all 10 cases involved bodily injuries: half resulting in death, and the remaining half resulting in severe injuries. All cases were considered more complex, with financial implications of injuries on the lives of the injured or relatives of the deceased and resolved north of $150 million. Out of the $4.1 billion in total top 10 cases in our study, roughly $2.2 billion was settled within the top 3 cases. Car accidents tend to generate emotion in a jury, often granting sizeable awards not generally sought in other injury cases.

Managing Uncertainty with Strategic Insurance Program Design

The challenging litigation trend for large auto cases requires careful planning for Umbrella and Excess Liability renewals. The first step in approaching the Excess Casualty market is to conduct a thorough gap analysis of risk controls intended to minimize the potential of big auto losses.

To improve their risk profiles and ensure compliance with Department of Transportation (DOT) regulations, companies should consider conducting a mock DOT audit and gap analysis by location by working with a third-party vendor, their auto liability carrier, or even a state trucking association. Companies without DOT-level fleets can and should provide evidence to their auto liability carrier that they are limiting their auto liability exposure.

Here are some of our recommendations for engaging the current Excess Casualty market:

- Strategically approach the placement of umbrella/excess layers by budgeting for increased costs and engaging in focused competition among insurers

- Cultivate strong relationships with incumbent insurers to explore other options as the market changes

- Break up expensive larger layers into smaller layers to maximize competition among legacy and new market participants

- Expand search for capacity to the Excess and Surplus market in the US and global markets

In addition to these tips, we recommend that companies renew their focus on driver safety, regular employee training, background checks. and accident-prevention strategies.

Safety must be a top management priority. Companies should build, maintain, and document a safety and training process that includes ongoing coaching in operating new technology in vehicles.

Fleet Management Principles

Here are some essential fleet management principles to implement:

- Strengthen hiring practices. Hiring practices prove to be an important factor in fleet management—clean records and experience tend to provide favorable results.

- Update technology. Forward collision warning devices and GPS, which provide constant, real-time updates on vehicle location and status, are popular tools to mitigate auto risk.

- Analysis and Intervention. When accidents happen, analysis and intervention will be important to settlement outcomes and ongoing operations behavior.

Distracted driving is a significant concern for commercial auto insurers, impacting rates and road safety. Distracted driving is a factor in 80% of crashes, claiming 3,522 lives in 2021 according to the National Highway Traffic Safety Administration (NJTSA) Drivers who use cell phones are four times more likely to be involved in a crash

According to NHTSA, drowsy driving led to 684 deaths in 2021. These deaths most often occur between midnight and 6 am, involve a single driver, and are on rural roads. Companies need to be mindful of driving times to mitigate drowsy driving.

Companies need to put strict rules in place regarding cellphone use, enforce rest breaks, and limit night driving. Improved communication about these rules will demonstrate management's commitment to driver safety.

If you would like more information on this analysis or on ways you can better handle the current Excess Casualty market, contact your Woodruff Sawyer representative.

Author

Table of Contents