Blog

Personal Liability Protection: A Simple Guide for Directors and Officers

As a director or officer of a public or private company, you need to have strong protections in place to reduce your exposure to personal liability, as well as appropriately respond in case you become subject to an investigation or are named in litigation. The alternative is to leave yourself open to expensive problems.

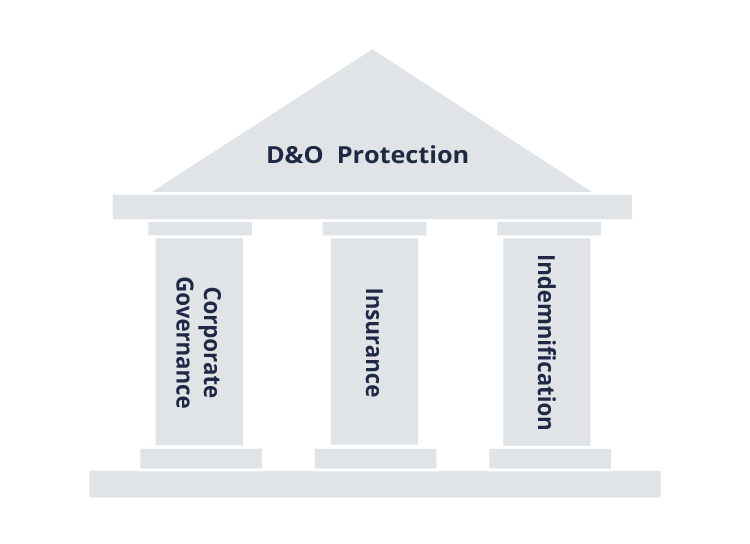

This graphic provides a good way to think about these protections:

When each of the three pillars is well structured, you should have optimal protection from personal losses if you are sued for alleged or actual acts in your capacity as a director or officer.

The multi-million-dollar question: “What does it mean to be well structured?”

This article walks through some of the considerations directors and officers should make when assessing the protections afforded to them by the companies they serve. If you're considering taking on a new director or officer role, what follows will be especially valuable to you as you conduct your due diligence.

Pillar I: Corporate Governance

A company’s organizational documents (i.e., certification of incorporation and bylaws) will typically include language indemnifying directors (and often officers) “to the fullest extent permitted by law.” There are generally references to insurance and the ability of the company to enter into indemnification agreements with its directors and officers. However, these documents tend to be light on details and may exclude important points such as:

- Whom you should reach out to if you are sued

- Whether you can hire your own attorney to defend yourself

- The presumption as to whether you acted in good faith

- What the impact of something like a plea of nolo contendere is

- How many days the company has to advance legal fees, if at all

Waiting to negotiate these details until after a lawsuit is filed could potentially put an enormous amount of financial pressure on directors and officers who need to hire lawyers right away. This is where insurance and indemnification agreements can help bolster and/or clarify the general indemnification parameters included in the organizational documents.

Specific to Delaware companies, see here for a discussion regarding new protection that can be extended to officers, and here for a discussion regarding why it is important to include federal choice of forum provisions in your company’s certificate of incorporation.

Remember too that a strong governance risk profile can dramatically reduce a company’s—and its directors’ and officers’—liability exposure. How so? Maintaining and adhering to good corporate governance practices is essential for any company to effectively and proactively identify and respond to risks. For directors, this is especially important given their duty of corporate oversight, which is part of their fiduciary duty of loyalty to monitor a company’s operations and associated risks. As we previously discussed, oversight claims brought against companies, directors, and officers can yield massive financial settlements for those plaintiffs that bring them.

Elements of a strong governance risk profile for public companies can include:

- A code of conduct and ethics

- An insider trading policy

- A whistleblower policy and hotline

- A corporate communications policy

- A health & safety policy

- A confidentiality policy

The number and types of policies that a company maintains will vary depending on its risk profile. However, having policies isn’t enough. Companies need to revisit their policies and update them to reflect changes to their business, regulatory environment, risks, etc. Lastly, training on these policies is important, and in some cases required, to encourage a strong culture of compliance. Latham & Watkins provides some considerations that companies should take when building a best-in-class compliance program.

Pillar II: D&O Insurance

It’s not just oversight claims that can result in large settlements against companies. We previously covered the five categories of suits in which large dollar settlements may be more likely. Moreover, given the rising costs associated with responding to investigations and engaging defense counsel, even if claims are dismissed, directors and officers could be placed in a precarious financial position if they are expected to front investigation and defense costs.

This is where a robust D&O insurance program is critical. A company and its directors and officers generally are afforded coverage through three separate “Sides”, Side A through C, with a shared limit of liability. We provided an overview of D&O insurance, but to summarize: “Side A” provides coverage for non-indemnifiable losses for directors and officers, such as bankruptcy and derivative suits; “Side B” reimburses the company for indemnifiable losses for directors and officers; and “Side C” reimburses the company for its defense costs and settlements of securities claims. You may also be familiar with what is known as standalone Side A, which is reserved exclusively for individual directors and officers. We also encourage you to view our Whiteboard Breakdowns on Sides A, B & C and on Standalone Side A Difference in Conditions.

A question that you will inevitably have as a director or officer will be: “Do we have enough insurance coverage?” Working with a broker that understands your business, the market, risk profile, and risk tolerance will go a long way in helping tailor a D&O insurance program that is set at a level that can appropriately respond to claims.

Finally, independent directors may want to consider purchasing a wealth security policy, a type of insurance policy only available to independent directors. This type of policy is purchased by an individual director, usually schedules all the directors’ boards, and provides a limit that doesn’t have to be shared with anyone else.

Pillar III: Indemnification Agreement

A company’s organizational documents typically cover indemnification, albeit superficially, but a thoughtfully drafted indemnification agreement between you and the company can provide you with significant benefits. These benefits include:

- Ensuring your indemnification rights can’t be changed unless you consent. A company’s organizational documents can be modified. More importantly, they can be modified without your consent. An indemnification agreement with a modification provision that requires mutual consent of you and the company ensures that you keep your rights.

- Providing clarity regarding requirements for eligibility of indemnification and advancement. As discussed earlier, a company’s organizational documents tend to be light on details regarding indemnification and advancement. So even if both are generally addressed, you are better served by also having an indemnification agreement that is thoughtfully constructed to include details regarding the process. For example, your indemnification agreement should specify what types of events trigger indemnification and/or a right to an advancement of expenses. This is especially important in cases when you become the subject of an investigation or claim, and you would like to (and should) engage an attorney to represent you. Any delay in wading through what should be administrative concerns at this stage could negatively impact your ability to appropriately respond to an investigation or claim.

- Delivering a level of protection that D&O insurance policies may not provide. D&O insurance policies are negotiated annually, and terms and conditions can change—not always for the better. For example, these policies contain exclusions and limitations on coverage that may change year over year, such that you may not be covered for certain types of claims, or if you are, there are limitations around coverage. Notably, in the current market, carriers have taken very different positions on whether to provide coverage for books and records requests and at what level. The exclusions and limitations included in D&O insurance policies may not exist in a personal indemnification agreement.

- Provides peace of mind in the case that you leave the company, the company is acquired, or other changes in circumstances. Indemnification agreements can be especially important in any changes in circumstances. For instance, an investigation or claim may be brought against the company, directors, and officers years after an alleged cause of action. While you may no longer be on that board when a claim is filed, you may have been on the board during the period that the alleged cause of action took place. This means that you would likely be named as a defendant. Whom do you call at the company to ask about how you should respond? What if the company’s ownership has changed and the new management is unresponsive? If you engage an attorney to represent you, will the company reimburse and/or advance your expenses? This is where that indemnification agreement that you wisely entered into while serving as a director will come in handy. Not only will you have a roadmap as to what rights you have available to you in response to being named as a defendant, but you will also have a legally enforceable agreement that the company would be hard-pressed to ignore.

As we previously covered what D&Os should consider when negotiating and maintaining their personal indemnification agreements, we won’t dive into that in detail here. However, we want to emphasize that it is a good idea to revisit your indemnification agreement every few years. A primary reason is to account for changes in the company’s risk profile, as well as developments in case law or lessons learned from other companies.

One example of why periodically revisiting your indemnification agreement is a good idea is a settlement reached by five former outside directors of Just for Feet. In this case, the company filed for bankruptcy after which it, along with its directors and officers, was sued. The executives drained all the D&O policies, leaving the independent directors to pay out of their own pockets. The settlement amounted to $41.5 million.

An independent director liability insurance policy would have saved the day for these outside directors. That type of policy would have provided a reserve of segregated funds just for the outside directors—funds that could not be touched by the corporation or its officers. However, that type of insurance may not make financial sense for every company. An alternative solution is to include verbiage in the indemnification agreements that prohibits the company from using insurance to settle claims to the detriment of their outside directors.

The Just for Feet example happened in 2007 and yet one can still find many indemnification agreements filed by companies with the Securities and Exchange Commission that do not include either of the solutions noted above. This is where consulting with a trusted legal advisor who has expertise in reviewing and drafting these documents will be worthwhile. They will be able to evaluate your indemnification agreement and suggest proposed enhancements based on developments in the law or examples like Just for Feet.

Parting Thoughts

As a director or officer, you shouldn’t have to lose sleep over personal liability. Having a well-structured corporate governance program, a tailored director and officer insurance program, and a state-of-the-art indemnification agreement can go a long way to helping you sleep at night.

Woodruff Whiteboard Breakdowns: Independent Directors Liability vs. Wealth Security Policies

Authors

Table of Contents