Blog

When a Wealthy Individual, Not D&O Insurance, Indemnifies Directors

Readers of the D&O Notebook are aware that the current high cost of D&O insurance is causing many companies to focus on ways to manage the cost of D&O renewals, including by changing the mix within their insurance programs to save money.

But what if the cost of D&O insurance is still too high?

Another creative option in the news recently involves an individual board member (in one instance a board chairman, in another a CEO) offering to indemnify individuals in lieu of D&O insurance.

Pulse Biosciences, Inc., a public company listed on the Nasdaq, is one company that has disclosed this type of extra-corporate indemnification arrangement.

Before discussing the details of this arrangement, I will first tackle the question of why we have not seen many companies do something like this in the past.

Is Extra-Corporate Indemnification a New Idea?

The idea of someone other than the company providing directors with indemnification is not new. An easy example is the indemnification situation enjoyed by directors representing venture capital or private equity money invested with a company.

Not only are these VC and PE-related directors typically indemnified by their VC or PE firms, they are also often the beneficiaries of insurance obtained on their behalf by their firms in case a portfolio company's D&O insurance proves to be inadequate.

Of course, the portfolio companies still usually purchase D&O insurance. This is in part because all the non-VC or non-PE members of the board, including any officers who are also directors of the company in question, typically do not enjoy these extra layers of protection provided by VC and PE firms to their representatives.

Another example of extra-company indemnification occurs when a wealthy individual affiliated with a private company (often a chairman) agrees to indemnify an individual who would otherwise not agree to join the board of a chairman's company.

While this is not a common arrangement, it does happen from time to time. When a company is private, these arrangements often remain undisclosed. (This is in contrast to public companies, where disclosure of such an arrangement is required.)

The idea that an individual affiliated with a public company would take the step of personally indemnifying individual board members, however, is relatively novel.

Such an idea would typically not be worth entertaining because D&O insurance has traditionally been relatively affordable.

In addition, the cost of indemnification could be significant given that we are talking about liability exposures of public company directors.

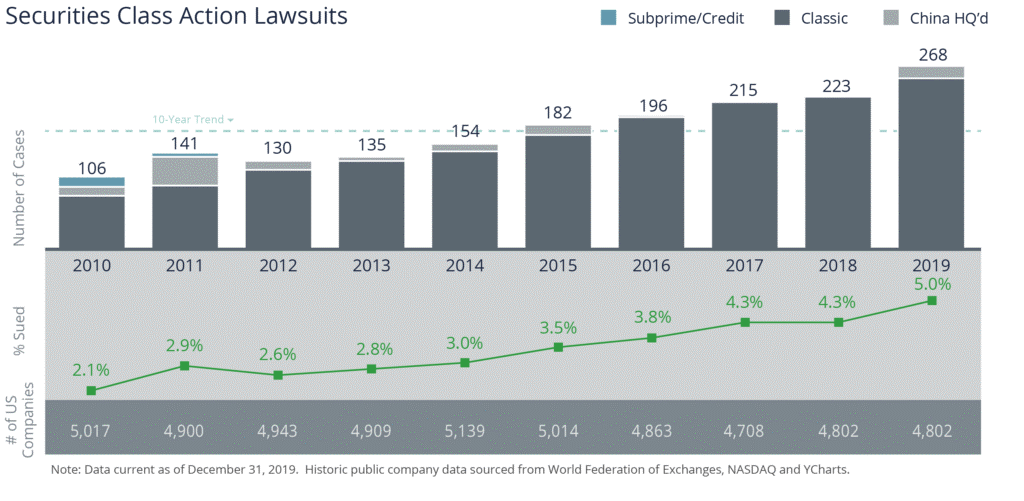

Recall that in 2019, per the Woodruff Sawyer Year-End Flash Report, we saw another all-time high in the frequency rates for securities class action lawsuits when 5% of public companies were sued.

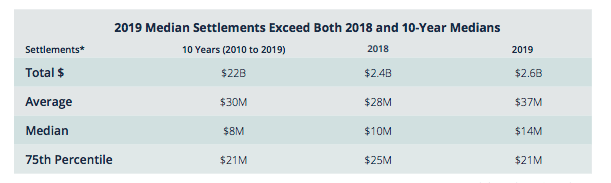

Moreover, the average settlement for securities class action suits for the last decade is $30 million, a hefty sum indeed.

Of course, it is typical for a company to provide personal indemnification agreements to its directors and officers, particularly if the company is a public company.

Unfortunately, there are limitations on the efficacy of corporate indemnification agreements. For example, if a company becomes insolvent, then the indemnification agreement is not worth anything.

Another example of when corporate indemnification agreement is not useful pertains to the settlement of breach of fiduciary duty suits brought derivatively. In most states, including Delaware (the state of incorporation for most companies), settlements of derivative suits are not indemnifiable by the company.

(Quick reminder: The "Side A" portion of a D&O insurance policy can respond to both situations, which of course accounts in part for the popularity of D&O insurance.)

The two limitations to corporate agreements outlined above, however, would not apply to indemnification provided by a party other than the company, such as the case with the Pulse Biosciences indemnification arrangement.

Pulse Biosciences Indemnification Arrangement

On May 15, 2020, several sources including Reuters reported that Pulse Biosciences' chairman had agreed to provide the rest of the board indemnification in lieu of D&O insurance. At the time of this writing, the chairman owns 47.2% of the company.

The reporting was bare bones, reflecting the company's public disclosure of the matter in an SEC filing. The relevant part of the filing said only the following:

Pulse Biosciences, Inc. (the "Company") has determined not to renew its directors and officers liability insurance policies this year due to disproportionately high premiums quoted by insurance companies. Instead, Robert W. Duggan, chairman of the Company's board of directors (the "Board"), and the Company have entered into a letter agreement, dated May 12, 2020 (the "Letter Agreement") pursuant to which Mr. Duggan has agreed with the Company to personally provide indemnity coverage on substantially the same terms as the Company's prior coverage program for a one-year period, and has agreed to deposit at least $30,000,000 of cash and/or marketable securities as security for such obligations.

To the extent permissible by law, the Company will pay a fee of $2,500,000 to Mr. Duggan that shall be due on May 13, 2021, the last day of the one-year period, in consideration of the obligations set forth in the Letter Agreement. Based on the terms quoted by insurance companies, the Company estimates that the total cost to the Company, including insurance premiums, broker fees and any financing of these costs would have been in excess of $2.8 million. The other members of the Board are third-party beneficiaries under the Agreement. The Letter Agreement also provides for an expedited dispute resolution process. It is intended that the Letter Agreement will be replaced and superseded by a later agreement more fully setting forth the rights and obligations of the parties thereto.

In the same filing, the company promised to disclose the written agreement as an exhibit to its Form 10-Q for the quarter ended June 30, 2020.

Is It a Good Idea for a Director to Accept Indemnification from a Fellow Board Member?

There is no doubt that in most cases a director or officer would prefer to be insured by a credit-rated insurance company instead of the average rich person.

Setting aside creditworthiness, most individuals do not have the diversified resources that an insurance company has—including experience when it comes to negotiating and settling claims with the kinds of plaintiffs that routinely sue public company directors.

In the current D&O insurance environment, however, not all companies are able to obtain as much insurance as they want at a price they deem to be affordable. Some companies will handle this by re-organizing their insurance program or taking other similar steps.

Pulse Biosciences, on the other hand, took a new route: Per their disclosure, their chairman has agreed to deposit $30 million in cash or marketable securities so that these funds can be used on terms that are similar to the company's expired D&O insurance program.

The disclosure indicates that the arrangement may only apply to the directors of the company, and not the officers as well. The chairman will be paid $2.5 million for having done this, with payment to be received when the obligation terminates in one year (on May 13, 2021).

The company disclosed that a similar amount of insurance would have cost them $2.8 million, though presumably that insurance would have covered both directors and officers, and not just directors.

It is important to remember that the company could not completely replace the coverage provided by the insurance program on its own due to the limitations on corporate indemnification outlined above.

What Issues Does This Type of Arrangement Raise?

The upside to this arrangement is, of course, that the company did not have to pay the premium required by the insurance company. But there are still issues of concern.

Available Funds

One concern could be whether the indemnifying party would actually have the funds available should indemnification be needed.

Pulse Biosciences has avoided this issue. The company disclosed that the chairman will deposit a full $30 million in cash or marketable securities. The company did not disclose if this is an account that remains in control of the chairman.

Presumably the indemnified parties might feel more comfortable if the funds were held in a trust account controlled by someone other than the chairman.

Negotiating Power

The disclosure notes that there will be a letter agreement to be disclosed soon with the company's next 10-Q with a more robust contract to follow.

Presumably the other directors were comfortable with the letter agreement. However, they will not exactly be in a good bargaining position when it comes to negotiating the terms of the more robust contract to follow given that their D&O insurance program will have already lapsed.

Coverage Issues

Another issue is that dropping the D&O insurance program has consequences in and of itself.

For example, when a D&O insurance program renews, the new program continues to cover claims for past directors and officers if those claims arise in the current policy period.

Directors rolling off a board and officers separating from the company all expect to have this coverage as a matter of course. Indeed, this is a reasonable expectation in a world where everyone renews their D&O insurance.

At this time, it remains unclear what arrangements may have been made for past directors and current and past officers of Pulse Biosciences. One way to ensure that the past directors and officers are covered for claims brought in the future relating to past acts would be for the company to purchase a tail policy on the expiring policy.

If the company purchased a tail policy, or "run-off" as it is sometimes called, then the old policy will be held open for a specified term so that it can pick up new claims relating to things that happened before the run-off began.

Unfortunately, even just a one-year tail policy for a public company typically costs between 100% to 200% of the annual premium, something that a company dropping insurance for lack of affordability may have been reluctant to pay.

Consider, too, what happens if a company wants to purchase D&O insurance in the future after having dropped the coverage altogether.

If the company wants to purchase D&O insurance in the future, perhaps when prices have come down, the company will have to provide a warranty statement attesting that it knows of nothing that is reasonably likely to lead to a claim. Any exceptions will be excluded from coverage going forward, an unhappy situation if the excluded event turns into a costly claim.

Possibly a more concerning coverage issue is that carriers may impose a broadly worded prior acts exclusion on the D&O insurance policies when a company attempts to re-enter the D&O insurance market (insurance brokers refer to this as a "break in continuity"). The result of a broadly worded prior acts exclusion is that future claims will only be covered if the activity that is the focus of the suit took place after the beginning of the policy period (referred to as a "past acts date"). Claims by their nature are about events that happened in the past. Thus, the coverage afforded by the traditional D&O insurance policy will be greatly weakened for the first several years.

How Will Shareholders Feel About This Type of Arrangement?

The Strong Argument for Applause

Given the potential liability faced by even the most diligent board members, there is no reason to imagine that the company could retain its board if the board were not being protected from potential liability.

Thus, arguably shareholders should applaud the Pulse Biosciences arrangement; after all, the company saved money on the cost of retaining its board of directors.

The argument that the arrangement makes sense for shareholders is especially strong for Pulse Biosciences given its financial situation. At the time of writing this article, the company's market capitalization is less than $280 million.

The form 10-Q filed on May 11, 2020 shows a cash balance of about $16 million and no revenue (typical for a pre-commercialization life sciences company).

Even with the additional $30 million raised by the company in June 2020, the $2.8 million they would have had to pay for their D&O insurance is an enormous amount of money for a company in this financial position.

In the face of this, the company's chairman has provided the indemnification for a $300,000 discount compared to what the company would otherwise have had to pay. Thus, the shareholders are at least moderately better off than they otherwise would have been.

The Argument for Concern

On the other hand, shareholders might object to the arrangement out of concern that the arrangement calls into question the independence of the indemnified directors.

As I have written elsewhere, under corporate law the fiduciary duty of loyalty requires that directors act independently and avoid self-dealing.

A shareholder might ask the question: How independent can a director really be if that director is beholden to another person on the board or in management who is personally indemnifying the director?

In the case of Pulse Biosciences, the potential indemnification is for up to $30 million. By way of context and for comparison, per the company's proxy disclosure, board members on average make about $220,000 per year for their service.

In other words, the value of the potential indemnification far outweighs the compensation board members receive from the company to serve on the board.

To be sure—and this is a point worth stressing—it is the chairman of the board who is providing the indemnification to the other directors, not a member of management. The latter might be a more difficult case.

Per the proxy statement sent to shareholders before the May 14, 2020 annual shareholder meeting to elect directors, the Pulse Biosciences board found the four independent directors who are the beneficiaries of the indemnification arrangement to be independent.

What about the independence of the chairman himself? Per the company's proxy statement, the board found the chairman to be an independent director within the meaning of the independent director guidelines of the Nasdaq Stock Market.

It may be worth lingering on the question of whether the chairman is still an independent director in light of his being paid $2.5 million for providing the indemnification arrangement, albeit this amount will only be paid on May 13, 2021.

Nasdaq Stock Market Listing Rule 5605(a)(2), which provides guidelines on director independence for Nasdaq-listed companies, focuses on whether an individual—in the opinion of the board—has a relationship that would "interfere in the exercise of independent judgment in carrying out the responsibilities of a director."

There is also a non-discretionary portion of the rule, which states certain circumstances in which a person "shall not be considered independent." One such circumstance is when a director accepts "any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence."

This part of the rule is subject to some exceptions (e.g. director compensation itself), none of which are likely to be relevant to the payment the $2.5 million payment due to the chairman of Pulse Biosciences on May 13, 2021.

Per the rules of the Nasdaq Stock Market, if the chairman does not accept the payment, he would still be independent the following year. Accepting the payment in 2021, however, would cause the chairman to no longer be independent at that time.

It seems to be up to the board to decide if the potential future payment causes the chairman not to be independent now.

Is an Indemnification Agreement from a Fellow Board Member Right for You?

This question will not come up for most public companies. While many directors of public (and private) companies are wealthy, few directors will have the inclination much less the means to put millions of dollars of personal cash in trust for the fellow directors.

Those that have the means may not want to do this for a price that is less than what insurance carriers are charging, perhaps believing that carriers may be better at pricing the risk compared to an individual without the experience, models, actuaries and other resources a well-rated D&O insurance carrier has.

(A director attempting to charge the company the same or more than what an equivalent insurance program would cost would be hard pressed to defend this as anything other than self-dealing.)

If you are in a company that has a director willing to put up the capital, does the arrangement make sense, assuming that you could become comfortable with the terms of the arrangement?

Details like the scope of coverage and what to do if there is a dispute can be difficult to work out, which is of course why D&O insurance contracts are as long and as detailed as they are. Presumably, however, with the help of expert counsel, all the parties could agree to the appropriate language.

What is left is the tricky question of independence.

If an officer, for example a CEO, is offering the indemnification then the officer has no new issues because the officer was never an independent director.

If an independent director is the person offering the indemnification in exchange for a fee, that director will likely stop being independent, possibly even before receiving compensation for having offered the arrangement depending on the board's analysis of independence.

Moreover, whether the rest of the board remains independent may be up for analysis as well. This analysis will differ depending on whether the indemnifying party is the CEO of the company or a fellow independent director, with the latter being the easier case. The concern, of course, is that such questions will be answered through litigation.

Litigation brought by a shareholder unhappy with the arrangement seems unlikely. After all, due to the arrangement, the company ends up spending less money than it otherwise would have to protect its directors.

The unfortunate case will be if a stock exchange threatens a company with de-listing due to a lack of independence, or if there were some other circumstance in which having a committee of independent directors would have been useful.

The most obvious cases are special committees empaneled to address something like a derivative suit or to entertain an offer to buy a company.

Not having an independent committee in these circumstances creates litigation risk for the company, not to mention the director.

This is something to consider as you determine whether or not you want to accept indemnification from a fellow board member in lieu of D&O insurance.

Author

Table of Contents