Guide

M&A Looking Ahead Guide 2024: Trends and Predictions

Get analysis and valuable predictions into the private equity and transactional markets to help guide your 2024 M&A insurance program renewal.

Woodruff Sawyer’s M&A Looking Ahead Guide 2024 features proprietary research on private equity and transactional markets and expert insights to help guide your 2024 M&A insurance program renewal.

In this article, we feature highlights from the new report on M&A insurance pricing and coverage—and you’ll find much more information when you access the Guide. Plus, check out the Looking Ahead Guide webinar for more insights.

Top Trends in Private Equity Funds

As we predicted in last year’s Looking Ahead Guide, 2023 has been a tough year for dealmakers. Since peaking in Q4 2021, quarterly volumes are now down 24% by deal count and 49.2% by deal value (according to PitchBook’s Q2 2023 US PE Breakdown) and exit activity has fallen 75% from peak (2021) to trough on a quarterly basis, showing no signs of improving over the next several quarters.

However, even in this challenging market, private equity funds are still putting capital to work by keeping deal sizes small or finding alternative sources of capital to finance the transactions. Looking forward to Q4 2023 and into 2024, we believe that while the deal landscape may continue to evolve and new structures develop, deal flow will increase compared to 1H 2023.

As deal flow picks up, insurance due diligence (including post-close diligence) will continue to gain steam as deal teams and operating professionals seek ways to improve and maximize EBITDA efficiencies and mitigate risk to their investment assets.

In our M&A Looking Ahead Guide to 2024, we’ve identified four emerging trends in the middle market private equity deal landscape. Here is a brief overview of those trends and how they affect risk management.

Focus on Value Creation

As deal flow has struggled, private equity professionals have been focusing on value-creation strategies. Throughout 2023 and we believe into 2024, operating professionals will focus more on EBITDA margin improvement versus solely top-line growth. We believe there will also be a renewed focus on reviewing insurance and risk management programs as well as employee benefit programs to ensure they are optimizing efficiencies and mitigating, transferring, or accepting risk where necessary.

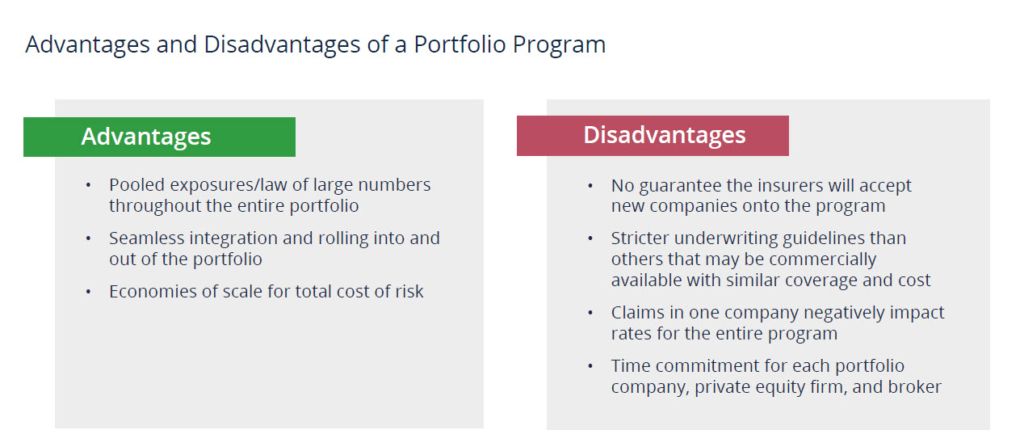

Portfolio Programs Offer Short-Term Gain

Portfolio programs continue to gain steam because private equity professionals are looking for ways to gain value from their portfolios. However, we believe portfolio programs do not work because the short-term increase in margin and value creation is typically not worth the work to set up the program.

Deal Structure Impacts Insurance

Add-on acquisitions, take-privates, corporate carveouts/divestitures, and growth equity deals are becoming more prevalent in today’s deal landscape. Traditional stock or asset deals with less debt are also increasing. Although we expect the deal landscape for leveraged buyouts (LBOs) to improve in Q4 2023 and throughout 2024, the insurance strategy around a transaction is critical to getting deals done efficiently.

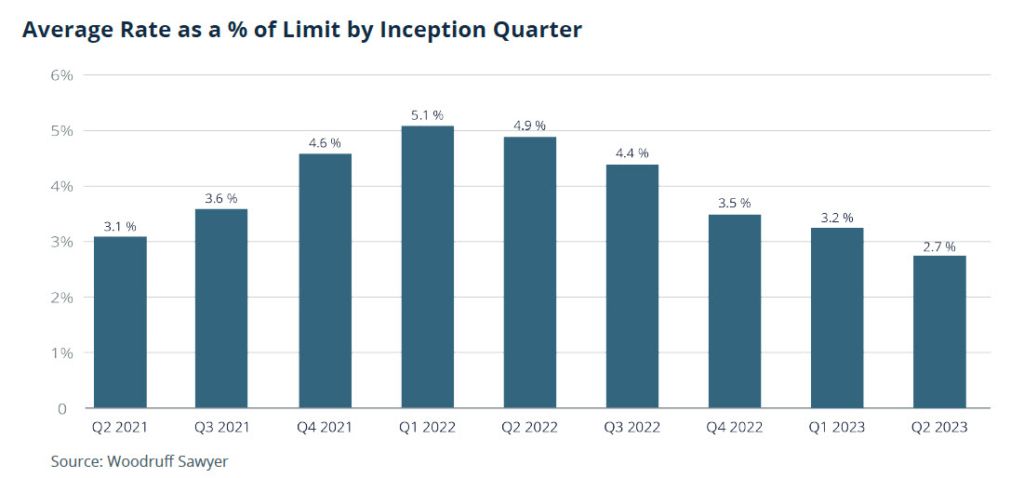

Competition Keeps RWI Rates Low

Private equity firms can expect low reps and warranties insurance (RWI) rates in Q4 2023 and into Q1 2024, decreased retentions for the first 12 months, and broadened terms and conditions. The competitive landscape for RWI may shift slightly throughout 2024 as deal flow increases, but we expect it to remain steady due to an increased supply of capital as well as new entrants in the market.

| Watch the webinar Looking Ahead to 2024: Trends in M&A and Private Equity |

Competition Fuels the Transactional Insurance Market

As the transactional market adjusts to reduced deal flow and smaller deal sizes, we are seeing fierce competition from insurance carriers; rates are dropping to 1.9%–2.5%. Additionally, the standard retention—the amount of loss the insured must bear in the event of a claim before the policy limit kicks in—has decreased from 1% of the purchase price to 0.75% on average, with many underwriters offering an initial retention as low as 0.5%.

For M&A insurance buyers, lower prices mean it’s a good time to get reps and warranties insurance (RWI), especially for deals that underwriters have been more cautious about in the past.

Here are the five top trends we’re seeing in the transactional insurance market:

Secondaries on the Rise

The use of RWI for secondaries will continue to increase. We’re also noting a rise in “hybrid” secondaries, where the secondary has a broader set of operational reps and warranties being added to the previously sought basic ones.

Further Price Drops May be Unsustainable

It’s unclear how much further the market can drop since the marketplace must be able to sustain itself, especially with these multiyear products.

New Products Multiply

New products, such as an RWI “light” solution, are growing. Underwriters have made attempts at writing RWI on a portfolio basis, and we see increasing interest in insurance being attached to litigation funding deals to offset risk.

Low Retention Rates Will Impact Claims

We are seeing retentions start at a range of 0.5%–0.75% from day one. We expect these low rates will lead to a rise in claims.

Claims Activity Rises

We’ve noted an uptick in claims activity—a standard phenomenon across all insurance lines in a downturned economy. However, with the lowering of retentions, we expect to see greater claims activity overall, leading to some fundamental changes in the number and value of claims across the board.

Access the Guide for More

Woodruff Sawyer’s M&A Looking Ahead Guide 2024 covers pricing trends and much more, including:

- Expert insights from Woodruff Sawyer’s team of specialists

- A further look at what to expect in 2024

Get instant access to the full interactive M&A Looking Ahead Guide to 2024

Author

Table of Contents