Blog

More Securities Class Actions Should Go to Trial, Contingent Liability Insurance May Help

As we approach the end of 2020, we continue to see big suits and settlements in D&O litigation world. At nearly every board meeting I attend someone will exclaim that more of these suits should go to trial . . . and the lawyers will explain the risks of doing so. But what if there were a way to ring fence the risk of an adverse final judgment in a D&O suit? My colleague Teresa Milano discusses this enticing possibility. –Priya Huskins

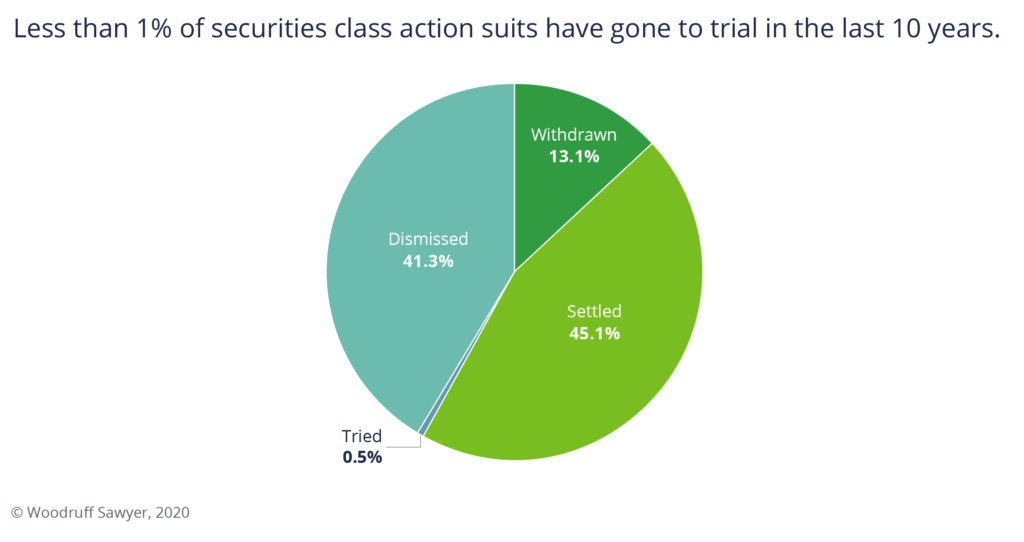

Director and officer cases rarely go to trial. In fact, Woodruff Sawyer’s proprietary D&O DataBox insights show that in the past 10 years, only 0.5% of securities class action lawsuits have done so.

Looking at the rest of the cases, about 45% settle with the remainder prevailing on a motion to dismiss or being withdrawn. The lack of cases going to trial is problematic.

With defense costs being substantial and the dynamics of settlement negotiations emboldening plaintiffs, settling director and officer litigation has a hefty price tag. Plaintiffs are not concerned about proving the merits of their cases, since they know they can ordinarily expect a settlement.

The increasing number of securities class action filings and the growing severity of settlements has created a challenging D&O insurance market with no signs of relenting, making this trend even more troublesome.

Pursuing trial is one way to “reset” the plaintiffs’ expectations. Yet, no one is going to trial. Why?

High Costs of Litigation

Defending director and officer litigation is expensive. At the outset of litigation, defense attorneys try to predict how much a lawsuit will cost. Various factors and the different trajectories a case may take can all impact the costs of defense.

High attorney billing rates, staffing structure, research expenses, and potential experts’ fees are elements of a case that can add up quickly. Additionally, these cases move slowly. Litigating these suits can take several years or longer, depending on the complexity of the case and amount of motion practice involved.

As a result, defense budgets can be sizable, making a shorter, potentially less expensive path towards a resolution more enticing. However, defense costs are only part of the picture.

The alleged damages and potential exposure arising from these suits can be large or even uncertain. Defense costs, coupled with the potential damages exposure, can often exceed the available D&O insurance limits.

The Damages Analysis

Due to the potential cost of ongoing litigation, mediation is often sought early on in a case. At this juncture, it is common to have little or no discovery, not to engage experts, and to only have a preliminary damages analysis.

The preliminary damages analysis typically focuses on “plaintiff-style” damages. These are estimates that provide the plaintiff’s view of the potential dollar exposure, assuming the plaintiffs prevail on the merits of their case. As a result, this view tends to represent a worst-case scenario for defendants and can overstate damages by failing to consider certain key factors for the defense. Unfortunately, the costs to obtain a more rigorous damage analysis can often approach six figures and may not be pursued early in the case.

This can make it difficult to push back on the plaintiff’s excessive damage demands. At this point, negotiations tend to only focus on getting the plaintiff to reduce their demand, rather than the case's merits.

This dynamic reinforces the notion that plaintiffs will not be pressed to prove their case, even frivolous ones. They can roll the dice and usually get a settlement.

The Defense Verdict

Another piece of the puzzle is assessing the likelihood of a defense verdict. However, the outcome of trial is unpredictable. And no one likes uncertainty, especially if losing a case may result in the defendants paying for a judgment.

If defendants lose a securities class action trial, D&O carriers may take the view that there is an “adjudication” of fraud sufficient to trigger the fraud exclusion found in most policies. The risk of getting an adverse judgment and not having D&O coverage foot the bill is daunting; the risk may not be worth it, even if the case is defensible.

Additionally, sometimes the company's financial condition may depend on the outcome of a lawsuit, making the stakes even higher. Staring down the barrel of a potentially massive financial loss is far from ideal, especially when there are less risky options available.

How Can We Get More Cases to Trial? Contingent Liability Insurance May Help.

Given the considerable costs and risks, securities class actions do not get far enough down the litigation road to focus on the case's merits. As a result, early settlement discussions continue to be the norm and in-turn, plaintiffs continue to be incentivized to file suit given their favorable odds of getting a payout.

Is there a way to shift this dynamic to get more cases to trial? Maybe. Contingent liability insurance might help.

Contingent liability insurance is a tailored insurance solution intended to address a specific risk that other insurance products do not cover. These policies can cover various things: mergers and acquisitions, intellectual property infringement claims, and litigation exposures. It is important to keep in mind that the contingent liability policy is intended to satisfy a non-appealable adverse judgment. Its purpose is to protect the defendants for the potential exposure of a judgment to minimize the risk of proceeding to trial.

Defendants facing frivolous securities litigation can also purchase this product for securities class action suits, but this fact is not well known. Purchasing a contingent liability insurance policy for pending securities litigation can help mitigate risk and ring-fence exposure. Companies, directors, and officers named in a securities lawsuit with an inflated and unsubstantiated demand and a defensible case may want to consider this insurance.

A contingent liability insurance policy would sit above (attach excess of) a company’s D&O insurance policies. The contingent liability policy is for a “judgment only” and comes into play when there is final, non-appealable adverse judgment. This policy differs from D&O policies by (1) not covering any defense costs, and (2) not contain the fraud exclusion found in most D&O policies.

Thus, if a case proceeds to trial but the parties decide to settle before there is a ruling, the contingent liability policy would not come into play.

At the onset, it is important for defendants interested in this insurance to have a discussion with outside counsel about potential attorney-client privilege issues. The contingent liability carrier will need to obtain quite a bit of sensitive litigation information. In terms of the process, the contingent liability insurance carrier will review the case-specific data to better understand the potential exposure and financial risk. The carrier will then decide whether to offer insurance to the defendants of securities class actions after performing necessary due diligence which may include:

- Assessment by experts of qualitative and quantitative information: This will be an evaluation of whether the litigation is too unpredictable to price, a comprehensive damages analysis, and the overall estimation of the defensibility of the case.

- Accessibility to information and people: They will want to access litigation documents, data, and evidence, including confidential and privileged information, as well as obtain cooperation from attorneys, insurers, defendants, witnesses, and any relevant third parties in order to properly assess the case.

- Cooperation by D&O insurers: They will want an agreement to proceed with defending the case and address any coverage issues. For example, they may want to pursue waiving the fraud exclusion due to the case's perceived defensibility, since fraud is not insurable.

- Alignment of interests: The defendants, counsel, and D&O insurers must all be on the same page about the case, the risks, and the strategy.

Whether or not this product is a viable option will require close conversations with the contingent liability insurance carrier as well all involved on the defense side. Premiums will vary based on the specific facts of the case in question, and there is often a diligence fee associated with the review of the case. Purchasing this product to cover the potential exposure of an adverse judgment above the D&O insurance is premised on the agreement that everyone on the defense side will work cooperatively with all of the D&O insurance carriers and the contingent liability carrier.

Final Thoughts

As 2020 ends, one thing remains clear for D&O insurance: The challenging market conditions are likely to continue. Securities class actions cases are on the rise and show no signs of slowing as the global pandemic and recessionary environment persist.

From mega settlements to low-value cases settling for smaller amounts, the severity of settlements is also climbing. With these cases hardly going to trial, plaintiffs will continue to file lawsuits and most cases will settle.

Claim payouts will endure and keep affecting the D&O insurance market in terms of both rates and retentions. Contingent liability insurance may be a product to help bring more securities cases to trial and deter frivolous suits from being filed, and this vicious cycle from continuing.

For more information on the trends impacting D&O insurance, check out our on-demand webinar: D&O Looking Ahead to 2021.

Author

Table of Contents