Blog

SPACs Poised to Turn a Corner in 2024: Annual Risk Update

Here we are again—another year of SPAC ennui. We’re hearing derisive comments about the death of SPACs, unending deadline extensions, almost 200 liquidations, 70 deal terminations, and general SPAC malaise. If you’ve followed SPACs in 2023, you might even be wondering why this blog is still here.

The answer is that not all is doom and gloom in SPAC-land. Those in the know realize that there are still good deals to be made using the SPAC vehicle. They are keeping that knowledge to themselves, allowing the media to paint a different picture for the rest.

Let’s look at some of the interesting recent trends, including SPAC lawsuits, that can give us insights on how things might progress in 2024.

| Learn more about SPAC activity in 2023 and what to expect in 2024 in our conversation with Doug Ellenoff. |

SPAC Lawsuits by the Numbers

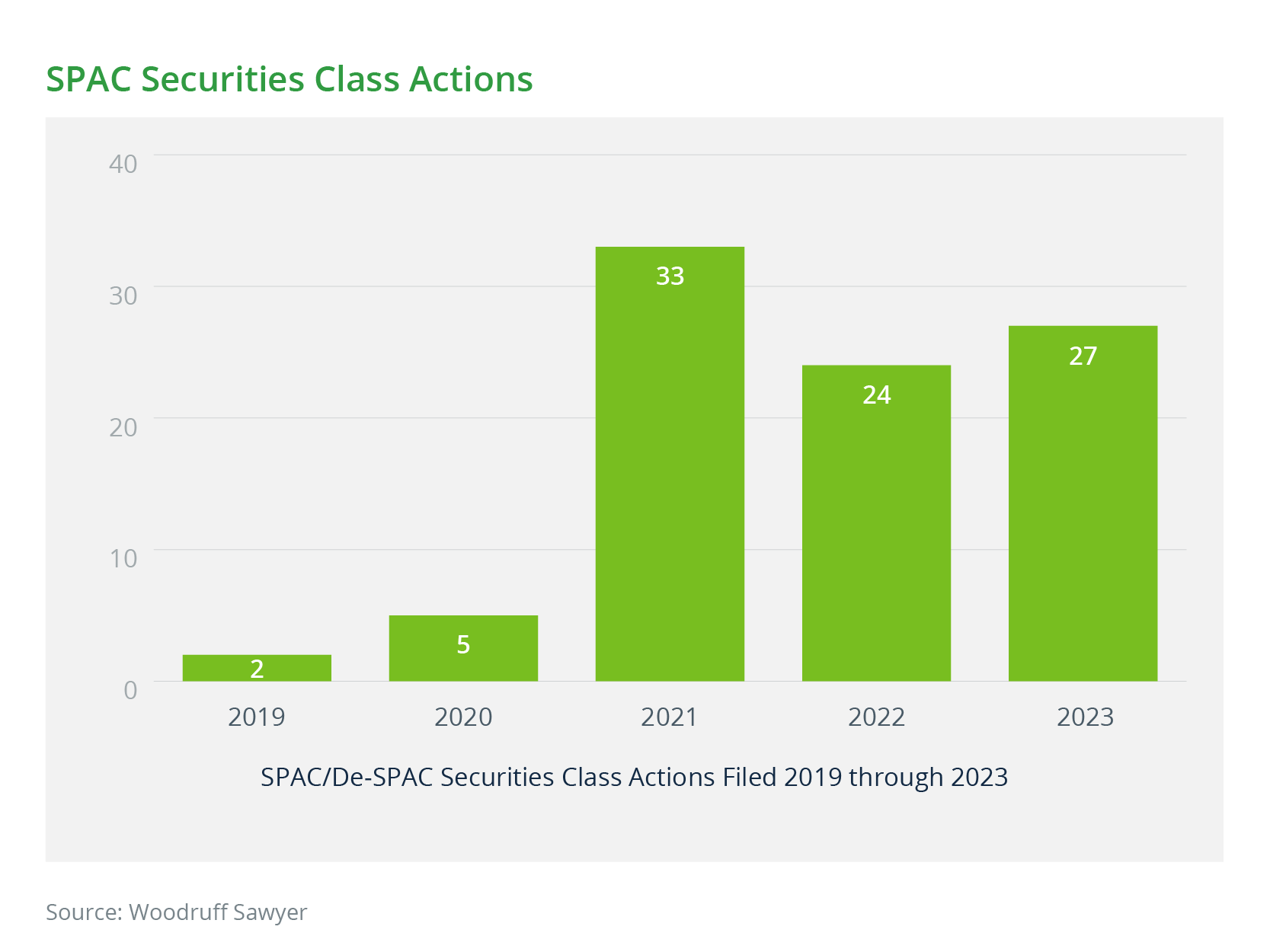

In 2022, we observed a 27% decline in the number of SPAC-related securities class actions (SCAs) from the previous year; there were 24 cases in 2022, down from 33 cases in 2021. A few new cases were filed in the first half of 2023, but activity picked up in the second half, with a total of 27 filed SCAs by year-end.

Half of these cases stemmed from business combinations that closed in 2021. The rest were related to deals that closed between 2019 and 2022. At least four of the 2023 SCAs were followed or accompanied by a bankruptcy filing.

Reasons for SCA Numbers Holding Steady and an Interesting Development

The likely reasons for the number of SCAs holding steady are (1) an increased sophistication of SPAC market participants and (2) lessons learned from others’ previous errors.

Continued difficulties in the financial market in 2023 made it difficult to single out dismal SPAC performance when many traditional IPOs and mature public companies were also underperforming. As we reported last year, when the entire market is hurting, it is difficult for a plaintiff’s attorney to claim that one particular team or merger did particularly badly.

The proposed SEC rules, which came out in March 2022, were largely integrated into the playbook for a new SPAC IPO or a de-SPAC even before they were finalized in January. This delay in finalizing the rules is another reason for a smaller number of SCAs.

The third reason—which was not really present in 2022 but became noticeable in 2023—is the fact that many plaintiffs opted not to bother with an SCA but to instead bring their claims in Delaware as direct-action breach of fiduciary duty suits. These plaintiffs were undoubtedly encouraged by the Delaware courts’ negative view of SPACs as exemplified by several decisions that came out in early 2023.

SPAC Lawsuits Are Old News

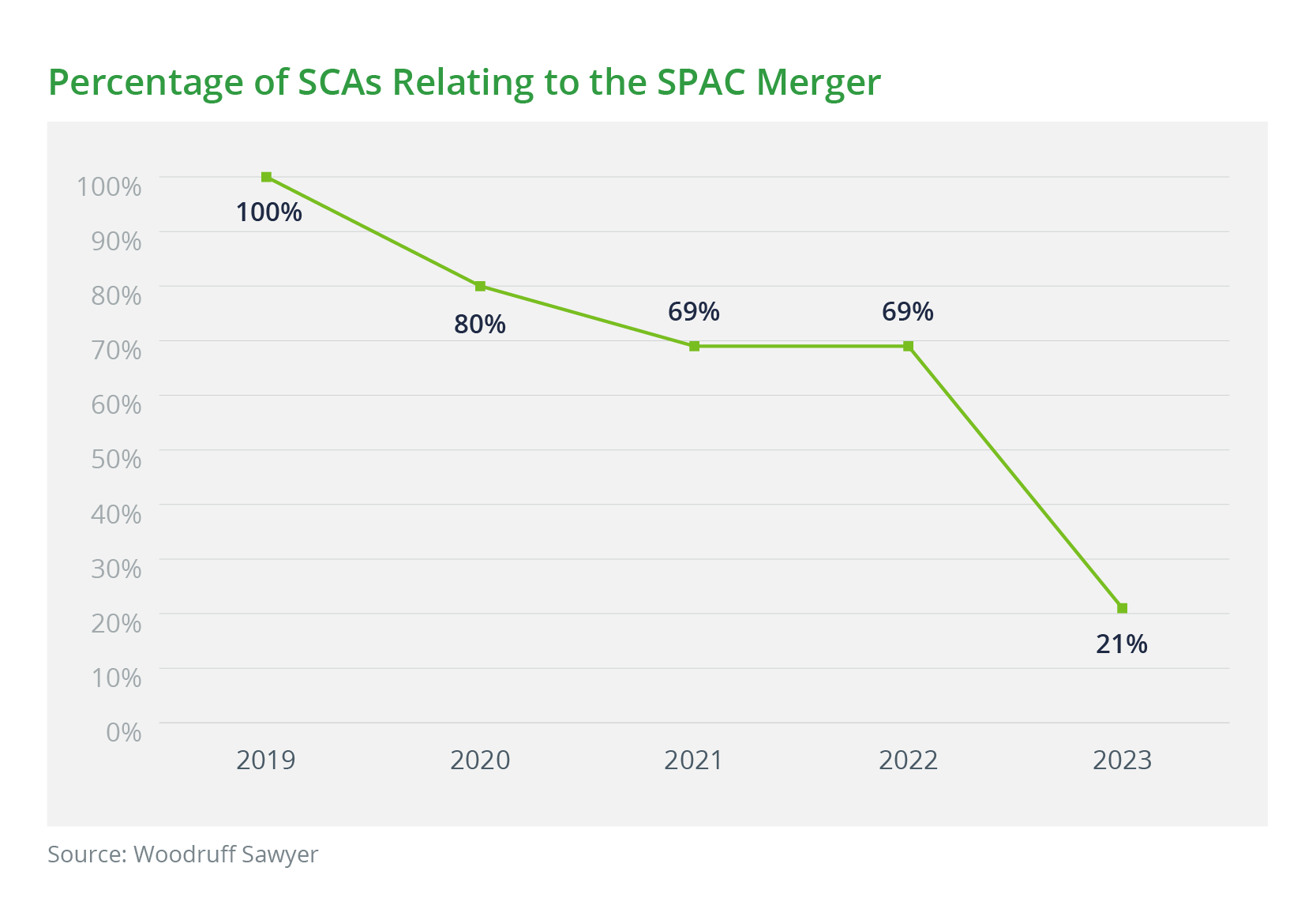

Another important element that emerged last year is the fact that many of the recent lawsuits have nothing to do with the original SPAC or its business combination. The plaintiffs bringing SCAs in 2023, while mentioning the fact that the company had originally gone public via a SPAC typically in 2021 or thereabouts, had no issues with any SPAC-related activities. Their claims centered on the business failings of the operating company stemming from the recent market downturn or other non-SPAC-related business problems a year or two after the merger.

A good example of this is the Fisker, Inc. lawsuit, which was filed three years after the closing of the business combination with no former SPAC executives or SPAC sponsors named as defendants. The allegations revolved around disappointing financial results, losses and production cuts, and material weaknesses in internal control over financial reporting. However, they did not relate to either the SPAC formation, the actions of the SPAC team, or the SPAC merger.

Our data shows that while many of the SCAs brought against SPAC-related entities in 2022 were still related to claims stemming from the SPAC’s business combination, most of the SCAs since then have focused on business failures of the post-de-SPAC entity, which did not tie back to the entity’s business combination.

Our conclusion here is that as entities continue to operate post-de-SPAC and mature as public companies (like all other public companies that went public via a traditional IPO), those that run into business issues are the ones that are going to be singled out for an SCA. The fact that these companies started their public life via a de-SPAC will have no bearing on the SCA, as is exemplified by the majority of the SCAs we saw in 2023.

SPAC Litigation Compared to SPAC Activity

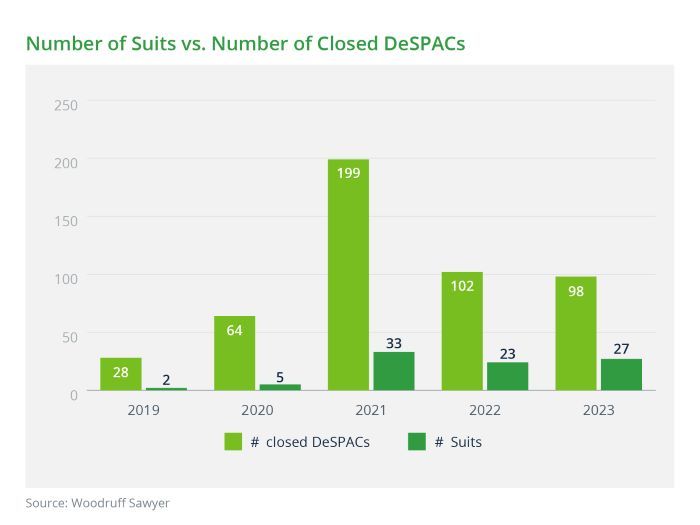

SPAC lawsuit data can never be viewed in a vacuum. To understand the dynamics of this kind of litigation and developing trends within it, we must understand the deals that are being done and not done in the market. The graph below shows the number of filed SPAC-related securities class actions as compared to the number of closed de-SPAC transactions in the same year. It typically takes a few months—nine months on average—after the merger occurs for a lawsuit to be brought. Understanding the lag between a SPAC merger and the lawsuit, it is interesting to see the decline not only in the absolute number of SCAs from 2021 to 2023 but in the number of SCAs relative to the number of completed mergers in each of those years.

New Types of SPAC Lawsuits

We saw a few new types of lawsuits in 2023. The most interesting takeaway is that there were several suits against SPAC advisors.

For example, in May of 2023, a suit was filed in Delaware Chancery Court in connection with the Lottery.com SPAC deal. The lawsuit named not only SPAC directors and officers but also the financial advisor involved with the deal, Chardan Capital Markets, LLC. The lawsuit alleges that the defendants, including Chardan, breached their fiduciary duties by approving due diligence that should have revealed that the deal was not a great one.

And, as mentioned above, we are seeing an increase in the frequency of the direct-action breach of fiduciary duty suits being filed in Delaware, with several being dismissed but many proceeding forward. The usual themes for these suits include an accusation that the SPAC’s directors and officers rushed into a transaction, failed to conduct proper due diligence, entered into a deal outside of the SPAC’s targeted industry, and omitted important information relating to potential dilutive effects of the merger. The move by the plaintiffs’ bar to channel SPAC-related disputes through Delaware courts is logical, given that court’s typically hostile attitude towards SPACs and a few plaintiff-friendly decisions handed out in 2022 and 2023.

What we are beginning to see, however, is that only about 30% of the 2023 SPACs opted to be organized in Delaware. Compare this percentage to almost 100% of SPACs launched in prior years. SPAC sponsors, who are watching the unfavorable developments in Delaware courts and unwilling to shell out extra funds for the new 1% excise tax, are clearly reconsidering their place of incorporation. At this point, most new teams are opting for the Cayman Islands over Delaware.

Likelihood of Lawsuits

Our clients often want to know the likelihood of their team or venture getting sued. This information can assist teams in deciding on the amount or type of directors’ and officers’ (D&O) insurance they will purchase. Although the answer is complicated, some recent data may be instructive.

Companies that go public via a traditional IPO are more likely to get sued than mature public companies, and companies merging with a SPAC are more likely to get sued in an SCA than those going public via a traditional IPO.

How likely? Based on our data, we would expect to see:

- About 3% of mature companies (those that have been public for 10 years or more) getting sued

- About 13% of newly IPOed companies getting sued

- About 18% of newly de-SPAC’d companies getting sued

The reason the numbers are higher for new public companies, including SPACs, is simple—they are more likely to stumble out of the gate.

SPAC Bankruptcies

A few examples of serious stumbles are the 21 SPAC-related bankruptcies in 2023, as reported by Bloomberg. Fortune noted that the flexible workplace provider WeWork Inc. was the largest of these entities to succumb to a Chapter 11 filing in 2023. The list of the largest bankruptcies also included the electric vehicle makers Proterra Inc. and Lordstown Motors Corp. At least eight of these bankruptcies followed a previous SCA.

Of course, no company wants to find itself being forced to reorganize or wind down in bankruptcy, but are 21 bankruptcies catastrophic? Considering that about 515 companies went public via a SPAC since 2018 (the modern era of SPACs), 21 might not be such a daunting number.

In the wider market, S&P Global reported that US bankruptcy filings in 2023 hit a 13-year peak. S&P Global attributed the 642 bankruptcies in 2023 to rising interest rates and related operational difficulties, which are, of course, factors that would affect SPAC-related companies as well.

SPAC Settlements

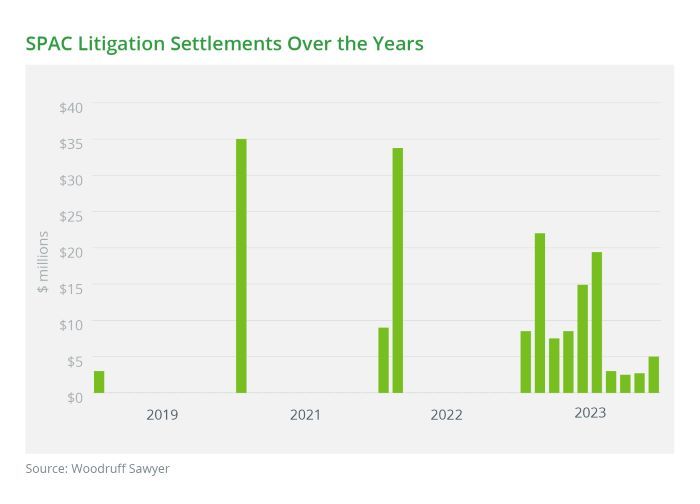

Most lawsuits end in settlements. Ten settlements of SCAs that were recorded in 2023 totaled nearly $94 million.

Outside of the actual settlement amounts, some of which in the above cases were covered by a D&O insurance policy, the defendants had to also pay substantial attorney fees. When deciding on the limit of a D&O policy, it is worth factoring in the potential costs of the attorney fees, which will be due whether the lawsuit ends up being frivolous or ultimately gets dismissed.

Regulatory Enforcement Actions

The other piece of the risk puzzle is, of course, the risk of regulatory enforcement actions and investigations. With the SEC continuing its openly hostile stance towards SPACs, many of us expected to see a barrage of SPAC-related investigations and enforcement actions. That expectation has not been realized, but here are some examples that made the headlines in 2023:

- African Gold: Civil penalty of $103,591 in February 2023. The SEC settled charges against African Gold Acquisition Corp. for internal controls, reporting, and recordkeeping violations, which enabled African Gold’s former CFO to misappropriate approximately $1.2 million from the company’s operating bank account. As a result, African Gold made materially false filings with the Commission and maintained inaccurate books and records.

- Morgenthau: Forfeiture of $5.1 million, restitution of $5.1 million, and 36 months in prison for the SPAC’s former CFO in April 2023. In January 2023, the SEC brought fraud charges against Cooper J. Morgenthau, the former CFO of African Gold Acquisition Corp. The charges revolved around Morgenthau orchestrating a scheme in which he stole more than $5 million from the company and from investors in two other SPACs that he incorporated.

- Corvex: Settlement of a $1 million civil penalty million in April 2023. The SEC charged investment adviser Corvex Management LP with failing to disclose conflicts of interest regarding its personnel’s ownership of sponsors of several SPACs into which Corvex advised its clients to invest. Corvex also agreed to a cease-and-desist order and a censure.

- Marcum: In June 2023, Marcum LLP, an audit firm, agreed to a $10 million penalty, censure, and the undertaking of remedial actions to settle SEC charges against the firm. The charges were related to systemic quality control failures and violations of audit standards in connection with audit work for hundreds of SPAC clients.

- Digital World Acquisition Corporation (DWAC): $18 million penalty if DWAC closes a merger transaction. In July 2023, the SEC settled fraud charges against DWAC for making material misrepresentations in forms filed with the SEC as part of DWAC’s IPO and proposed merger with Trump Media & Technology Group Corp (TMTG). The SEC found that DWAC misled investors and the SEC by failing to disclose that it had formulated a plan to acquire and was pursuing the acquisition of TMTG prior to DWAC’s IPO.

- Crowe U.K.: In August 2023, the SEC charged Crowe U.K. LLP, a London-based audit firm; its CEO, Nigel Bostock; and senior auditor, Matthew Stallabrass, for the firm’s deficient audit of music streaming company Akazoo Crowe U.K., Bostock, and Stallabrass agreed to settle the charges and pay penalties of $750,000, $25,000, and $10,000, respectively.

- Alfonse Gregory Giugliano: In September 2023, Giugliano, the former National Assurance Services Leader at Marcum LLP, agreed to pay a civil penalty of $75,000 and step down from leadership positions for failing to sufficiently address and remediate numerous deficiencies in Marcum’s quality control system.

- XL Fleet: Civil penalty of $11 million. In September 2023, the SEC charged Spruce Power Holding Corporation, the successor to XL Fleet Corp., which provided hybrid electric vehicle systems for commercial fleet vehicles, for misleading investors about revenue projections. The SEC found that the company’s projections, which were featured in public filings ahead of the 2020 SPAC merger, were misleading.

The list of regulatory actions against SPACs is shorter than one might have anticipated from the negative press that SPACs usually attract. In addition to the above eight actions, which totaled penalties of about $46 million, we noted a few others from 2022 and previous years in our earlier updates.

Update on the D&O Insurance Market

The number of SPAC IPOs and de-SPACs as well as cases and enforcement actions relating to them are all factors that influence the availability and pricing of D&O insurance. As SPAC sponsors and target companies consider the risks and decide on risk mitigation measures, they need to consider the size, structure, and costs of their D&O coverage.

SPAC D&O coverage does not operate in a vacuum, however. It heavily depends on overall economic conditions and the wider D&O market, which includes coverage for traditional IPOs and mature public companies.

In 2023, we saw a significant easing in pricing for and availability of SPAC coverage, which stemmed from the continuing dearth of traditional IPOs and the significantly lower number of SPAC IPOs and de-SPACs. Competition among insurance carriers continues to be strong. Many have weathered the ups and downs of the recent SPAC environment and have a much better understanding of its risks.

Our prediction is that SPAC teams will continue to enjoy reasonable premium pricing as well as continued D&O structure innovation and flexibility from D&O carriers in 2024.

Authors

Table of Contents