Blog

Representations and Warranties Insurance: Q3 2020 Market Update

It has been a disruptive year to say the least and M&A deals are no exception. COVID-19's impact on transactional insurance like representations and warranties is coming into clearer focus but continues to evolve—as are mergers and acquisitions.

The good news is that we are starting to see more deals and exclusions in reps and warranties policies are becoming more specific (rather than the broad COVID-19 exclusions we saw earlier this year).

Pricing for coverage has remained fairly constant and we're seeing a slight trend towards minority investments, which comes with specific considerations for reps and warranties coverage.

COVID-19's Impact

Since we last wrote about COVID-19's impact on reps and warranties insurance in March, we've seen some shifts. Back in March, COVID-19-related exclusions were beginning to emerge and now in August, we're seeing some new trends.

Initially, most underwriters were looking to add very "blanket" or "broad" exclusions, for example, "loss based upon, arising out of or resulting from losses to the extent attributable to COVID-19." It would be easy to link practically any claim to COVID-19 with this type of exclusion.

Now we are seeing an increased amount of underwriters offering "underwriting to risk" in reps and warranties. This usually means restricting the exclusion to the event that impacts the supplier and customer contracts. One example would be the inability to get raw materials in and the company's ability to perform services or create goods under contract.

The policy's exclusion language might read something like:

Losses arising from the effects of the COVID-19 disease and/or SARS-CoV-2 virus on supply chain disruptions and non-performance of service services.

At the other end of the scale we are seeing a couple of underwriters offering a very tight exclusion with regards to COVID-19, which reads as follows:

With respect to COVID-19, the Policy would not provide coverage for: (a) Losses arising out of, relating to or resulting from or to the extent increased by the failure to protect any employee, contractor, officer, director, manager, agent, customer, client, supplier, distributor or any other person from the transmission of a novel coronavirus, including the coronavirus disease (COVID-19) or any evolution thereof; and (b) to the extent applicable, breaches of bringdown representations to the extent out or resulting from the coronavirus disease (COVID-19).

Some key points about this language:

- Part (a) only excludes loss arising from the target company causing infection in others and employees.

- Part (b) affects the interim period. The Interim period is the time between the sign and the close of a transaction. Sometimes it is a few days and sometimes up to a year. Part (b) would give the underwriter the opportunity to reassess the potential impact of COVID-19 at the time of closing. If nothing had occurred or if there was a simultaneous sign and close, this part would not apply.

Pricing Updates

The only underwriter who has formally stated that they are lifting their base rate on reps and warranties insurance is AIG. Other than that, pricing has remained fairly constant.

We have found with this type of coverage that price is very rarely the deciding factor. Coverage, on the other hand, can vary greatly between different underwriters. For example, willingness to cover minority investments with 100% coverage, to cover the exclusion of multiple damages or even the willingness to cover cyber risks is a much greater factor for our clients.

Deal Flow

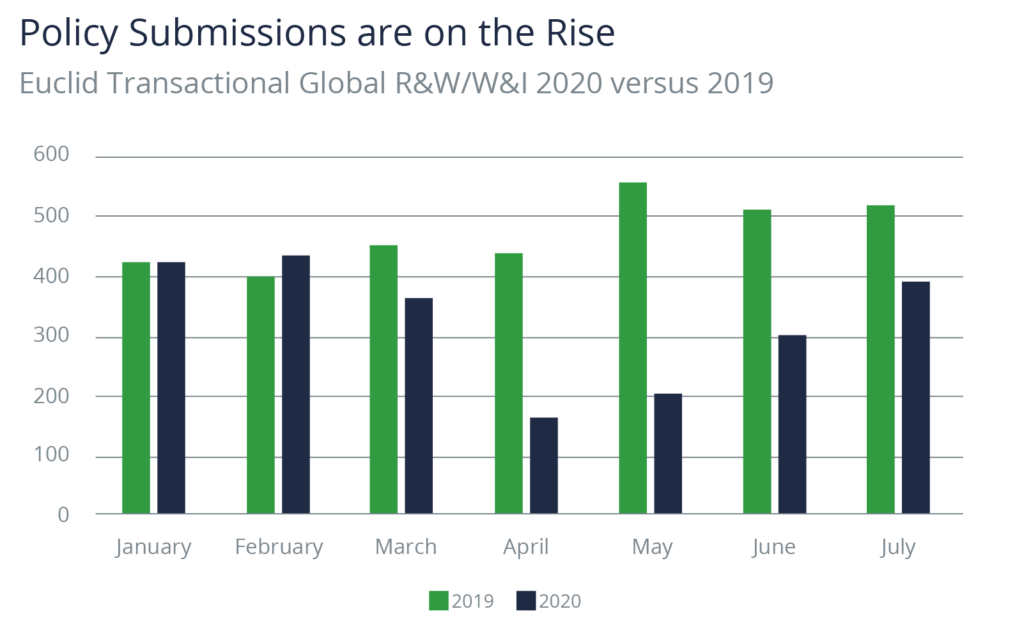

By May, weekly reps and warranties insurance submissions had dropped by more than 70%. We are glad to say that in the past two months, deal flow is back on the rise.

The first group back to the deal table was the strategic buyer rather than financial buyers like private equity, with the exception of SPACS, which are out in force.

First we noticed deals that had been put on hold due to COVID-19 coming back. Then we saw our strategic buyers going out to source new deals, mostly in more traditional markets like manufacturing or semi-conductors.

The other trend is hospitality deals that were beginning pre-COVID and went on hold reappeared at greatly reduced enterprise values.

Whilst in the last month we are beginning to see distressed deals, many other businesses are not considering discounting their businesses beyond pre-COVID-19 valuations.

Minority Investments

At the beginning of the year we had noticed a slight trend towards minority investments, mostly from private equity firms. In the post-COVID deal world, however, we are beginning to see it in the SPAC space, too. The issue for reps and warranties insurance is whether coverage is pro rata of the equity investment or 100%.

For instance, Company A is valued at $100 million. Private equity company wants to pay $25 million and own 25% of the share capital. When it comes to the question of representations and warranties coverage, the issue becomes whether they just want to cover their share 25% pro rata or 100%.

If they simply cover their share and there is $100 in losses, for example, they'd receive $25. If they cover 100%, they'd receive the full $100. However, there is a limit to the number of markets that will provide that kind of coverage, which inevitably leads to it being more expensive.

If minority investments are less than 50%, it's a very restricted market for 100% reps and warranties coverage, but it is available at a materially higher price.

In closing, we are seeing a rapid change in reactions to COVID-19 from March until now. We expect it to continue to change as the economic impact of the pandemic continues to be revealed. We are impressed by our colleagues in the market who have stepped up to the challenge and found ways to stay commercial. We look forward to continuing to adapt and keep our clients up to date on a market that is changing on a weekly basis.

Author

Table of Contents